2025: Ethereum Won, ETH Didn’t

Wrappers, treasuries, and throughput drive the machine, not the money

Today’s edition is brought to you by Fuse Energy.

They are building a modern energy company from the ground up — using blockchain infrastructure to make electricity cheaper, more transparent, and more efficient.

Instead of bloated utilities, hidden fees, and zero accountability, Fuse Energy brings:

Lower-cost energy through smarter infrastructure

Transparent billing powered by on-chain systems

Faster settlements and real-time data

A path toward cleaner, decentralised energy markets

This isn’t “crypto for crypto’s sake.” It is blockchain doing real-world work, starting with energy.

If you care about where Web3 actually touches reality, Fuse Energy is worth paying attention to.

Hello,

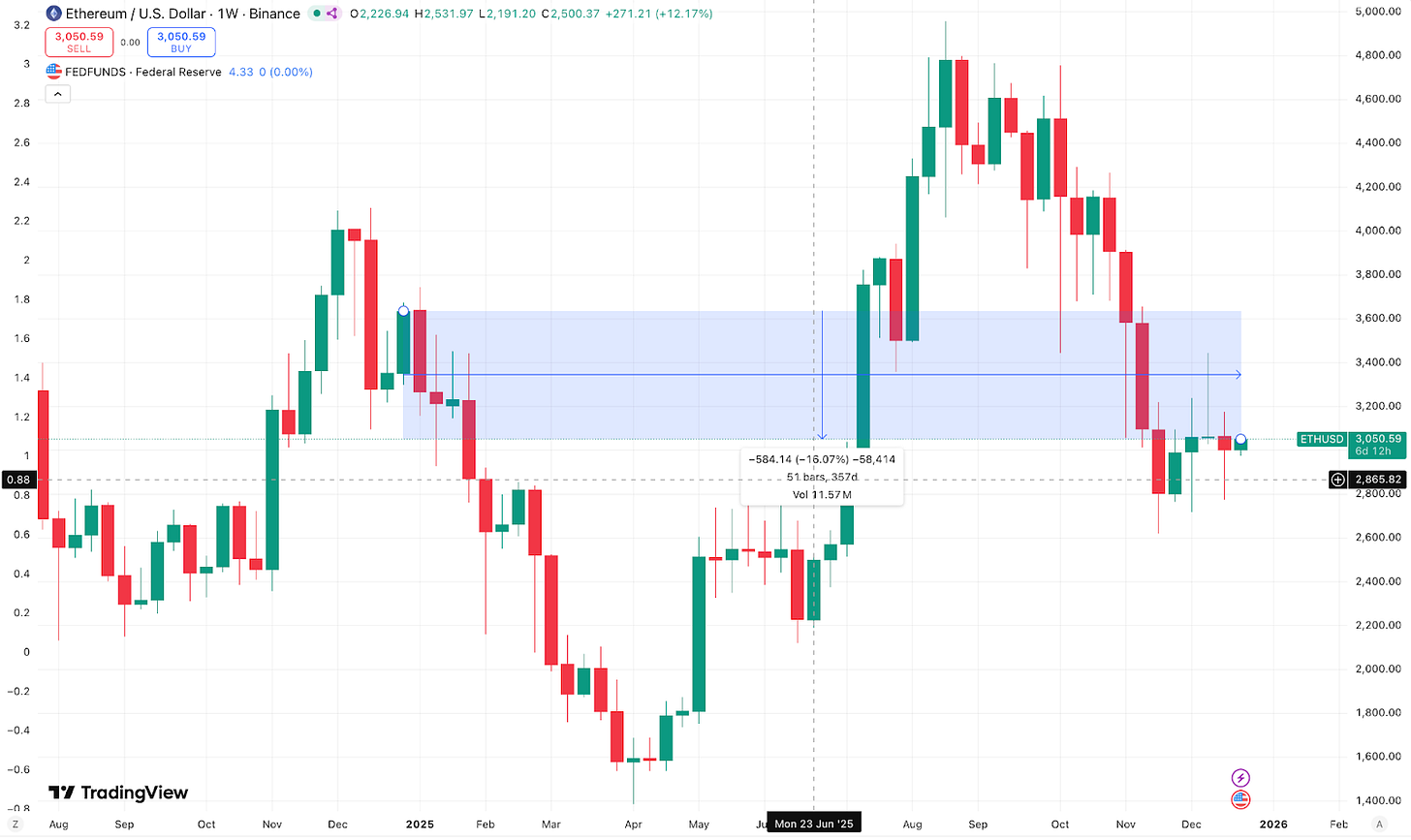

As an ETH-bullish guy, I am guilty of doing this annoying habit this year. I’d open ETH charts and perform my little mental math ritual to gauge how deep in the red my portfolio was. Afterwards, I’d close it, hoping to see it turn green in the not-so-distant future.

As the year ends, I expect most ETH holders who bought at the start of the year to be disappointed. However, Ethereum, the blockchain, has stood out amid the price action and wealth generation its token, ETH, has generated over the past 12 months.

Today’s story is about how Ethereum and ETH have performed this year.

It hasn’t been a good one if you define “good” as “making money”. But, if you look beyond the returns on its native token, ETH became easier to hold in 2025, mainly through market-driven wrappers such as exchange-traded funds (ETFs) and digital asset treasuries (DATs). Ethereum’s two upgrades, Pectra and Fusaka, also made it easier and faster to use the chain at scale.

In today’s quantitative analysis, I will show how 2025 unfolded differently for Ethereum, the network, and ETH, the asset, and what it means for both as we head into 2026.

Ethereum Gets a Shelf

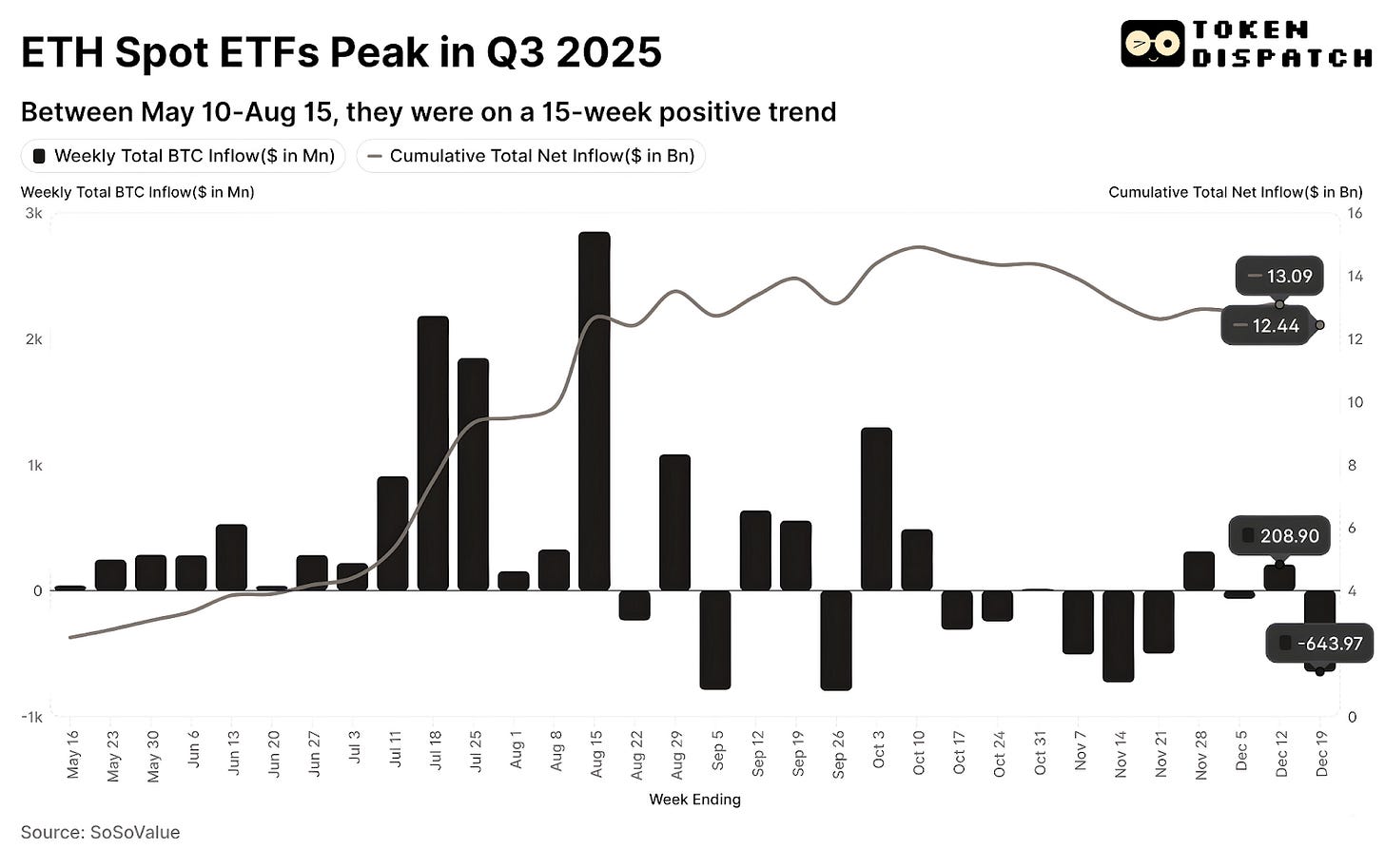

For most of the last two years, the idea of “institutional ETH” seemed like a far-fetched dream. As of June 30, ETH ETFs had accumulated just over $4 billion in inflows since their inception a year ago. Publicly listed firms had just begun warming up to the idea of holding ETH in corporate treasuries.

A turnaround of fate followed in the second half of the year.

Between June 1, 2025, and September 30, 2025, cumulative inflows into ETH ETFs had turned almost fivefold, surpassing $10 billion.

This ETF surge brought with it a psychological shift. It made buying the asset much easier and expanded ETH’s reach beyond builders and traders to a third group seeking exposure to the second-largest cryptocurrency.

This brings me to the second development that emerged this year.

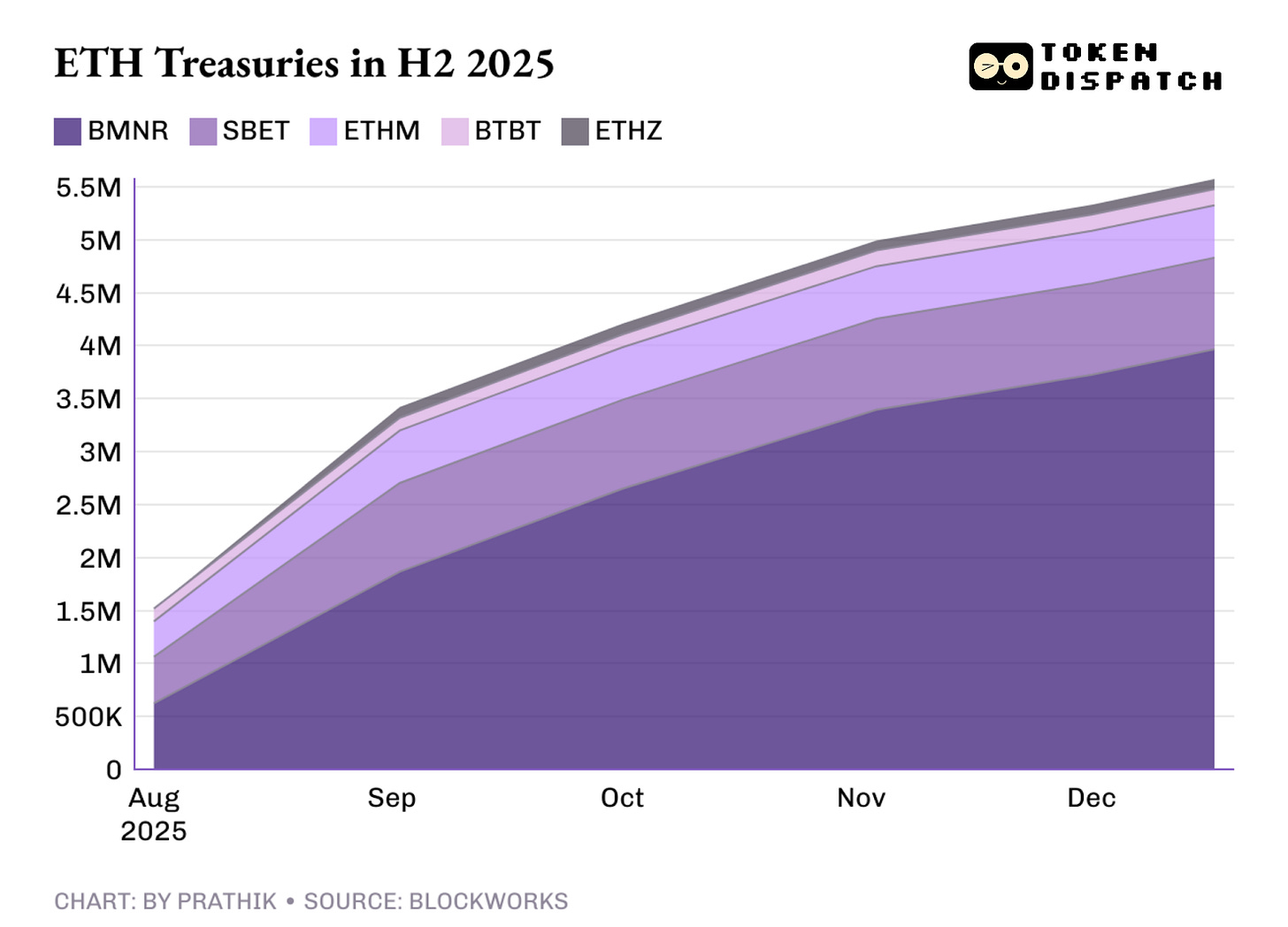

Ethereum’s Newest Buyer

For nearly half a decade, Bitcoin corporate treasuries seemed like the most natural form of treasury, thanks to Michael Saylor’s Strategy (formerly known as MicroStrategy). At least until cracks began to show, the thesis appeared to be the cleanest form of crypto exposure for corporations. Companies listed on the stock exchange bought scarce cryptocurrencies, which drove up crypto prices, which in turn boosted the company’s share price. The firm could then leverage this to sell more shares at a premium.

Read: Where’s DAT Beta? 🎁

So, when ETH treasuries became a thing in June this year, it initially puzzled many. It was what ETH made possible, which BTC treasuries didn’t, that made them stand out. Especially after Joe Lubin, co-founder of Ethereum and founder and CEO of ConsenSys, announced his decision to chair SharpLink Gaming’s board and lead its $425 million Ethereum treasury strategy. The bet seemed calculated.

Soon after, many more corporations followed SharpLink’s lead.

Today, the top five ETH treasury firms hold 5.56 million ETH, over 4.6% of the Ethereum supply, worth more than $16 billion at current prices.

When buyers seek an asset through wrappers like ETFs and treasury vehicles, the asset starts to behave like a balance-sheet line item. It attracts governance, reporting, board-level discussions, quarterly updates and risk committees.

The staking angle allows ETH treasuries to offer something their BTC counterparts can’t.

While Bitcoin treasuries help corporates realise gains only when they sell their BTC at a profit, holding ETH itself allows ETH treasuries to earn more ETH by staking it to secure the network.

If companies can find a way to complement their business revenues with staking income, they can sustain their treasury business.

Read: ETH’s Treasury Turnaround 🏛️

And then, people started paying attention.

The Elusive Marketing

People who have followed Ethereum through its journey know how closely marketing and Ethereum often run in parallel. Instead, it tends to look boring until an external event, such as a product wrapper, a cycle shift, or a new narrative, forces people to take note of Ethereum’s potential.

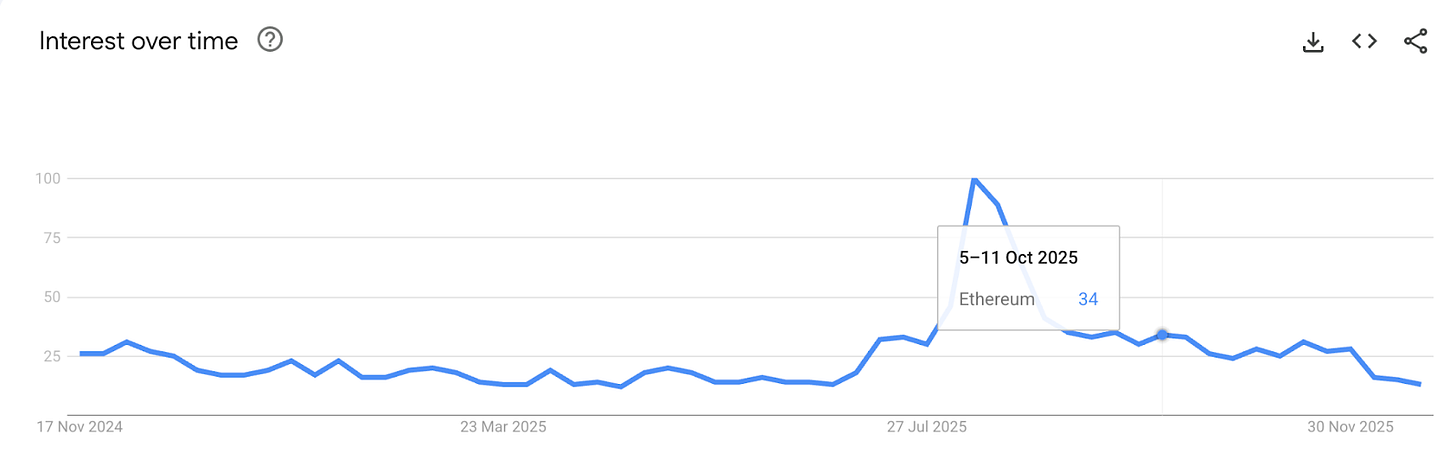

This time, attention grew as ETH DATs rose and inflows into ETH ETFs increased. I measured this attention in one of the crudest ways possible: by checking whether retail users, who usually don’t care about blockchain roadmaps, were thinking about Ethereum.

Google Trends surged during the July-September period, in line with the momentum of ETH DATs and ETFs. Traditional routes to owning Ethereum sparked retail curiosity. Curiosity brought attention.

But attention alone is not enough. It is fickle and can vanish as quickly as it rises, which brings us to one of the most under-appreciated reasons why Ethereum believers count the year as a big success.

Hosting Internet’s On-Chain Dollars

If you zoom out far enough from any price chart, the troughs and crests can seem like mere consequences of fluctuating sentiment. But stablecoins and tokenised real-world assets (RWAs) are not like that. They are rooted in strong fundamentals, bridging traditional finance with decentralised finance.

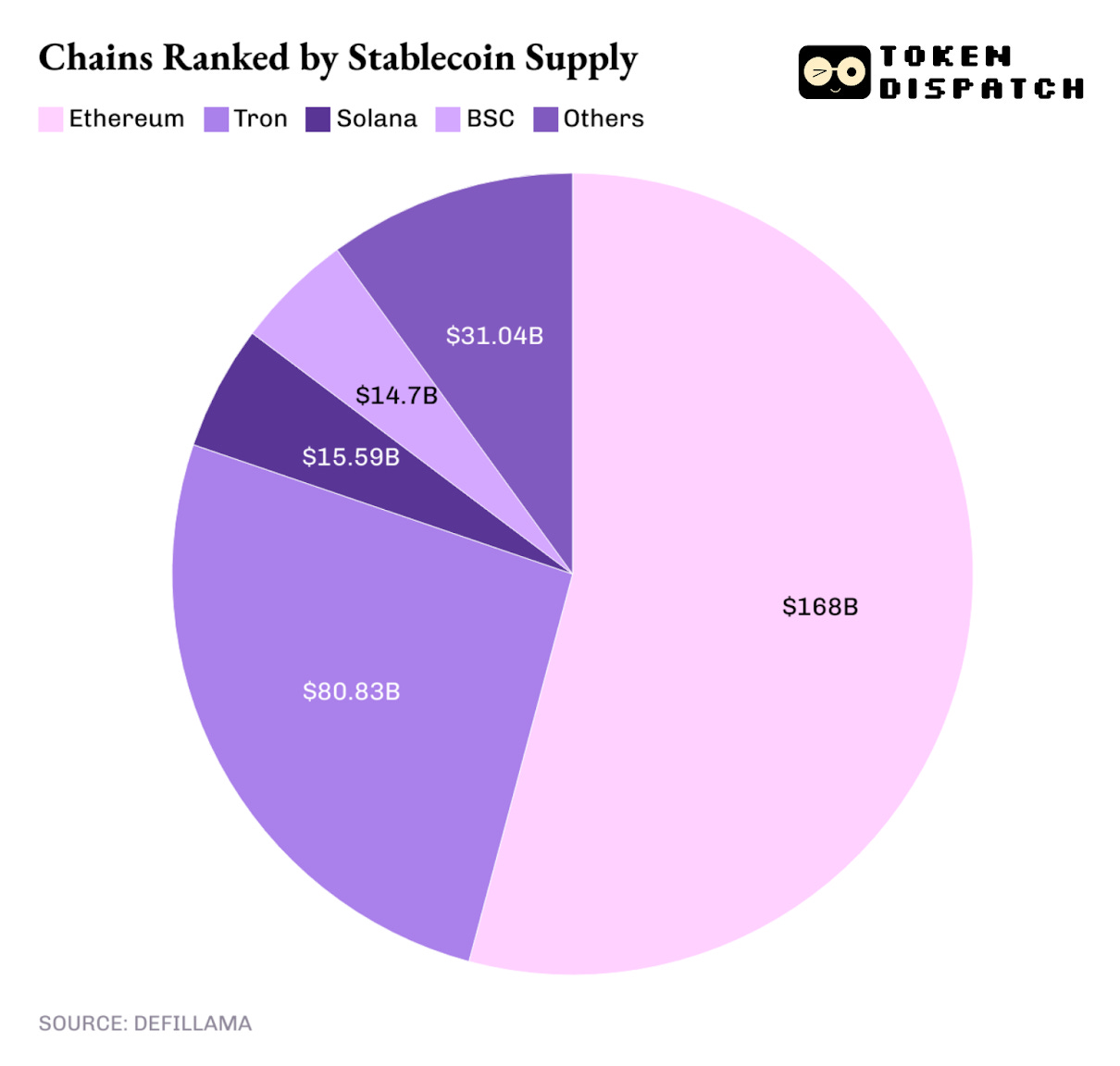

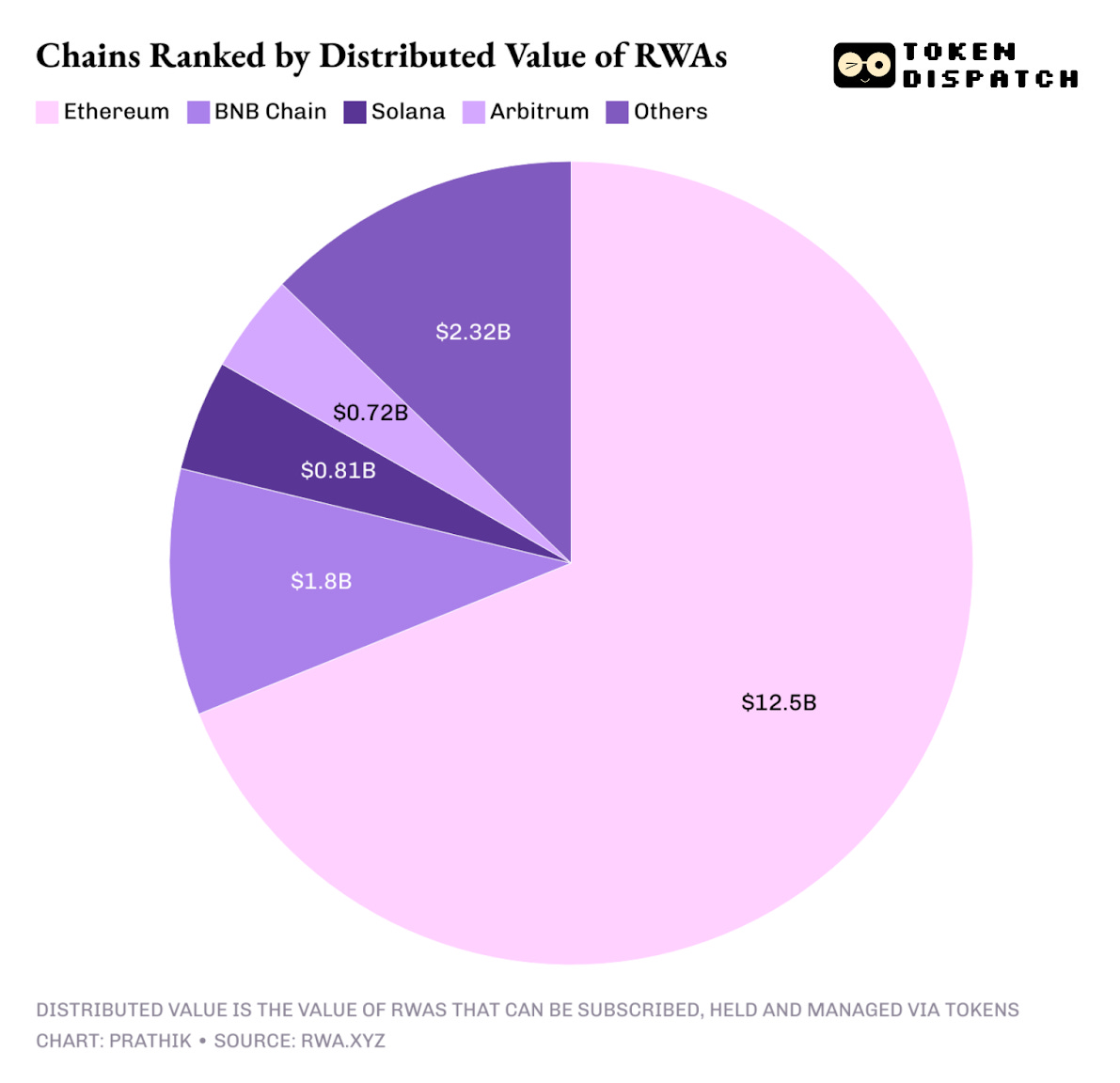

In 2025, Ethereum still retained its crown as the most favoured platform for the dollar layer, enabling stablecoin circulation and the tokenisation of real-world assets.

On tokenised RWAs, you see the same phenomenon.

Ethereum still accounts for the majority of “distributed” tokenised asset value at the time of writing. This means that more than half of the tokens that allow their holders to buy, manage, and hold their tokenised RWAs were issued on the Ethereum chain.

So, while ETFs made it easier to buy ETH, treasuries allowed buyers to hold ETH through a regulated Wall Street route, gaining exposure to leveraged ETH.

All this further integrated Ethereum into traditional capital markets, where people were already comfortable holding assets in a regulated environment.

The Dual Upgrades

Ethereum underwent not one, but two major upgrades in 2025. These upgrades made the network feel less congested, more stable, and more usable as a base layer for those looking to settle their transactions on a trusted platform.

Pectra went live in May, expanding blob capacity to improve scalability and reduce Layer-2 (L2) transaction costs by providing more space for L2s to post their compressed data. It also enabled higher transaction throughput, faster confirmations and better overall efficiency for rollup-centric applications.

Later in the year, Fusaka followed to scale further and enhance the user experience.

Read: DAwn of Ethereum ⛓️

Overall, Ethereum spent 2025 optimising to behave like dependable financial infrastructure. The upgrades prioritised uptime, throughput and cost predictability. These qualities are vital for rollups, stablecoin issuers, and institutional users settling value on-chain. These choices make Ethereum more reliable at scale, even if they don’t significantly support the short-term link between network activity and ETH price.

Where That Leaves Us

If you are looking for a simple, binary takeaway from the year — “Ethereum good” or “Ethereum bad” — 2025 might not offer a clear answer.

Instead, it presents a more interesting, but uncomfortable truth.

In 2025, Ethereum made its way into the books of fund issuers (ETFs) and the balance sheets of public companies (DATs), and it retained attention that aligned with institutional allocation.

ETH holders, however, lived through a year where the price chart didn’t mirror the blockchain’s progress.

ETH holders who bought on January 1 are still down at least 15%. The year did see ETH register an all-time high near $4,953 in August, but that didn’t last. It now trades near a five-month low.

Ethereum will still enter 2026 with robust upgrades and a heavy volume of stablecoins and tokenised RWAs. If the network can capitalise on the momentum from these wins, it can channel it into long-term price action.

That’s all for this week’s quantitative analysis. I will be back with the next one.

Until then, stay sharp,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.