Hello

When markets get jumpy, retail doesn’t always quit. They flip the way they express their opinions, from investing to trading outcomes.

That’s what the past quarter’s trading volume tells us.

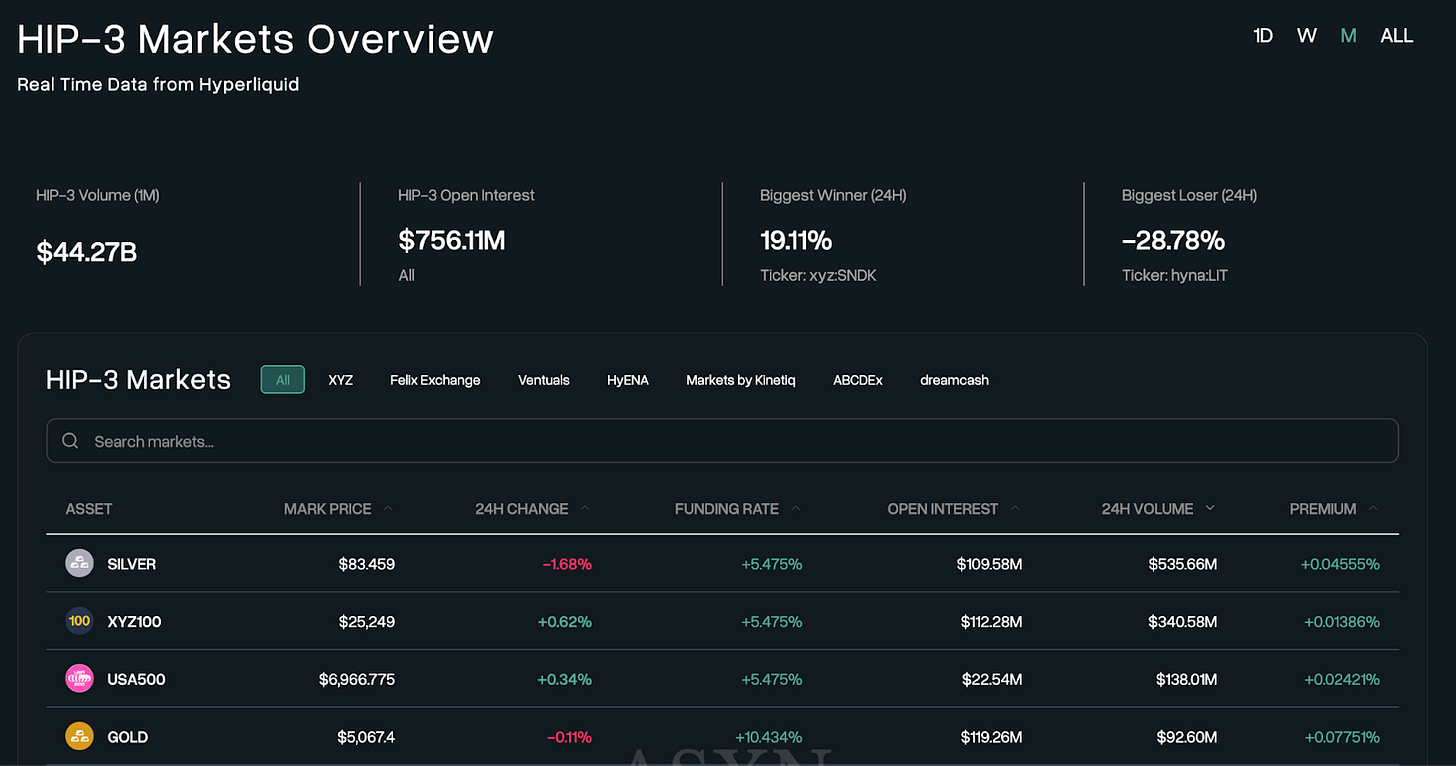

Real-World Assets’ on-chain trading volume recorded the fastest growth period last quarter. Both commodities and stocks tripled their supply within the last quarter.

Uncertainty in macroeconomic conditions is redirecting retail capital toward more volatile assets and away from long- term investments. And most excitingly, crypto infrastructure has captured a significant share of this capital.

In late January, Silver saw its most volatile day in decades and dropped by more than 30% in 36 hours. As shiny metal’s volatility peaked, Hyperliquid captured 2% of the world’s largest silver futures market.

The strange part? While gold dominates traditional futures markets by 4-5x over silver, the ratio has flipped on-chain.

As of the time of writing this article, Hyperliquid’s gold volume runs six times lower than that of silver!

What’s the Metal?

While TradFi and RWA instruments have been on-chain since 2021, their volume has taken off significantly over the last quarter in particular. One reason is a more mature on-chain infrastructure. There is also a change in broader global investment behaviour.

Global policy shifts and the rise of AI are driving capital flows out of banks and into commodities and equities. Uncertainty in the U.S., driven by the looming debt crisis, recurring tariff announcements, government shutdowns, and weak macroeconomic metrics, has led retailers to stockpile gold and silver, significantly increasing their prices. And unsurprisingly, retail is part of this bandwagon.

The COMEX silver and gold micro markets, which are dominated by retail participants, have seen a sharp increase in volumes. Micro Gold volume has grown at an average of 58% per year, while Micro Silver volume has seen an average annual growth of 93% over the last five years.

This is exacerbated by retail’s growing uncertainty in global policies, equity movements and BTC/Crypto.

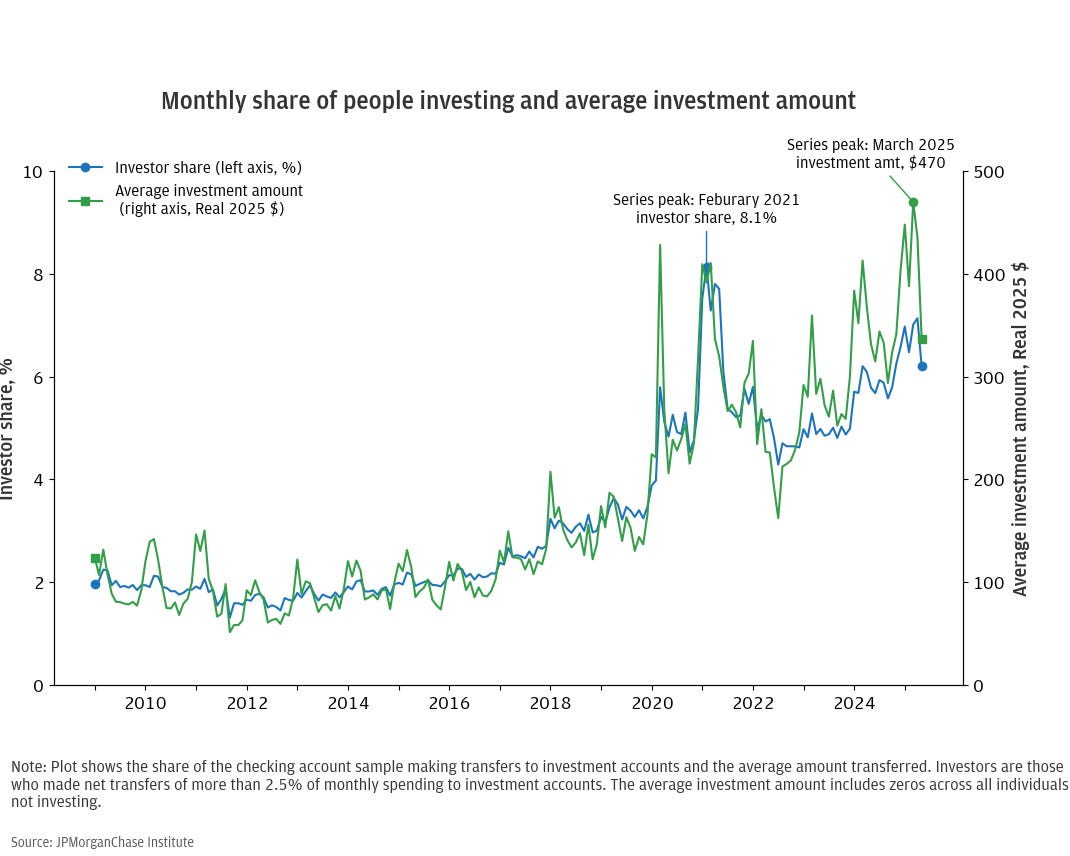

This story, however, is not limited to commodities. JP Morgan reported that retail investments rose 50% from 2023 to 2025.

Gen Zers are also entering the market earlier: the share of 25-year-olds in 2024 who held investment accounts was 37%, up from 6% in 2015. And crypto is the primary investment instrument for Gen Z, with 55% of their investment in digital coins today.

As a result, this rise in retail and Gen Z investors globally has now moved on-chain, as reflected in RWA growth.

In the last quarter alone, on-chain stock adoption almost tripled from $350 million to almost $1 billion today. Meanwhile, on-chain commodities have risen from $2.3 billion to $6.8 billion in the same time period.

This fresh volume is now trickling down to find the best avenues to trade.

We are now seeing once-in-a-decade swings in metal markets, and this rising volatility in macro markets is driving traders to perp exchanges. Trading in futures is growing faster than long-term investments. This parallels rising futures trading on global markets; we saw Cboe report a 24% increase in derivatives volume in a quarter.

Hyperliquid’s TradFi markets couldn’t have come at a better time. They were launched in October 2025 and have since captured a significant share of on-chain tradfi trading. Especially Silver.

But why silver? And why Hyperliquid? Let’s get to the bottom of it!

Silver Shines on Hyperliquid

Today, Hyperliquid has long dominated on-chain perps, commanding more than a quarter of the entire market. However, its expansion into TradFi assets is more recent.

Over the years, the product has expanded its market share. One such effort was through the launch of HIP-3 (Hyperliquid Improvement Proposal 3) markets late last year. These enabled fully permissionless creation of new perpetual futures, allowing developers to deploy custom markets by staking 500K $HYPE.

Read: Everything Is a Ticker 📊

Hyperliquid has expanded to TradFi assets such as indices and RWAs - metals, stock indices or pre-IPO stocks through these builder-deployed markets.

Collectively, these TradFi instruments now account for ~30% of platform volume, with daily notional turnover exceeding $5 billion. And silver constitutes the largest share of these flows.

So, why silver over gold? And why Hyperliquid?

There are two main reasons why:

Silver’s Volatility

While gold serves as both an institutional hedge and a store of value for retailers, silver has historically attracted more speculative trading activity. Silver’s higher volatility (typically 2-3x gold’s price swings) and lower entry price make it more appealing for leveraged directional bets, exactly the profile that fits perp DEX traders.

Hyperliquid’s Retail First Approach

In contrast to institutionally dominated CME, Hyperliquid thrives by providing retail participants with superior execution and a more flexible trading environment than traditional exchanges. Which explains why, in its silver markets, the average trade size is ~$5K, with a median of just $1,190.

While CME currently requires an 18% initial margin (approx. 5.5x leverage) for silver futures, Hyperliquid silver perpetuals offer up to 20x leverage.

CME contracts have fixed expiration dates; retail traders must manually ‘roll’ them or face physical delivery. In contrast, contracts on Hyperliquid do not expire; they utilise continuous funding rates that simplify long-term management for retail traders.

House of All Finance

Silver’s market gain on the Hyperliquid proved HIP-3’s product-market fit (PMF) as a retail trading hub for volatile assets. But the event is significant for one more important reason.

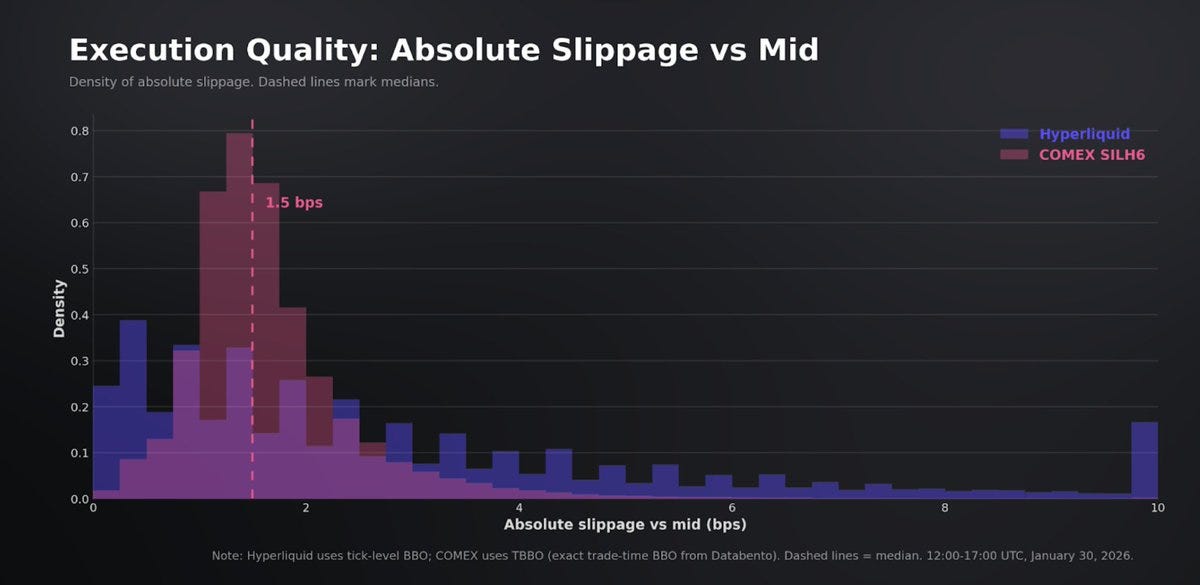

The record-high trading volumes on Hyperliquid recently also demonstrate its effective handling of global trades for a TradFi asset. For retail-size trades, the execution was better than that of the largest equivalent TradFi futures market, COMEX, with the median spread 0.06% better than COMEX’s.

The market even sustained the recent silver crash. For the smaller trade size of an average silver trader on Hyperliquid, the trade spreads on the market stick very close to COMEX spreads.

Hyperliquid demonstrated resilience and delivered competitive execution under adverse market conditions. It also proved the stress test as a house for all of finance.

Read: Hyperliquid: House of Finance 🏦

In addition to comparable execution for retailers, Hyperliquid markets are open 24/7 and trade on weekends.

The weekend mechanism enables price discovery during non-trading hours. When external oracles resume on Monday, this internal price is pulled back toward the external reference. This interim window allows traders to position ahead of the opening auction.

During the weekend, silver fell from $85.76 to $83.70 ahead of reopening. Over this period, the market saw 175,000 trades worth $257 million in notional volume.

While this was only a fraction of the weekday volumes. Hyperliquid’s continuous weekend market produced a price level highly similar to COMEX’s opening auction, and Sunday’s final internal price was closer to Monday’s open than Friday’s close.

Time will tell if the weekends can attract comparable volumes to become an efficient way to price when the market opens on Monday.

However, it should be noted that in the HIP-3 markets, the DEX remains retail-first rather than institutional. Because COMEX holds significantly more depth on larger spreads compared to Hyperliquid. The larger the trade size, the better execution one can expect on COMEX versus Hyperliquid.

Looking Ahead

Success in the silver markets has brought Hyperliquid significantly closer to its vision of becoming the “House of All Finance.”

The scalability of these HIP-3 markets now hinges on three pillars: tighter spreads, institutional-grade execution, and a resilient oracle that can weather extreme volatility.

The January silver crash served as the protocol’s first true stress test, proving that a decentralised engine can maintain prices comparable to those of TradFi counterparts and provide 24/7 price discovery even when traditional giants like the COMEX are closed for the weekend.

However, a clear ceiling remains: currently, HIP-3 markets lack the deep liquidity required for large-scale institutional clips.

While they may not attract hedge funds in the immediate term, Hyperliquid has found a unique Product-Market Fit (PMF) by offering “institutional-lite” access to a retail-first audience. It is effectively democratising access to volatile

TradFi assets that are otherwise cumbersome to trade through traditional brokerages.

For other perp DEXs, the lesson should be: volume follows a volatile asset. The challenge for the coming months is whether Hyperliquid can catch the next narrative - be it non-U.S. equities, pre-IPO stocks, or prediction-style outcomes.

The ultimate question is whether demand for RWA perps is a structural shift in how we trade, or simply a byproduct of high-volatility times.

We will wait and see.

Until then, keep trading metals,

Nishil

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.