Billions are being fought over, but the prize is about four cents. That’s roughly the return every dollar in a US Treasury bill generates each year.

For nearly a decade, Decentralised Finance (DeFi) protocols have relied on USDT and USDC as the backbone of their products, all the while allowing Tether and Circle to capture the yield on their reserves. These companies have built billion-dollar profits from the simplest yield in the world. But now, DeFi protocols want that stream for themselves.

Stablecoin leader Tether currently holds over $100 billion in reserves, generating more than $4 billion in interest income. That’s more than the consolidated profit Starbucks made, $3.761 billion, serving coffee worldwide in the last fiscal year. And the USDT issuer does this simply by parking its reserves in US Treasuries. Circle leveraged the same approach when it went public last year, highlighting the float as its core revenue engine.

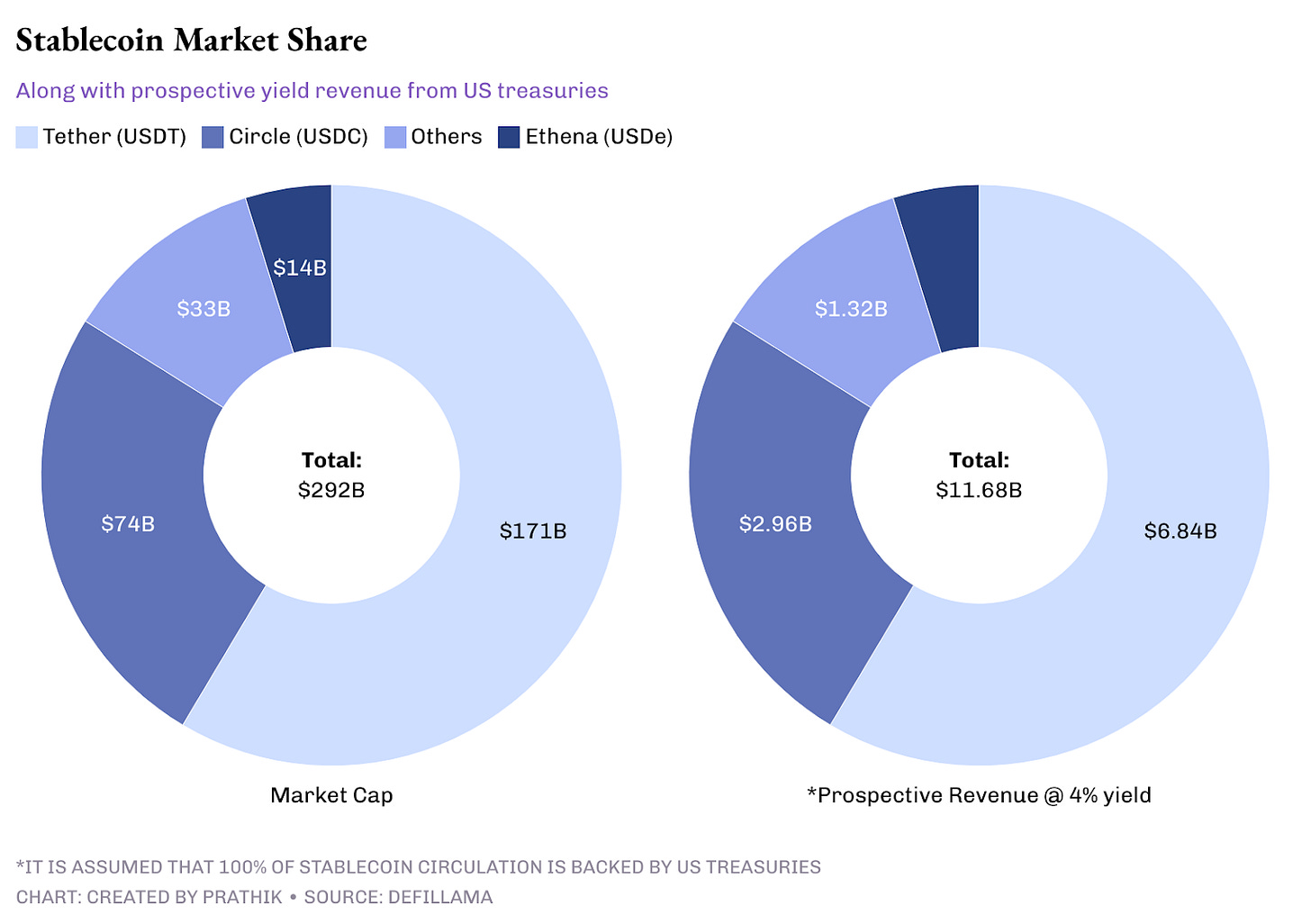

Today, over $290 billion worth of stablecoins are in circulation, generating about $12 billion in revenue annually. That’s a considerable amount of money to overlook. This has triggered a new war in DeFi where protocols are no longer content to let issuers capture this yield. They now want to own both the product and the infrastructure that powers their products.

Metamorphosis 2025: Where Web3 Meets AI.

On September 27–28, the Le Meridien, Gurgaon will host India’s flagship Web3 × AI Gala. This is where builders, executives, investors, and innovators come together to shape the next wave of technology.

Here’s why it matters:

1,000+ attendees under one roof, with 75% being C-level executives

50+ speakers and 25+ panel discussions across crypto, AI, and enterprise adoption

Direct access to leaders from across Web3 and AI, making this a serious dealmaking arena

The biggest opportunity to network, learn, and collaborate in the Indian ecosystem this year

Metamorphosis isn’t just another conference. It’s the largest 2-day learning and networking event in the space, bringing the industry’s best together to exchange insights and create opportunities.

📍 Sept 27–28 | Le Meridien, Gurgaon

🎟 Special for TTD readers: 50% OFF tickets with code “TTD50”

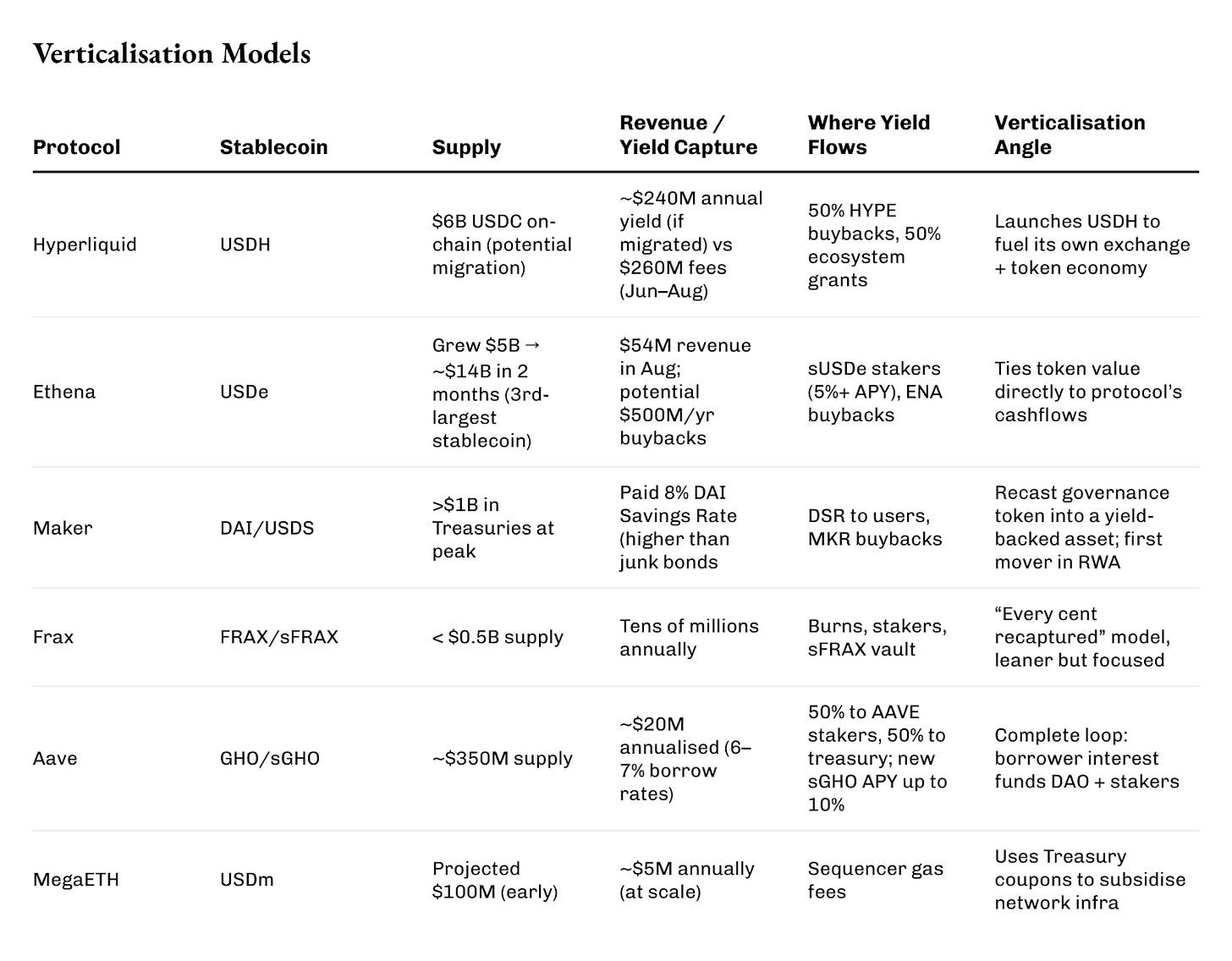

When Hyperliquid opened bidding for its native stablecoin, USDH, earlier this month, the requirement was that whoever won had to give the yield back. Native Markets, Paxos, Frax, Agora and Ethena put their hands up. The winner, Native Markets, promised 100% of USDH’s Treasury income would flow back into the chain: half for HYPE token buybacks, and half for ecosystem grants.

Read: Minting Control 🏦

Currently, $6 billion USDC sits across all protocols on Hyperliquid’s layer-1, potentially generating $240 million in revenue. This revenue, traditionally captured by Circle, could now be rerouted into token burns and incentives for builders. For context, Hyperliquid generated $260 million in net revenue from trading fees across June, July and August.

Ethena has gone even bigger, faster.

In just two months, its synthetic stablecoin, USDe, has jumped from $5 billion to nearly $14 billion in outstanding supply, overtaking Maker’s DAI and becoming the third-largest dollar-pegged stablecoin, behind USDT and USDC.

In August, Ethena recorded $54 million in revenue, the highest in 2025 so far. Now with its long-awaited fee switch activated, as much as half a billion dollars annually could be redirected into ENA buybacks, tying the token’s fortunes to the very cash flows generated by the system.

Ethena’s model involves going long on spot crypto, short on perpetual contracts, and distributing Treasury and staking yields. As a result, sUSDe stakers have enjoyed an annual percentage yield (APY) of over 5% APY on most months.

Read: The Ethena Speed Run 🏎️💨

Maker, the seasoned player, was among the first to utilise US bonds with stablecoin reserves.

At one point, it held over a billion dollars in short-term Treasuries, which enabled it to offer an 8% DAI Savings Rate, briefly higher than the average yield on American junk bonds. The excess funds were funnelled into its surplus buffer, then used for buybacks that burned tens of millions of MKR tokens. For token holders, this transformed MKR from a mere governance badge into a claim on real income.

Frax operates on a smaller scale but with a more focused approach.

Its supply hovers under half a billion dollars, a fraction of Tether’s $110 billion, yet it’s still a revenue-generating machine. Founder Sam Kazemian designed FRAX so that every dollar of reserve income is reinvested into the system. Some of this income is burned, some shared with stakers, while others are saved for sFRAX, a vault that tracks the Fed’s rate. Even at its current size, this system generates tens of millions annually.

Aave’s GHO stablecoin was built with verticalisation in mind.

Launched in 2023, it now has a $350 million supply. The trick was simple: every borrower pays interest directly to the DAO, rather than to external lenders. With borrowing interest rates at 6-7%, this generates around $20 million in revenue, half of which is shared with AAVE stakers, with the remainder going into the treasury. A new sGHO module will sweeten the deal by offering up to 10% APY to depositors, subsidised from reserves. In effect, the DAO is willing to spend its own funds to make its stablecoin resemble a savings account.

Then there are networks using stablecoin yield as raw infrastructure.

MegaETH’s USDm is backed by tokenised Treasuries, but instead of paying holders, the income funds the rollup’s sequencer fees. At scale, this could mean millions annually covering gas fees, effectively transforming T-bill coupons into a public good.

What ties all these moves together is verticalisation.

Each protocol is no longer content to depend on someone else’s dollar rails. They’re minting their own coins, capturing the interest that would once have gone to issuers, and looping it back into buybacks, treasuries, user incentives, or even subsidising the plumbing of a blockchain.

While the yield on a Treasury bill may seem dull, in DeFi, it has become the spark for building self-sustaining ecosystems.

When you compare these models, you see every protocol setting up a different valve to plug into the same four-per-cent flow. Buybacks, DAOs, sequencers and users.

Yield is passive money. It makes everyone reckless. Each of these models has its bottlenecks.

Ethena’s peg depends on perpetual funding staying positive. Maker has seen a real-world loan default and had to cover the loss. Frax retreated after the collapse of Terra, scaling back emissions to prove it wasn’t next in line. They all rely on one thing: the Treasuries held by custodians like BlackRock. These are decentralised wrappers around very centralised assets. And with centralisation comes the risk of a fall.

The new regulations also pose challenges.

The US GENIUS Act bans interest-bearing stablecoins outright. Europe’s MiCA sets limits and licensing requirements. DeFi has found a workaround by labelling yield as “buybacks” or “sequencer subsidies,” but the economics are the same. If regulators choose to act, they can.

Yet, the approach helps in building sustainable business models — something the crypto space has long struggled with. With so many models in operation, it shows the possibilities DeFi protocols now have. What’s being fought over today is the most boring yield in the world. Yet, the stakes are high. Hyperliquid is wiring it into token burns, Ethena into savings accounts and buybacks, Maker into central bank-style buffers, and MegaETH into rollup operating costs.

I want to find out if this movement will cannibalise the giants, pulling liquidity away from USDC and USDT. If it doesn’t, it will surely expand the pie, creating a parallel layer of yield-bearing stablecoins that will sit alongside the zero-yield incumbents.

No one knows yet. But the war has begun, and the battlefield is wide open: a stream of interest trickling out of US government debt, rerouted by protocols into tokens, DAOs, and blockchains.

The four-something cents that once belonged to issuers are now fuelling DeFi’s newest movement.

That’s it for today’s deep dive.

Until then … stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.