Hello

There is a straightforward theory behind why companies buy crypto for their balance sheets. If the asset they acquire rises in value, their shares should also increase. A corporate wrapper is supposed to provide investors with a cleaner, leveraged way to own crypto, managed by a trusted team.

This approach works well in a bull market, where almost anything works well. It works not so well in a bear market, where the logic reverses itself.

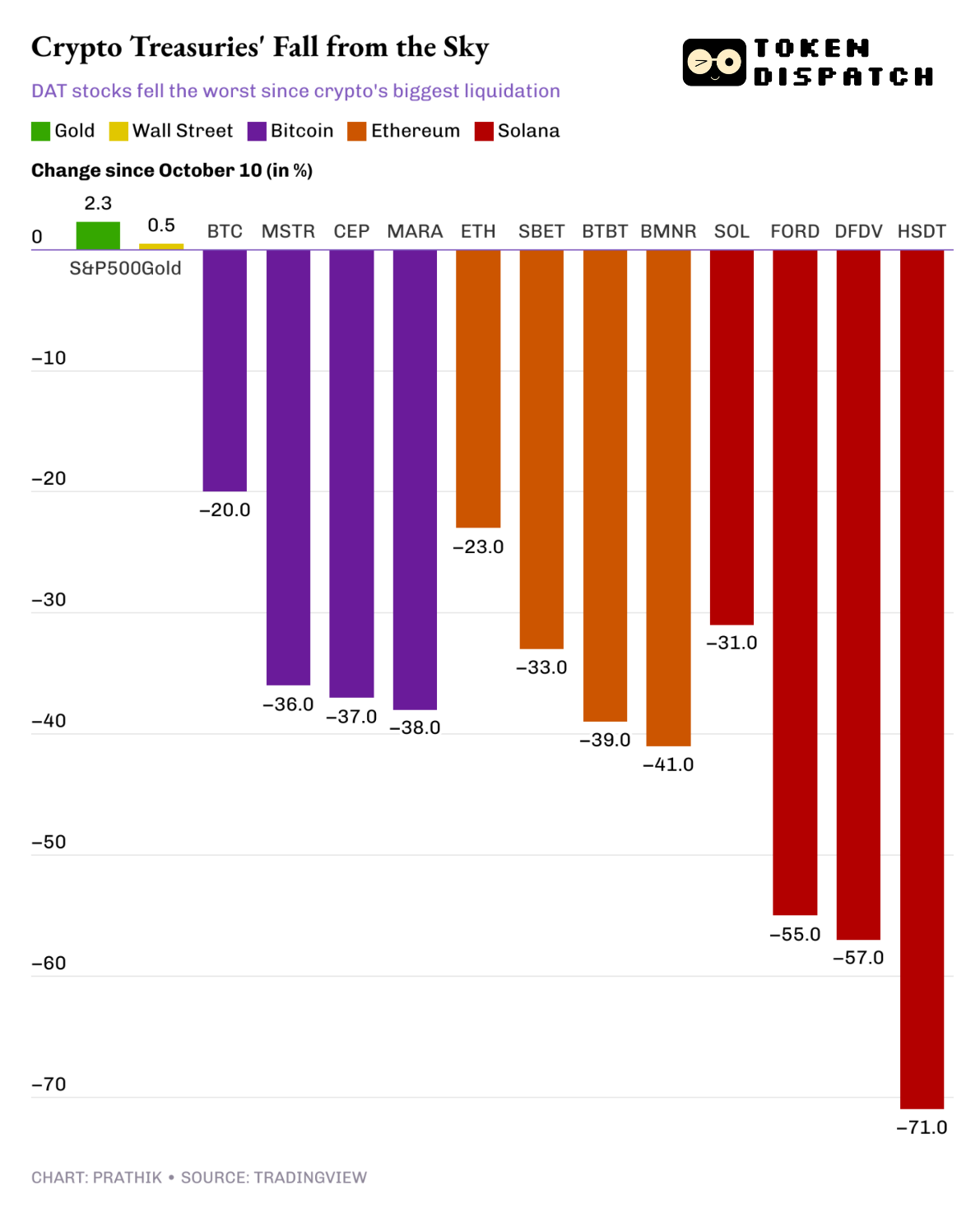

According to most traditional definitions, Crypto has officially entered a bear market. BTC (~30%), ETH (~40%), and SOL (~55%) are well below their peaks; each drifting below its 200-day moving average. BTC Spot ETFs, which were expected to represent durable, regulated demand, have recorded three straight weeks of outflows. On-chain metrics support this. Bitcoin’s MVRV ratio has fallen to levels last seen two years ago, the point at which many holders find themselves underwater.

If you are a company with crypto accounting for a majority of your assets, this is not ideal. Even more so, if the market stops valuing your business and starts valuing you as a publicly listed crypto wallet with employees.

This is what the Digital Asset Treasury group, or, as the crypto circle fondly calls it, ‘DAT’, is going through right now.

In this week’s quantitative analysis, I will show you how the “what if” scenarios that were once feared only as rare-case scenarios for DATs have materialised with the onset of a bear market.

Now, onto the story,

Prathik

The Stablecoin Chain for the Real World

If you’re done juggling volatile tokens just to move value, Stable is your platform.

Pay fees in USDT – no extra tokens, no surprises

Free peer-to-peer transfers, sub-second finality

Native USDT settlement + enterprise-grade throughput (10,000+ TPS on roadmap)

EVM-compatible, allowing developers already familiar with Ethereum tooling to build faster

Whether you’re a dev, business, or crypto user, Stable gives you rails that actually feel like digital dollars, not blocked rails.

DATs are businesses that, intentionally or otherwise, have become publicly listed proxies for crypto exposure with operating departments. For most of the past year, the market priced them as high-beta versions of the underlying coins. In a downturn, high beta becomes less glamorous.

And with the downturn now arrived, the situation has been anything but kind. DAT stocks were already off their highs a couple of months ago when I wrote the first quantitative analysis piece, here. The risks were clear back then, too, but they seemed distant. Today, those risks have crashed through the door.

Since the October 10 liquidation event - the worst ever in crypto’s history - DATs’ stock prices have fallen much more sharply than the prices of the coins they hold.

Read: Beyond the Wick 📉

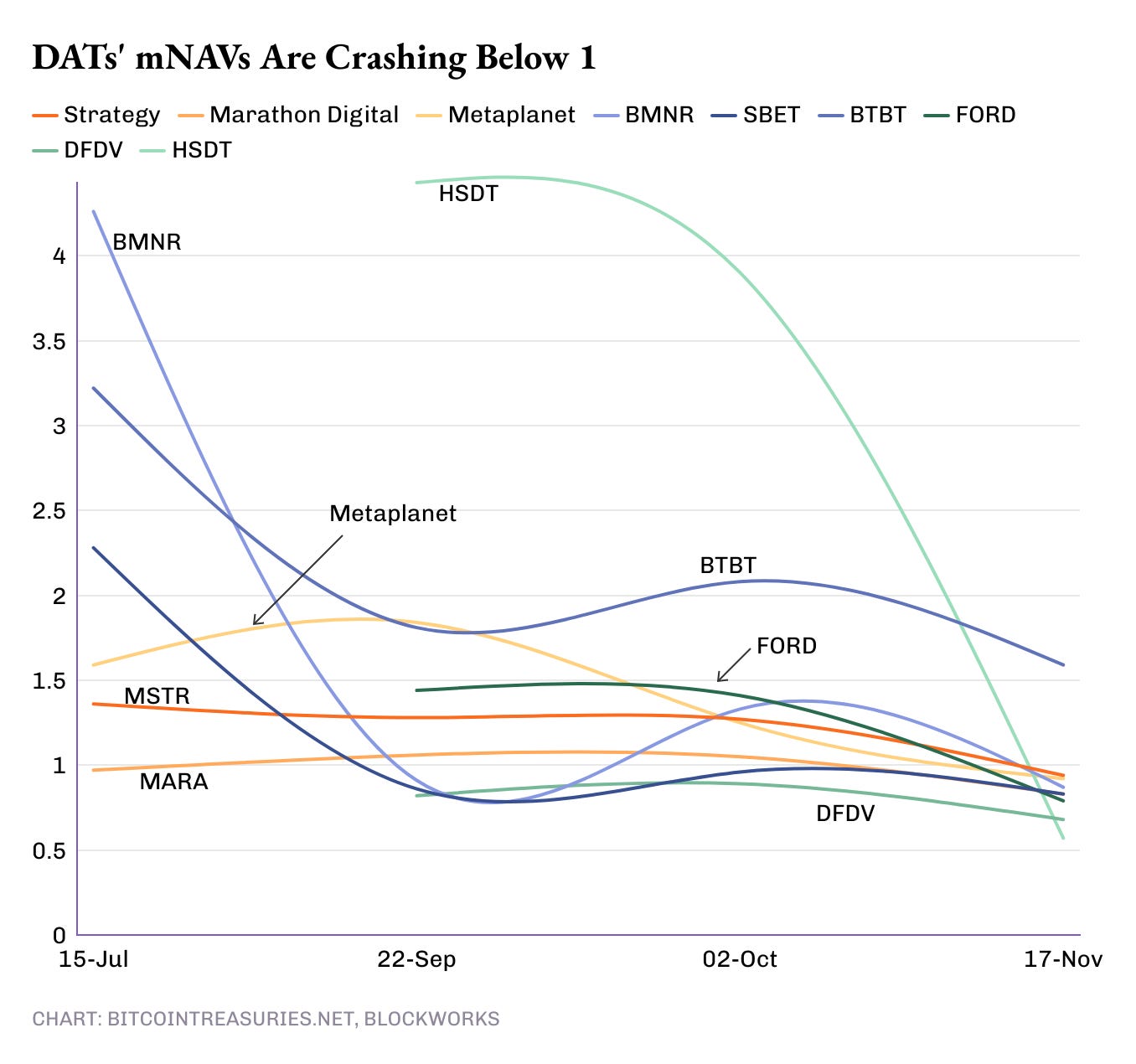

Their mNAVs, which are the simplest possible measure of how much the market values their treasuries, have slipped toward one (1) or below. Even Strategy (formerly known as MicroStrategy), the best-known example of the corporate-bitcoin strategy, now trades at its lowest mNAV in 21 months.

None of this is shocking or unexpected. It’s just that the bear market took the theoretical risks of the bitcoin-treasury trade, including dilution, leverage, cyclicality, investor patience, and turned them into observable, measurable things. The “what ifs” are now showing up in the mNAV charts.

mNAV Factor

(and why the market suddenly cares about it)

If you own bitcoin, you know what you own. If you own a company that holds bitcoin, the situation is slightly more complicated. It can vary from one DAT to another. In Strategy’s case, you could be holding a low-coupon bond that gives you the option to convert it into the company’s stock at maturity.

A simple way to quantify this complication is the mNAV (market capitalisation-to-net asset value) ratio. It answers how much extra shareholders are willing to pay for the wrapper.

When the ratio is above 1, shareholders are saying the wrapper adds value to the company’s existing business. They may like the management team, the growth story, or the idea that a business with a bitcoin balance sheet should have more upside than bitcoin itself. Sometimes they just enjoy the volatility. Sometimes it’s just more appealing and a straightforward route for a traditional investor who’s never played with crypto.

When mNAV is below 1, investors consider the company’s value to be less than the value of the crypto it holds.

A decrease in value could be due to excessive crypto leverage, weak operating results, or poor governance. But the broad idea of a below-1 mNAV is simple. Buying the company gives you worse exposure to the crypto asset it holds than buying the asset directly.

For most of 2025, the mNAVs of crypto-treasury firms have been drifting lower after the initial boost most newly turned DATs experience. Since October, these mNAVs have been falling closer to or below 1.

When mNAV dips below 1, it also makes it difficult to issue new equity at a premium, which in turn makes it challenging to fund additional crypto purchases. Most DATs have financed their treasuries with stock, including at-the-market (ATM) programmes, follow-on offerings, or conversion of debt that ultimately becomes stock. The economics only work cleanly when the shares trade at a price above the value of the coins per share.

This pattern has been uniform across crypto assets and firm sizes. Across BTC, ETH and SOL treasuries, the mNAV lines have converged near 1, or dipped below it. Small, experimental and flagship names - none of them have been spared. The reasons could differ depending on how one argues – leverage here, dilution there, a business model somewhere else. But the market is stating in unambiguous terms that the wrapper is risky in ways the underlying asset is not.

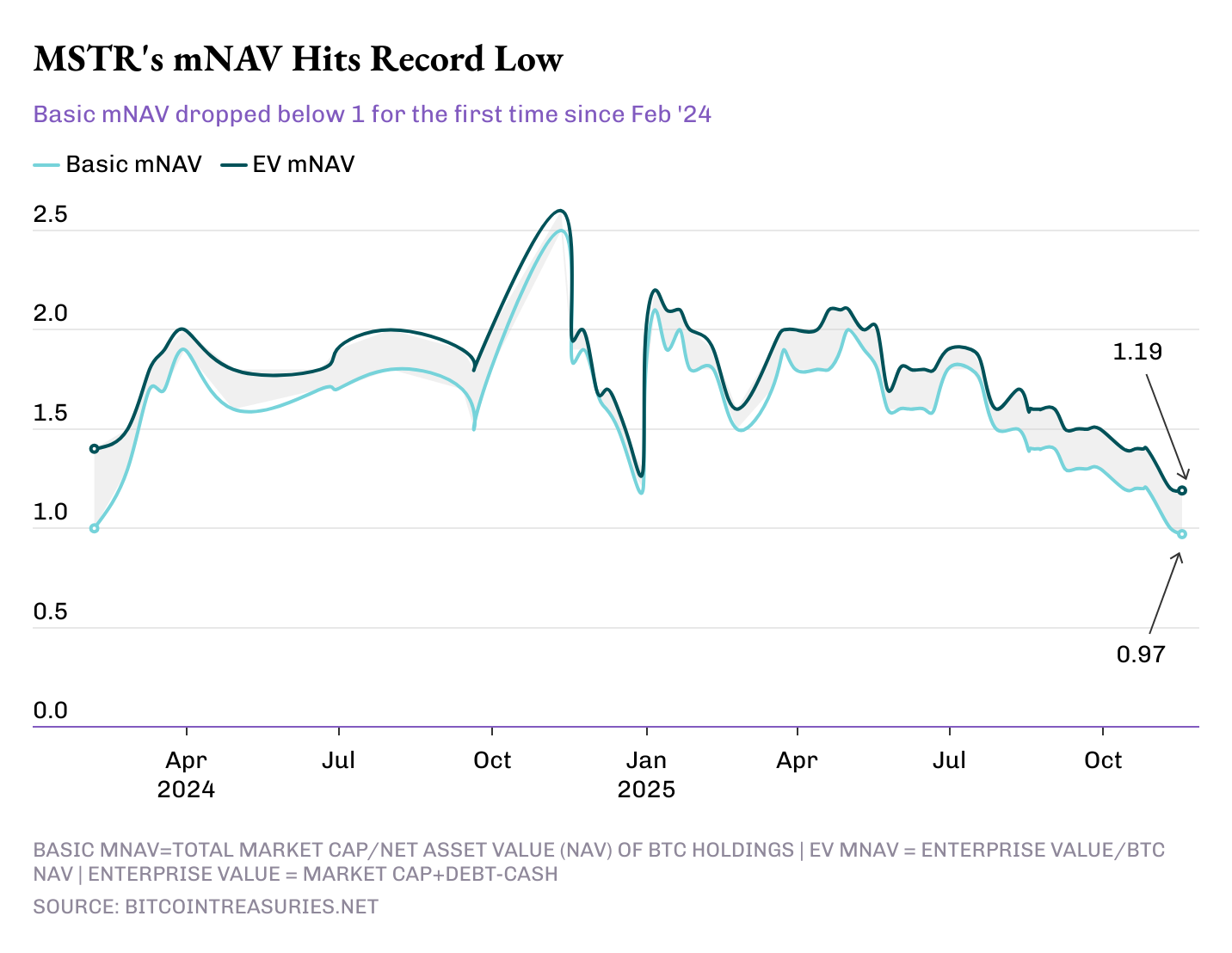

In some cases, investors are assigning a lower value to the business than its crypto holdings, even after accounting for its other operations. Strategy is the best example.

Shaky Strategy?

Michael Saylor’s BTC treasury giant has been the world’s most visible test of the DAT strategy. It has executed it consistently and at scale. It is the closest thing to a pure corporate bet on bitcoin’s long-term appreciation that public markets have ever seen.

Yet its mNAV is now at a 21-month low, below 1.

For most of 2024 and early 2025, Strategy traded with a comfortable premium to its bitcoin holdings. Investors treated MSTR as a levered exposure vehicle with an operating business attached. The premium made sense in the cyclical system where the company accumulated BTC, BTC rose, and, with that, the leverage amplified the stock’s upside.

The same logic is now working in reverse.

Strategy’s basic mNAV slipped below 1 for the first time since early-2024. The company slowed its BTC buying pace over the last two months.. But just as I type this, my phone alerted me that Strategy added 8,178 BTC to its treasury. Yet, the risks in the system loom large.

The DATs route looks riskier now than ever before because of this example. When investors feel sceptical about the one with a head start and a sub-$75,000 average BTC purchase cost, the entire wrapper strategy begins to show cracks.

Slowing BTC Purchases

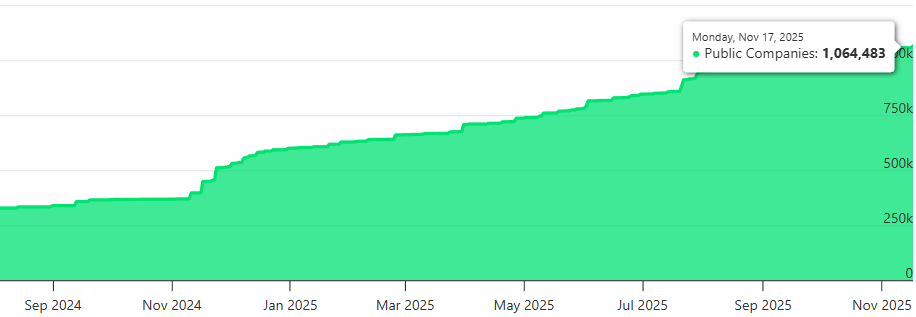

Another concerning signal is that companies are buying less BTC.

DATs bought 115,000 BTC since August 1 this year, of which only 17,000 were purchased since October 10. That includes the 8,178 BTC that Strategy bought as we write this. In the two months leading to the liquidation event of 10/10, DATs had added 90,000 BTC to their treasuries.

While this is a rational thing to do in bear markets, it also reinforces the mNAV problem. If a company does not expand its treasury when prices fall, it suggests negative sentiment within the DAT management team. It makes equity holders question whether the operating business is strong enough to keep accumulating. When this doubt crops up, the mNAV premium disappears.

Where do we go from here?

For most of the past year, DAT businesses and cryptocurrencies were treated as interchangeable. In practice, they are not. Crypto does not have debt covenants or operating losses, whereas companies do. These DATs will still have to report favourable results to maintain investor confidence.

The bear market exposes the old problems that DATs have always carried, and raises crucial lessons for investors.

Leveraged exposure to crypto will now appear riskier, while underlying operating businesses will be thoroughly scrutinised. Steady, consistent accumulation will not be easy to brand as a marketing tagline. mNAV is where all of this will reflect.

That’s it for this week’s quantitative analysis. I’ll see you next week.

Until then, stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.