Are ETFs Driving Bitcoin in 2024? 🚗

The launch of spot US Bitcoin ETFs in 2024 has been a pivotal moment for crypto. With institutions pouring in the money, BTC has not just got legitimacy but also a buy-in from the retail investors.

Hello, y'all. Saturday analysis we dive into the ETFs fireworks that’s defined Bitcoin in 2024.

FOMO about missing out on Coldplay live? Play Muzify quiz to score the concert ticket. It’s got over 2 million plays, are you on the board yet?👇

In October 2008, Satoshi Nakamoto - an eccentric name for a person whose hunt is still on - published “Bitcoin: A Peer-to-Peer Electronic Cash System” white paper.

With the white paper, the author proposed a decentralised, peer-to-peer network to challenge the traditional centralised financial systems.

This was in the backdrop on 2008 financial crises triggered by the housing markets collapse in US, and the domino effect paralysis the global economy.

Despite detailing how the network was capable of preventing double-spending through proof-of-work consensus, there were critics aplenty.

Some big and influential ones too.

Five years later, in 2013, investor and vice chairman of Warren Buffet-led Berkshire Hathaway Charlie Munger called it rat poison.

"It's stupid because it's very likely to go to zero.”

Bitcoin was worth $150 that year.

Five years later in 2018, when Bitcoin was trading at $9,000, he was asked again what he felt about the asset, he said: "So it's more expensive rat poison."

At the same time, his investor partner Warren Buffet called it "rat poison squared.”

Four more years later in 2022, Buffet didn’t budge.

He wouldn’t want all the world’s Bitcoin even for $25.

“I wouldn't take it because what would I do with it? I'd have to sell it back to you one way or another. It isn't going to do anything.”

Two more years later, back to the present, on October 31, 2024, Bitcoin turned 16.

Trading around all-time high and enjoying a seat at the table at the upcoming 2024 US Presidential Elections.

The elections hold the key for Bitcoin and the entire crypto landscape.

Read: Will Crypto Cast its Vote in 2024? 🗳️

Still, less than a week to go for the elections and Bitcoin is hovering around $70,000, not too far from the all-time high. Earlier in the week it almost broke its all-time high price. Fell around $200 short.

If you look at the charts carefully, Bitcoin is badly stuck in a range from $73,000 to $49,000 for around eight months now. From March to October 2021.

What’s even more fascinating is the big three-month rally from about $40,000 to almost $74,000 in the first quarter of 2024.

There in lies the story. The one that has defined Bitcoin in 2024.

The very Wall Street that was sceptical about Bitcoin embraced it.

Berkshire Hathaway might be the world's 9th most valuable company by market cap, and their promoters might not entertain anything Bitcoin. The Wall Street has moved on.

Not just embracing Bitcoin, but pitching it as the asset that’s the hedge against global inflation.

Ironically, Bitcoin sits three spots ahead of Berkshire Hathaway in world’s top assets by market cap.

What’s the story?

Exchange-traded fund.

The US Securities and Exchange Commission (SEC) on January 10, 2024 approved spot Bitcoin Exchange-traded Funds (ETFs).

Read: Why Bitcoin ETFs a big deal? 🤔

The floodgates opened. Everyone was at the party.

Giants such as BlackRock, Fidelity, and Invesco have put their weight behind it this time.

Result? Just a month later in February, BTC’s market cap crossed $1 trillion mark, for the second time after December 2021. And has stayed above the mark ever since.

The ETFs flow has defined the Bitcoin price in 2024.

Where are we today?

Bitcoin dominance touches 60% first time since March 2021.

ETFs are one of the best performing ETFs this year, if not the best.

Read: What’s Up? ETFs 🚀

Read: Crypto’s Best September Yet? 🫵

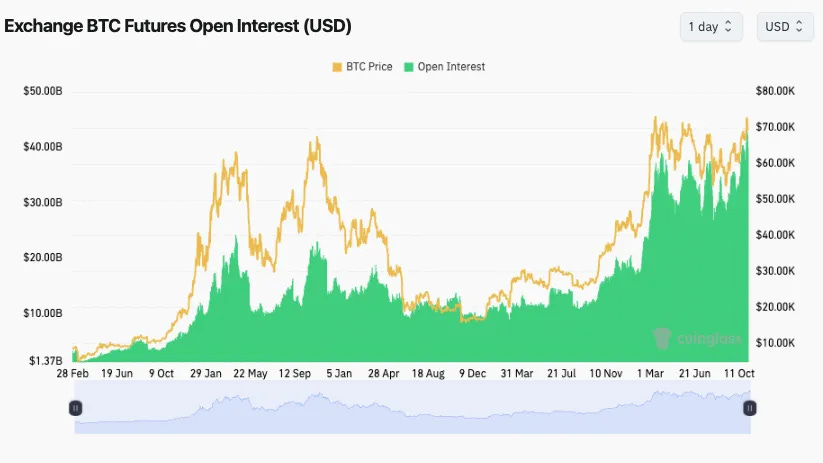

New ATH for Open Interest ($43.6 billion) in Bitcoin.

Between October 21-25, the 11 spot Bitcoin ETFs bought a combined 15,194 BTC, nearly five times the 3,150 BTC mined in that period, showed data from HODL15Capital.

ETF holdings now just over 1 million BTC, close to what Satoshi Nakamoto holds.

BlackRock is leading the pack.

Read: US Bitcoin ETFs vs Satoshi Nakamoto? 💪

So, how is all this impacting Bitcoin?

Consistent buying pressure by institutional interest pumping in money in ETFs.

More demand, higher prices for Bitcoin.

Now you get where those ATH record-threatening prices were coming from.

But how can ETF activity alone swing Bitcoin prices amid many other factors?

Significant Volume.

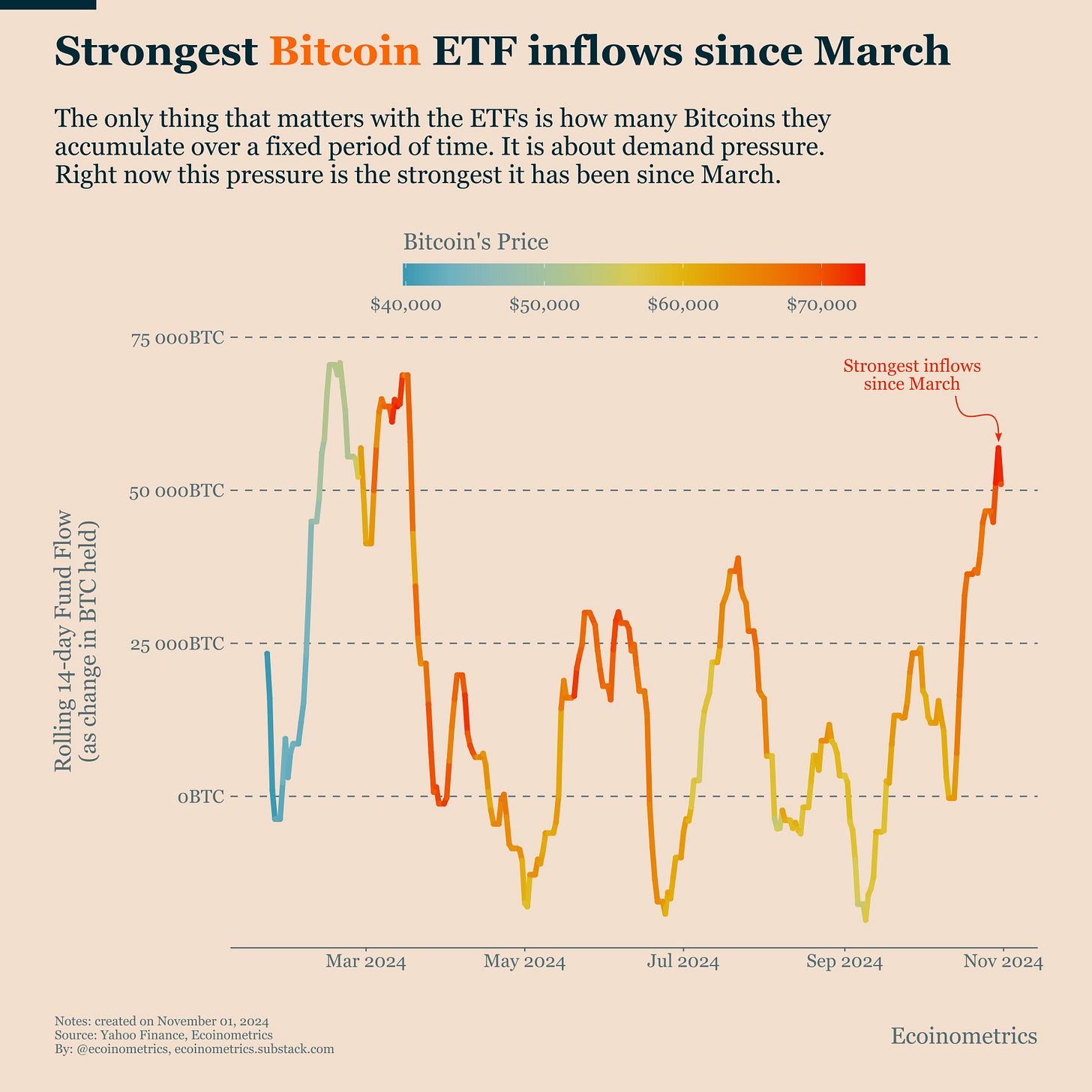

Activity on ETFs is peaking.

After months of modest inflows since March, ETF inflows are finally peaking.

This is single-handedly outsizing any other factor in driving up BTC price.

The Home for All the Music Lovers

Muzify - With over 2 million plays, is more than just a platform.

It's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

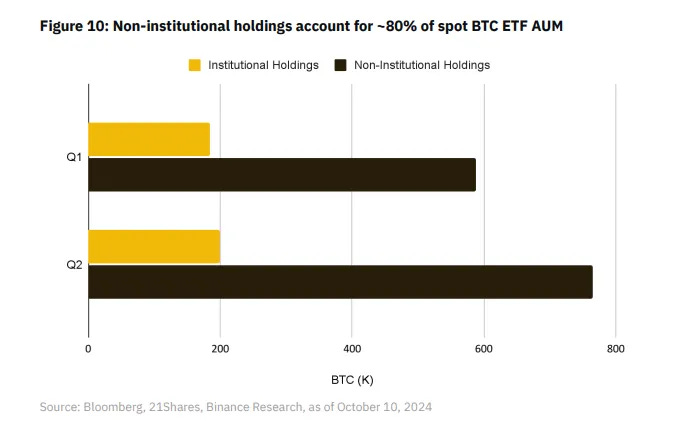

Are retail investors signing up for ETFs?

They are lapping them up.

Says who? A report by Binance.

Non-institutional investors accounted for ~80% of the total assets under management (AUM) in spot BTC ETFs as of October 10.

What’s attracting the retailers?

Reward + Reduced Risks + Liquidity = ETFs

“Spot ETFs are serving dual roles: not only onboarding new investors but also attracting existing investors who prefer the regulated structure of ETFs over other, more complex options, such as direct on-chain holdings or illiquid, high-fee alternatives like Grayscale’s Bitcoin Trust,” Binance said in the report.

ETFs give investors the exposure to a potentially inflation-beating asset, Bitcoin, without worrying about the technological knowledge needed to invest and track their portfolios.

Imagine if the world’s largest asset management company with a $10 trillion AUM - BlackRock - is issuing Bitcoin ETFs.

Maybe even the biggest of critics would be tempted.

Even Mr Buffet? Maybe in a parallel universe?

In fact, BlackRock's entry into crypto matters more than US Election.

QCP Capital's founder and chief investment officer Darius Sit.

"The biggest change this year has been BlackRock. Suddenly we have bitcoin being distributed in BlackRock’s extensive network. When you have [BlackRock CEO] Larry Fink on CNBC talking about how bitcoin is a store of value, that's when you know crypto has become a part of the American investing narrative.”

"BlackRock has brought crypto from frontier to mainstream."

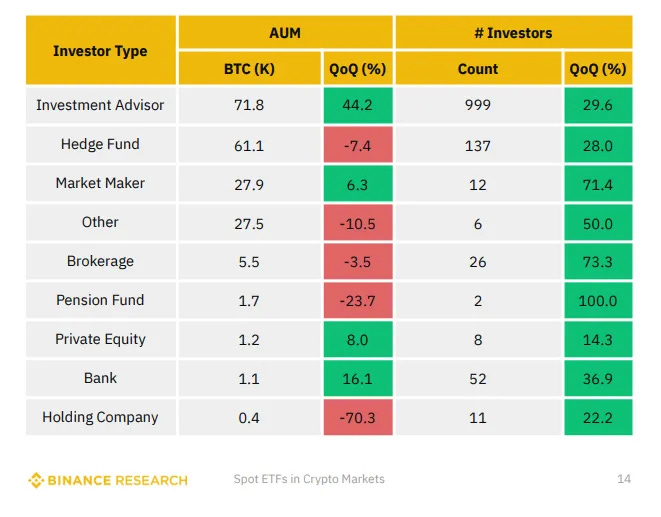

And BlackRock has got company of 1000 more such institutional investors.

The word’s spread far across the Atlantic.

BNP Paribas, Europe’s Largest Bank, bought BlackRock Bitcoin ETF before investing in US wealth and pension funds.

Besides BNP Paribas, BlackRock’s iShares Bitcoin Trust (IBIT) boasts of having 661 institutional investors on boards.

What else? 20% of its shares are held by institutions and large advisors.

With all this activity, where are ETFs headed?

Investment advisors are already adopting bitcoin ETFs faster than any other ETF in the history.

Says who? Bitwise CIO Matt Hougan.

Bloomberg’s ETF expert also agrees.

So, will ETFs take crypto to all households?

Token Dispatch View

Well, if you ask us. It is already happening.

The retailers have bought the story.

Biggest institutions are lending rock-solid support by absorbing all the selling pressure arising out of temporary factors.

Besides USA and Canada, countries such as Germany, Australia and Hong Kong have also jumped onto the ETF bandwagon.

The success of Bitcoin ETFs have already pushed industry to apply for ETF approvals for Solana, Ripple, Litecoin and multi-crypto ETFs.

What we also see unfolding is that investors are beginning to look at Bitcoin not only as a risk asset but also as a possible alternative to gold as a better hedge against inflation.

How can we say this?

In just one year of existence, Bitcoin ETFs have attracted more than 50% of the investor money that gold ETFs.

Oh, and let’s not forget about the 2 decades that the gold ETFs have already been around for.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

Bitcoin ETFs could change wealth management as we know it. Investment advisors who were previously limited to traditional assets now have a legitimate crypto option to offer their clients. If advisors start recommending Bitcoin ETFs as a diversification tool, it could potentially lead to a paradigm shift where crypto becomes a staple in many portfolios alongside stocks and bonds.

While ETFs bring legitimacy and increase liquidity, they might also lead to increased price swings if institutions decide to quickly exit their positions. I wonder if we’ll see a lot more volatility in Bitcoin as it becomes a more mainstream asset. Institutions can pump prices, but large sell-offs could also become a concern, impacting smaller retail investors who might be banking on Bitcoin as a ‘safe’ inflation hedge.