I am keeping the Monday book experiment going.

Last month, we were in Guizhou, watching chickens wear ankle trackers and AI manage pig farms. This time, we are in FBI conference rooms, IRS cubicles, and dark web forums with usernames like Dread Pirate Roberts and FrenchMaid.

We are reading Andy Greenberg’s Tracers in the Dark at an interesting time. Crypto Twitter has already decided that the next big story is privacy. Arthur Hayes is out there saying privacy will be crypto’s next dominant narrative and talking about going long on Zcash as a bet on rising surveillance and capital controls.

If you live in that feed for a while, “privacy” starts to sound like a clean trade. There is a ticker. There is a chart. You can long it.

Tracers in the Dark is the uncomfortable mirror. It is three hundred pages of what our “on-chain” world looks like from the other side of the table, inside agencies whose full-time job is to follow money. Nobody in this book is trying to sell a privacy narrative. They are just slowly realising that Bitcoin is the nicest, most cooperative ledger anyone has ever given them.

Once you see the chain through their eyes, it stops looking like magic internet cash (a phrase I hate) and starts looking like a diary you did not realise you were keeping.

This is part one of that read-along.

The opening is not what I expected. It does not start with Silk Road or some glamorous hacker. It starts in 2017, in a perfectly normal house in suburban Atlanta, where agents are raiding the home of an assistant principal because of a trail of Bitcoin transactions linked to a child exploitation site. An IRS criminal investigator named Chris Janczewski stands in the hallway, listening to the family being questioned and feeling slightly sickened by what his spreadsheets have just done to their lives.

It sets the tone. This is not going to be a victory lap about “yay, we caught the bad guys with cool tech”. It is about what it means when money itself becomes evidence.

From there, the book rewinds to the early 2010s, when everyone still spoke of Bitcoin as internet cash with a fake moustache. The phrase “anonymous digital currency” shows up in media articles, court filings, and even law enforcement briefings. If you wanted to do crime online, Bitcoin was supposed to be the smart choice.

The people who ruin that illusion are not cryptographers or hackers. They are auditors.

The main character in this stretch is an IRS criminal investigator named Tigran Gambaryan. You probably know him from a very different context as the former head of financial crime compliance at Binance, the guy who ended up in Nigerian courtrooms and on Wired covers instead of just in case files. Back in the period Greenberg writes about, he is still a US federal agent in the IRS Criminal Investigation cyber unit, working on Silk Road, BTC-e, Mt. Gox, and the early big crypto cases.

Read: Nigeria’s Crypto Crime Thriller 🇳🇬

He is not introduced as a genius. He is introduced as someone who used to handle routine tax cases, then ended up in this weird corner where taxes, drugs, and blockchains collide. The book makes a point of how mundane some of his habits are. He likes receipts. He likes reconciling numbers. He is offended by bad bookkeeping.

He is exactly the kind of person you should fear if your whole plan for evading the state quietly assumes that the numbers are too big and confusing for anyone to ever sit down and line them up.

One early scene that stuck with me is a payment of 525 Bitcoin in September 2013. Back then, it was about seventy thousand dollars. At today’s price, around $92000 per Bitcoin, that single transaction would be worth almost $48 million. On the blockchain, it is just another entry. The coins move from a dark-web drug lord to an undercover agent, and the only reason anyone knows now is that people like Gambaryan sat down later and traced them.

This is the book’s first real magic trick. It takes the blockchain, this thing most of us see as a chart or a number on CoinGecko, and turns it back into what it actually is: a permanent public diary of who paid whom, when, and how much. No names, just addresses. But the addresses repeat. They form habits.

The agents start stringing those habits together. You see the method slowly harden:

You watch where the money fans out.

You watch where it comes back together.

You look for the one place that touches something with KYC.

You subpoena that place.

You give the cluster a human name.

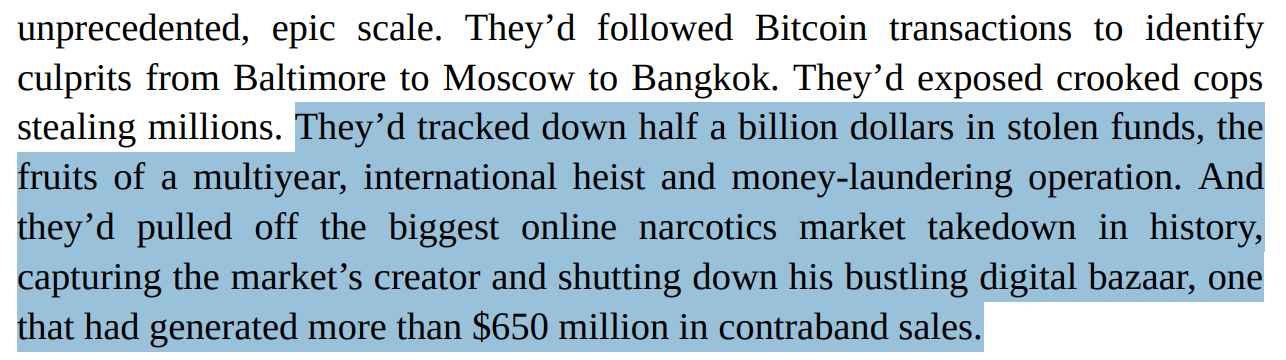

The Silk Road part of the story is familiar if you have been around crypto long enough, but the angle here is different. We know the broad outline. Ross Ulbricht created a Tor hidden service for buying drugs. He names himself Dread Pirate Roberts, posts long manifestos about free markets and liberty, and runs the whole thing like an overworked founder who has also read too much Ayn Rand.

What Greenberg zooms in on is the mismatch between the ideology and the threat model.

The Silk Road crowd spent a lot of energy on operational security. They used Tor, PGP, tumblers, and fake names. They worried about postal inspectors and undercover buys. They worried about informants on the forums. DPR agonised over whether to have people killed because he believed that was what a serious crypto-anarchist warlord did.

They did not worry nearly enough about a guy at the IRS being paid to stare at blockchain data all day.

Bitcoin was designed so that nobody could stop you from making a payment. That was the main enemy in the early cypherpunk stories. Banks, PayPal, Visa, whoever could freeze you. The network was meant to be resistant to that.

The book shows you how quickly that flips. The very same transparency that stops banks from censoring you gives investigators a timeline of your entire economic life. The thing that was supposed to make you untouchable slowly becomes the trail that gets everyone touched.

The moment the story moves beyond “good cops, bad dealers” is when the corrupt agents enter.

Greenberg spends a lot of time on Carl Force, a DEA agent who was part of the Baltimore task force on Silk Road. He goes undercover as “Nob” on the site, builds a relationship with DPR, and then quietly starts extorting him, taking bribes, and laundering his own coins through exchanges. Gambaryan and his colleagues end up using the blockchain to investigate him and another agent on the case. They sit in a room, pull up transaction after transaction, and realise that some of the addresses tied to Silk Road payments go straight to wallets linked to a law enforcement officer’s real identity.

That is the moment the tone changes. The ledger does not care about your badge.

It will happily document the drug dealer sending Bitcoin to the marketplace escrow. It will also happily document the federal agent siphoning Bitcoins from that same marketplace into his personal account. It will treat both as equal rows in the same story.

There is something very fair and very cruel about that. The chain offers no context. It will not mark some addresses as “necessary violence of the state” and others as “illicit”. It just records the value moving. The moral layer sits entirely on top.

What I liked in this early part is how messy everyone looks. The cyber-idealists are messy. DPR is half freedom fighter, half power-tripping admin. The criminal side is messy. Lots of the dealers are just small-time people in small apartments trying to make money. The agents are messy, with their own egos and blind spots. The only character that stays clean is the ledger.

In crypto, “follow the money” becomes a kind of background meme. We tell it as a joke. “Haha, of course law enforcement just follows the money, that is what they always did.” This book makes that sentence feel heavier. It shows you what following the money actually looks like in a world where the money is a globally replicated database.

Greenberg has this way of reminding you that every breakthrough was quite small from the inside. It is someone deciding to try a slightly weirder query. Someone thinking “what if I copy these addresses into Excel and see what clusters with what.” Someone in a meeting insisting that yes, this is enough to take to a judge.

There is still a big question hanging over all of this, and Part 1 does not completely answer it. It hovers in the background when Janczewski stands in that Atlanta house, listening to a terrified family. It is there when you read about Silk Road users being unmasked years after the site shut down. It is there when the corrupt agent realises the same tools he thought would hide his tracks are now documenting his arrest.

Who do you trust to hold an X-ray of your financial life?

We are used to thinking in terms of “do I trust this bank” or “do I trust this exchange”. Blockchains change that. They make trust feel less like “do I trust X” and more like “how many Xs now have a copy of what I did in 2017.”

That is the part that felt close to home for me.

I spend a lot of time in a world where “on-chain transparency” is considered a public good. Proof of reserves. Open liquidity. Composable DeFi. I like that stuff. I also know that the wallets we treat as “addresses in a pool” are often just people in precarious situations, improvising.

Reading the early chapters of Tracers in the Dark made me see some of our everyday rituals differently. When you bridge funds, swap, send to a friend, or ape into something stupid for fun, all of that sits somewhere as a neat list. It is not that somebody is reading it right now. It is that somebody can, later, when the incentives line up.

Part 1 is basically the origin story of that realisation. A handful of agents realise that Bitcoin is not a black box. They use that insight to take down Silk Road, catch corrupt colleagues, and start a new industry of tracing tools.

Next Monday, we get into that industry and into the bigger, uglier markets it went after. For now I am stuck on this very unsettling thought.

The thing that makes blockchains so powerful for building new financial systems is exactly the thing that makes them perfect tools for anyone who wants to reconstruct their past.

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.