For the past couple of months, I have been tracking ARK Invest’s daily trades in crypto companies. The US-based fund house manages assets issued under exchange-traded funds (ETFs) and a venture fund. Their buying-and-selling approach reveals an interesting story about how they time their trades in a sector where getting the timing right seems like a herculean task.

One move could be a coincidence. Two could be an instinct. ARK’s crypto trades show an unusual sense of timing that’s deliberate and not reactive. And this is evident in the fact that it turned in a profit of over $265 million by trading shares of just Coinbase and Circle in June and July.

And if you look closer, you see that ARK has been moving its money away from exchanges and trading platforms, toward infrastructure, treasuries, and token exposure.

Its recent trades give us a glimpse into how one of the most watched institutional investors is optimising returns for its retail crypto stakeholders by moving money quickly, and often, at just the right moment in and out of its funds. That’s a lot different and sophisticated than the "diamond hands" rhetoric would have you believe in the crypto space.

Future of Web3 Won’t Look Like Web3

Seed phrases. Chain switching. Wallet confusion. These aren’t features—they’re roadblocks.

NEAR Foundation is building the infrastructure to fix that.

They’re backing the tools and protocols that make Web3 usable for everyone—not just devs and crypto-natives.

Here’s what that looks like:

Login with email, self-custody included

One account across chains and apps

Gasless transactions and smooth onboarding

Abstracted chains, no more switching networks

If you're tired of UX getting in the way of adoption, NEAR is already building the fix.

👉Explore what NEAR Foundation is backing

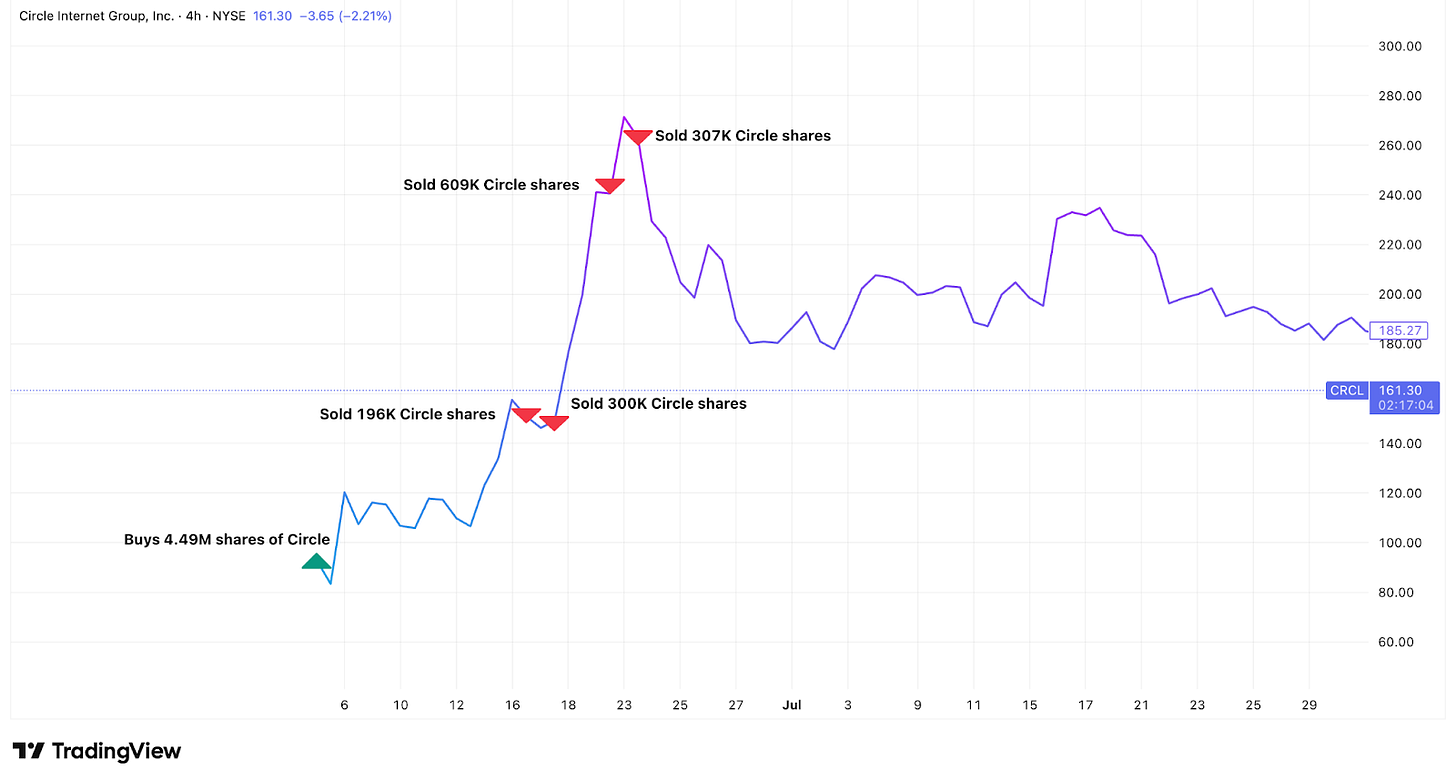

On June 5, 2025, Circle Internet Financial, the issuer of the largest US-regulated stablecoin - USDC, went public on the NYSE at $69 per share. ARK was an anchor investor, with 4.49 million shares bought for roughly $373 million across its funds.

At its peak on June 23, the stock closed at $263.45 per share. This meant the market was valuing Circle at roughly $60 billion, about 100% of the assets it managed at that point. It was possibly because the market was bullish about the future of stablecoins and was trying to price the forward income Circle would make at a 10x AUM from the current level. Yet, that would still be too big a stretch compared to the valuations traditional asset managers get. For perspective, BlackRock manages $12.5 trillion worth assets. Its market cap is just over $180 billion, about 1.4% of the assets it manages. That’s it. That was the sign for ARK.

Daily trade filings show ARK was selling Circle shares methodically across multiple funds as the premium on the share ballooned.

ARK began selling a week before the peak. In total, ARK sold ~1.5 million shares, about 33% of total holdings, worth about $333 million worth of Circle shares during the stock's parabolic rise. That’s over $200 million, or 160%, in booked profit on the shares it had bought on Circle’s Wall Street debut less than three weeks ago.

ARK's appetite for hot IPOs didn't stop there.

Last week, they snapped up 60,000 shares of Figma on its debut day. The San Francisco-based design software company had revealed in an SEC filing that it owned $70 million in Bitcoin ETFs and was approved to buy $30 million more.

The stock soared over 200% on its first day of trading, closing at $115.50 for a 250% gain. By the next day, Figma had risen another 5.8%.

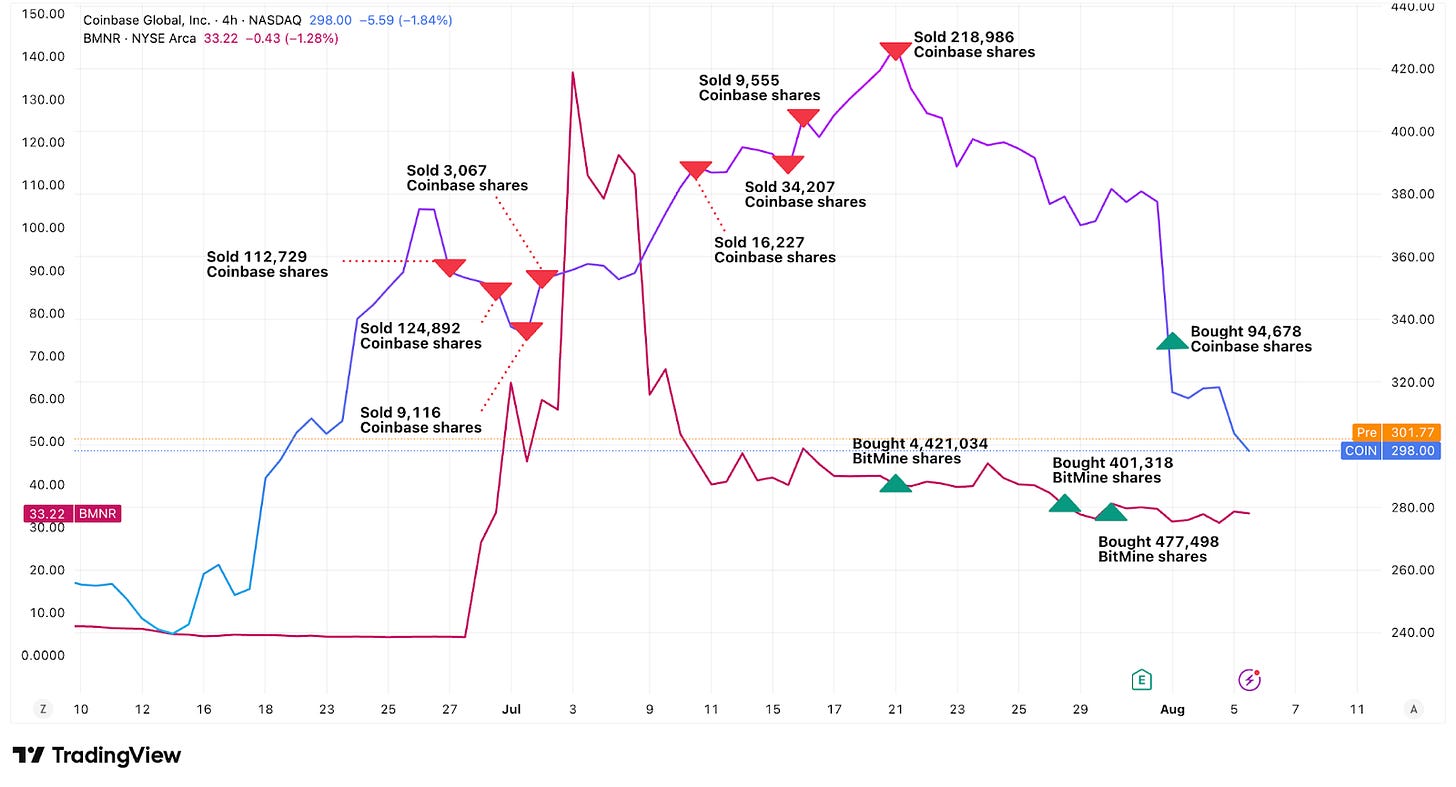

ARK's recent Coinbase trades give us more insights into its systematic profit-booking pattern.

As of April 30, 2025, ARK held 2.88 million shares of the US’ largest crypto exchange. Ever since, it has systematically booked profits through the end of July.

This coincided with Coinbase shares’ rally as Bitcoin hit new all-time highs above $112,000. During this period, Coinbase stock reached levels above $440 per share, its own all-time highs. On July 1, ARK offloaded $43.8 million worth of shares. On July 21, the day Coinbase hit its peak: ARK divested $93.1 million in shares across three funds. In total, ARK sold 528,779 shares, accounting for ~20% of its total Coinbase holdings, worth over $200 million between June 27 and July 31. That’s an average selling price of $385 apiece. Compare it against ARK Invest’s weighted average cost of ~$260 across four years of stacking Coinbase shares and that gives you a profit of over $66 million across these trades.

Last two months saw Coinbase lose its position as the top heavy-weight candidate across ARK’s portfolio of funds.

On July 31, after the market closed, Coinbase announced Q2 results that disappointed investors. The stock fell 17% the next day, from around $379 to $314. On August 1, the day of the crash, ARK bought $30.7 million worth of Coinbase shares.

These trades were not standalone. It was all part of a strategic shift by rotating capital from an over-heated crypto exchange ecosystem to something that was just beginning to garner a lot of interest.

Offloading Coinbase shares was accompanied with a similar sell-off in Robinhood, the former’s competitor. Both these divestments coincided with ARK rotating a major chunk of this capital into BitMine Immersion Technologies, dubbed as the "MicroStrategy of Ethereum". BitMine, led by Wall Street veteran Tom Lee, is building an Ethereum Treasury, aiming to hold and stake 5% of the overall Ethereum.

Read: ETH ETFs, One Year On 🍾

On July 22, ARK invested $182 million in BitMine via a block trade. But they didn't just buy once and forget about it. ARK was systematically buying BitMine on every significant dip, accumulating over $235 million worth in just two weeks.

What these trades show is that ARK is rotating away from crypto exchanges and payment companies towards what you might call crypto infrastructure. Coinbase and Robinhood make money when people trade crypto. BitMine makes money by owning crypto directly. These are different ways to get exposure to crypto adoption, but with different risk profiles.

Exchanges benefit from volatility and speculation. When crypto prices swing wildly, people trade more, and exchanges make more money. But this is cyclical. Treasury companies like BitMine benefit from crypto price appreciation directly. If Ethereum rises 50%, BitMine's assets rise 50%. There's no dependency on trading volumes or user behaviour. Even when there’s no significant capital appreciation, there’s consistent revenue generation by staking Ethereum onto the network.

But higher the reward, higher the risk. The treasury companies also face direct downside exposure. When ETH price falls, BitMine’s assets will also dwindle in value proportionately. This makes the treasury play one with much higher beta.

Read: ETH's Treasury Turnaround 🏛️

ARK’s trades reflect its belief that crypto is maturing from a speculative trading market into something more like permanent financial infrastructure. In that world, owning the underlying assets might be more valuable than owning the platforms where people trade those assets.

What's interesting about these trades is the timing precision. They sold Circle during a dream rally all the way as it peaked. They jumped into Figma's 250% IPO pop. They sold Coinbase, too, just as it peaked and doubled down after it crashed on disappointing earnings. They bought BitMine during multiple market dips.

Its methodology combines traditional value investing principles with precision timing. When Circle trades at 100% of assets under management, it's probably expensive. When Coinbase falls 17% in a day after earnings, it might be cheap. ARK also appears to time trades around predictable events - earnings announcements, regulatory decisions, market volatility.

There's also a bigger question here: why do these stocks trade at such dramatic premiums to their underlying assets in the first place? Circle briefly traded at the full value of the assets it manages. BitMine trades at multiples of its Ethereum holdings. These premiums exist because most investors can't easily buy crypto directly. Even if they can, the on-ramp and off-ramp platforms don’t offer a frictionless experience to a retail investor. If you want exposure to Ethereum appreciation in your pension fund, you can't buy Ethereum as easily as you can buy shares in a company that owns Ethereum.

This creates a structural advantage for companies that hold crypto assets. ARK's trades suggest they understand this dynamic very well. They buy when premiums are reasonable and sell when premiums become extreme.

ARK’s strategy proves that investing in crypto stocks need not be a simple buy-and-hold game. Especially if you want to optimise your returns. For anyone trying to follow ARK's crypto trades, it's not enough to know what they're buying. You need to understand why they're buying it, when they're likely to sell it, and what they're rotating into next.

For now, ARK's crypto trades offer a useful window into how professional money manages crypto exposure.

That’s it for this week’s deep dive. See you next week.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.