Hello,

Human civilisations have evolved over millennia in countless ways. The way we talk, dress, live, build structures, form communities, gather food, and much more. Yet, there’s one thing human civilisations have had in common - the urge to speculate.

Before the first idea of church and before the state came into being, humans were gambling. Of all the things they did consistently across cultures and centuries, placing bets on uncertain outcomes ranks somewhere alongside cooking and burying the dead.

The oldest known dice date back more than 5000 years. They were found around 2800 BCE in a backgammon-like game set excavated from a burnt city in modern-day Iran. In the 6th century BCE, gambling on chariot races was widespread in ancient Rome, luring all social classes, from senators to slaves. The Indian mythological war epic, the Mahabharata, turns on with a dice game. All four gospels of the Bible record soldiers casting lots for Christ’s clothes after crucifying him.

Every civilisation of every era, in recorded history or man-made epics, found a way to stake something real on an uncertain outcome. This shows that the desire to say “I know something that the world doesn’t” and to be rewarded for that knowledge are inseparable from being human.

Eras changed, venues changed, but the impulse to gamble stayed on. In fact, it evolved with time.

In 1720, the South Sea Company offered its Englishmen a tradeable stake in the future. The promise of a government debt-to-shares swap led to speculations, driving up share prices from around £100 in 1719 to nearly £1,000 in 1720. The potential trade never materialised, and the speculation culminated in the infamous financial crash, the South Sea Bubble, the 18th-century equivalent of a dot-com bust. The British Parliament then banned future speculative ventures.

The itch to speculate remained, just waiting for the next venue. Throughout the 20th century, traditional finance built an elaborate permissioned structure to rekindle this speculative impulse. They introduced a set of checks and balances: accredited investor rules, Pattern Day Trader restrictions, and markets that closed at 4 pm and reopened the next morning. The implicit message to the people was that “you could speculate, but only if you are already wealthy, only on our schedule, and only after completing the paperwork.”

The inconveniences irked many, but there was nowhere else to go. Until there was.

Consider what happened to silver last month.

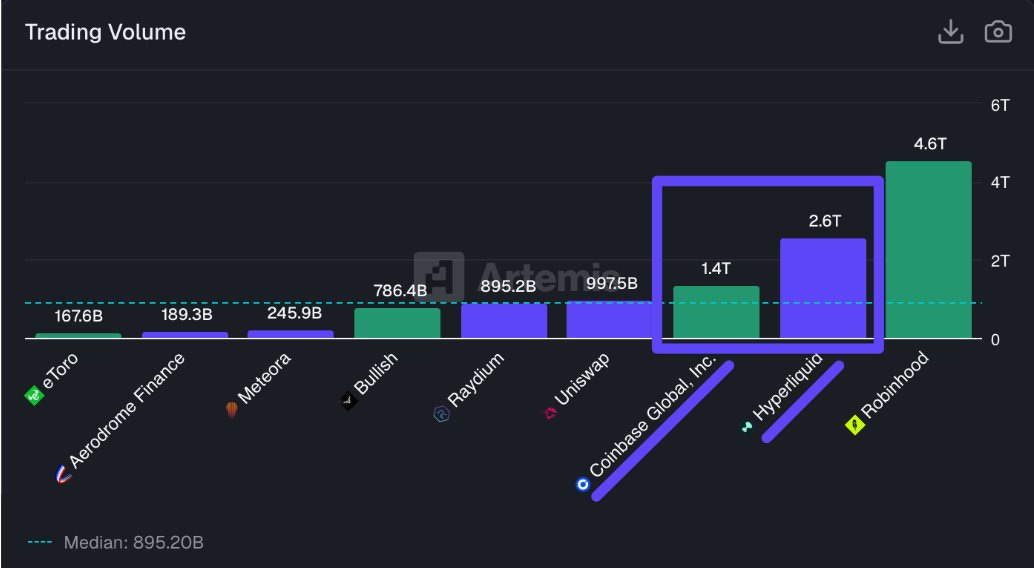

The shiny metal is among the oldest traded commodities on the planet. It has its own futures markets, institutional infrastructure and centuries of price history. In January this year, decentralised exchange (DEX) Hyperliquid listed a silver perpetual contract.

Within a month, it was handling 2% of global silver trading volume. Not 2% of crypto silver volume. Two per cent of the world’s silver trading was being routed through a protocol with no headquarters, no CEO, and no brokers.

Read: A Sliver of TradFi

It is worth asking where that volume came from. Hyperliquid’s existing user base was largely crypto-native. The silver market, however, is not. Noting the risk of overassumption, the most plausible interpretation of the numbers I derived is that the market attracted traders who always wanted this exposure but without the friction of the incumbent infrastructure.

Hyperliquid removed most of those existing barriers, including brokers, high margin and minimum account requirements, interface friction, and offered high leverage and lightning-fast settlements. Have some opinions to express at 3 am on a Saturday night? Sure, just open the platform, connect your wallet, and express your heart out.

Last month, Hyperliquid processed $2.6 trillion in notional trading volume, almost twice what Coinbase handled.

But comparing this with other crypto exchanges is secondary. What’s more important here is that a perpetual DEX offers humans a choice over their existing traditional financial infrastructure. Don’t mistake the absence of friction for the absence of risk. The same frictionless access at 3 am makes fortune-wiping losses possible at that ungodly hour. But isn’t that the whole point of speculation? With high reward comes high risk. And it’s the unbridled risk that completes the adrenaline experience that’s true to any gambling.

But gambling was never just about the reward. It was also about being right.

Every civilisation also had its oracle. Delphi, the ancient Greek oracle, charged consulting fees for delivering prophecies. Medieval courts often kept astrologers on retainer. The modern version of this saw television pundits being paid generously for delivering their verdicts with confidence and charisma on screen.

Opinions have always had social and economic value. What they lacked, however, at least until recently, was a common market price.

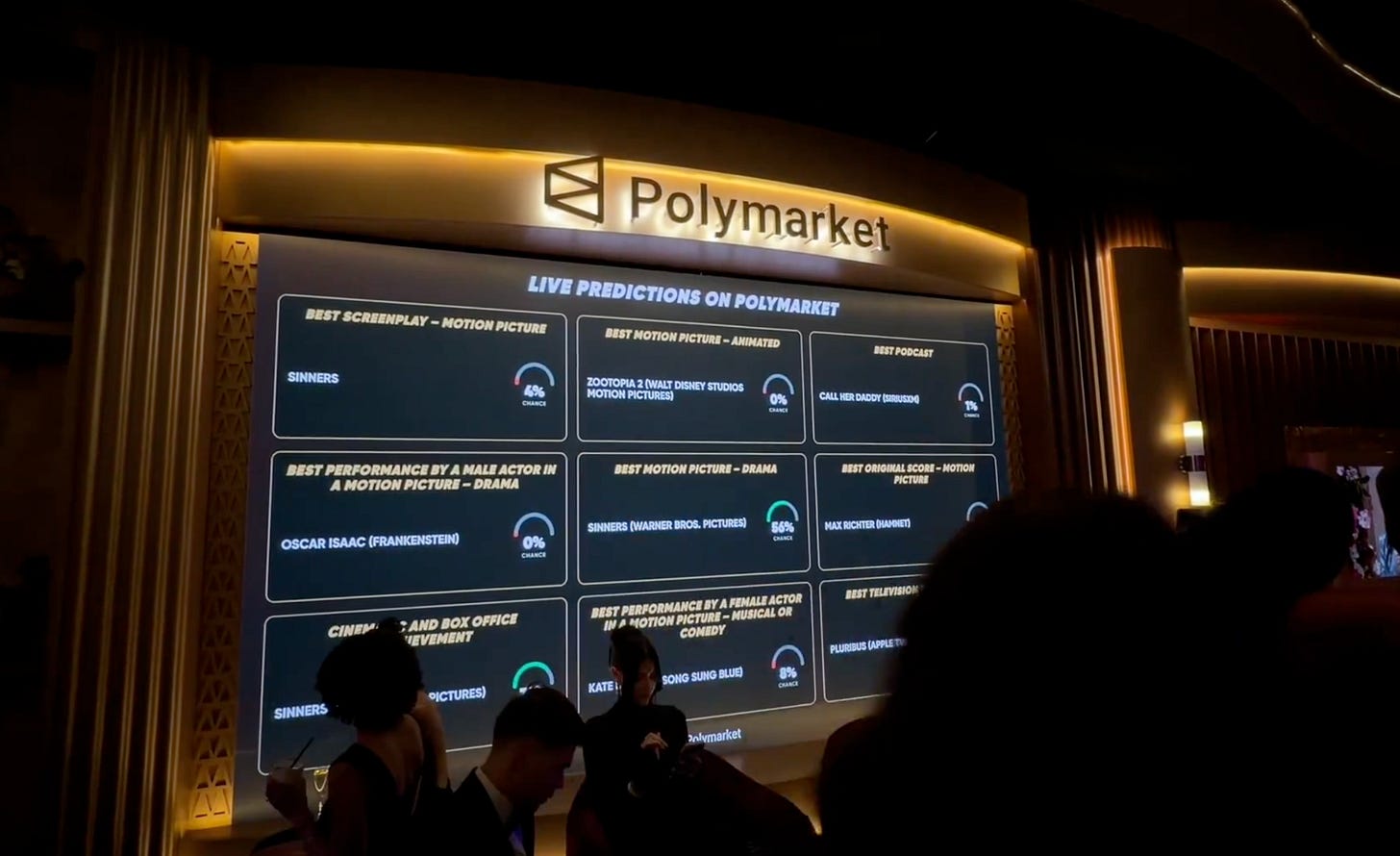

That’s where prediction markets came in. They monetised opinions. When you buy a contract on Polymarket or Kalshi, you are expressing views no longer into a void. Your conviction is being priced continuously against a counterparty who disagrees. If you are right, you collect, and if you are wrong, you pay. The incentive structure and the oracle produce the kind of accountability that ancient punditry never could.

What interests me more is not the existence of contemporary prediction markets but where they have ended up.

This year’s Golden Globes broadcast partnered with Polymarket and read aloud odds before every commercial break. Both CNN and CNBC have signed data deals with Kalshi. Robinhood launched prediction markets, and they became its fastest-growing revenue line at a roughly $300 million annualised run rate. On Super Bowl Sunday this month, prediction markets cleared over $1 billion in a single day. Kalshi even partnered with Venmo for payment integration.

These developments are not aimed at crypto-first individuals. They target sports bettors and political enthusiasts who seek to monetise what they believe they know, but the market does not.

While some view prediction markets as the future of news, their limitations cannot be overstated. There’s the never-ending problem of insider trading. But what excites me the most is how these markets open up a whole range of new primitives that solve everyday problems. Think hedging and insurance. We will dive more into this later this week.

Not every speculative venue has been built on such a solid foundation.

In January 2024, pump.fun launched, allowing anyone to create a tradeable token in seconds. The world went from fewer than 10 memecoins being launched over several years to over 70,000 tokens in a single day at its peak. The launch was backed by participation, with people betting on tokens built around jokes, collective momentum, and even political figures. It went all the way up to the POTUS, Donald Trump.

The TRUMP token, launched days before the presidential inauguration, was bought into by people across the globe. It served as a reminder of how people have always staked money on a cultural movement in ancient history. Crypto has just made the whole process programmable, frictionless, and instantaneous.

This is what I find humbling about crypto. It doesn’t delve into what is ethically right or wrong. Yet, the same system that helped Hyperliquid generate about a billion dollars in revenue also enabled the token launchpad, pump.fun, to earn over $900 million.

Crypto never offered a flawless system to begin with. It often introduced substandard systems as alternatives to the traditionally existing infrastructure. But what’s interesting is how, over time and through multiple iterations, some of these systems evolved into a frictionless, more efficient venue with no gatekeepers, yet were both sophisticated and reckless at once.

We see this pattern in the evolution of capital formation systems. The Initial Coin Offerings (ICOs) of 2017 promised something radical: anyone could fund a project and invest by bypassing venture capital gatekeepers. In reality, most of them failed or were fraudulent. But what followed were iterations and an honest look back at what failed. Each generation of crypto fundraising solved a problem and introduced a new one. As a result, we now see frameworks that take a step toward better addressing these challenges than earlier primitives did.

Read: Virtuals’ 60-Day Experiment

The fact that many projects today generate auditable revenue before issuing a token is evidence of the maturation of the capital formation industry. I don’t think there is anything idealistic about this. If anything, the industry became more practical about which markets would be sustainable.

Read: Burn, Baby, Burn

This shows how the speculative layer has matured over time to satisfy the same human impulse across millennia: the urge to gamble.

Beyond speculation, cryptocurrency has also enabled infrastructure to address another pressing human need: money transfer.

Although the settlement numbers for stablecoins remain open to debate, the places where they found their deepest adoption were not trading desks. They were adopted in countries including Argentina, Nigeria, and Venezuela, where inflation, fragile economies, and weak currencies prompted residents to adopt these digital-dollar equivalents for everyday commerce.

Stablecoins found their product-market fit in places where traditional institutions, like banks and governments, stopped working for the local citizens.

And then there’s the impulse that predates even speculation: ownership.

Long before humans gambled, they claimed. Territory, livestock, and grain stores. The concept of “this is mine” is arguably the most foundational economic behaviour among our species. Every legal system ever devised, from Hammurabi’s Code to English common law, has spent most of its energy defining and protecting who owns what.

Traditional finance built elaborate systems to serve this impulse. Deeds, titles, share certificates, custodians, transfer agents, and clearinghouses, like that an entire industry of intermediaries whose purpose is to record and verify that you own what you say you own. But we have a problem there. The infrastructure is slow, expensive and exclusionary. Settling a stock trade still takes a full business day. Transferring property can take months. And for billions of people worldwide, many of these asset classes remain entirely inaccessible.

Tokenisation attempts to compress that entire intermediary stack into code. A tokenised Treasury bill is still a Treasury bill. A tokenised ounce of gold is still an ounce of gold sitting in a vault. What changes is how ownership is recorded, transferred and used. Settlement becomes instant. Access becomes global. And assets that once sat idle in custody become programmable and composable.

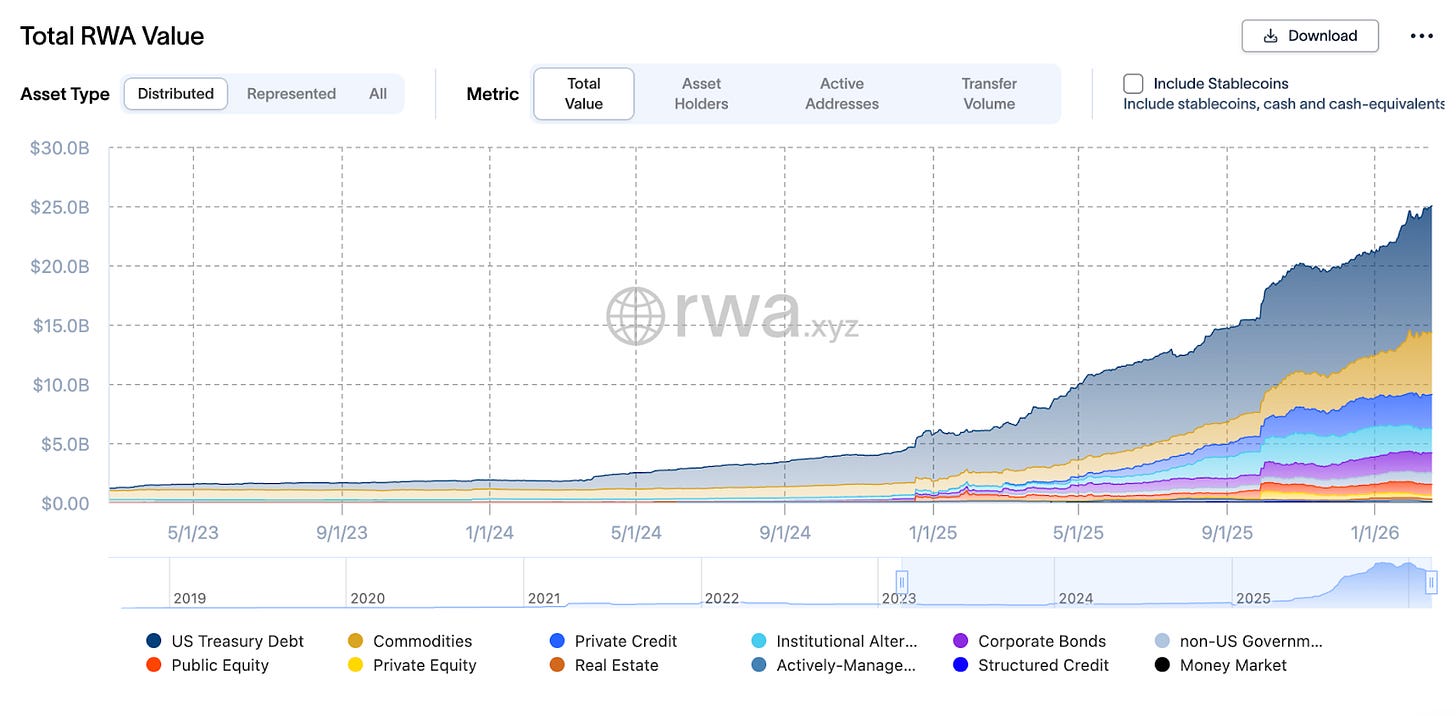

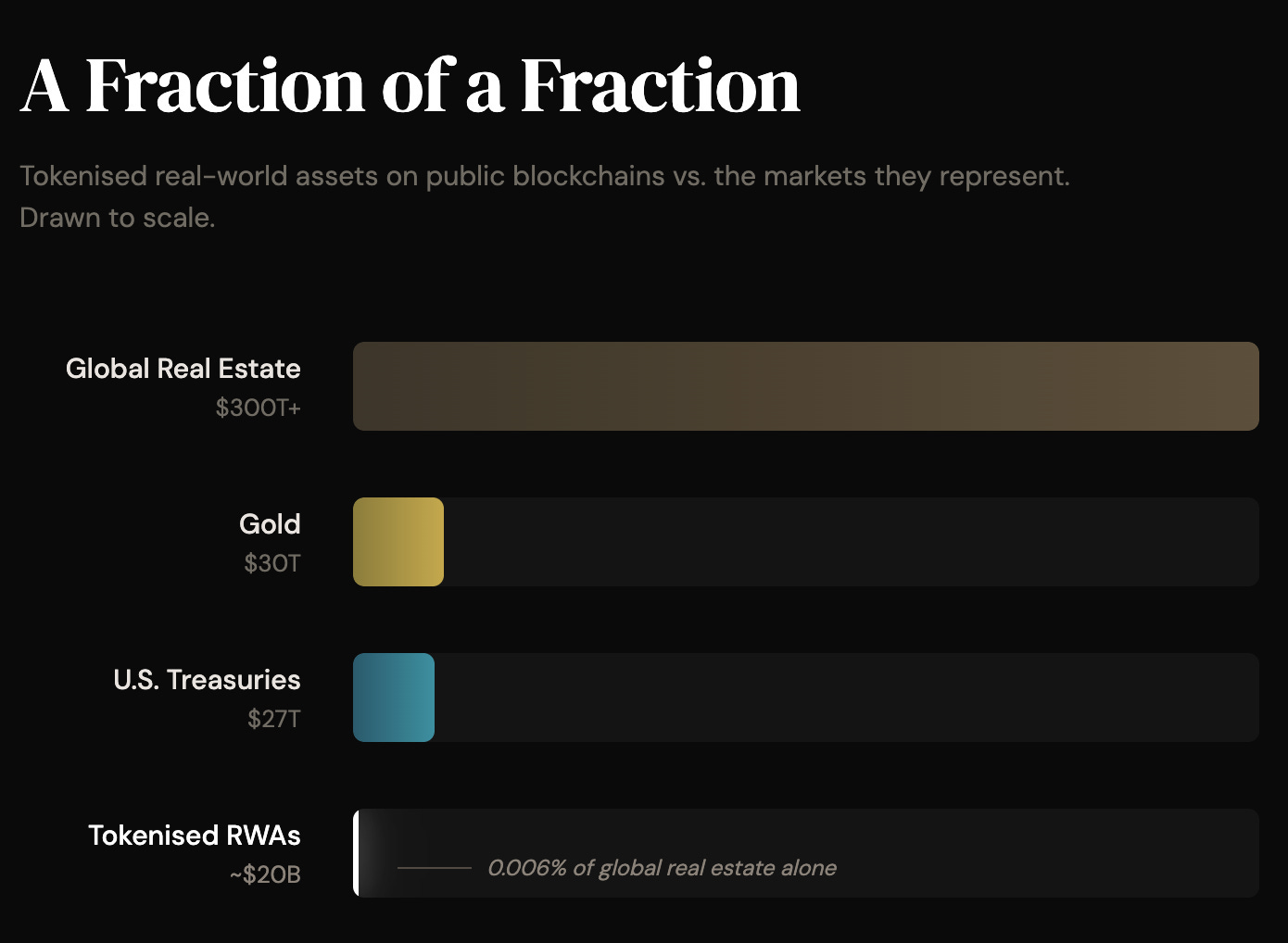

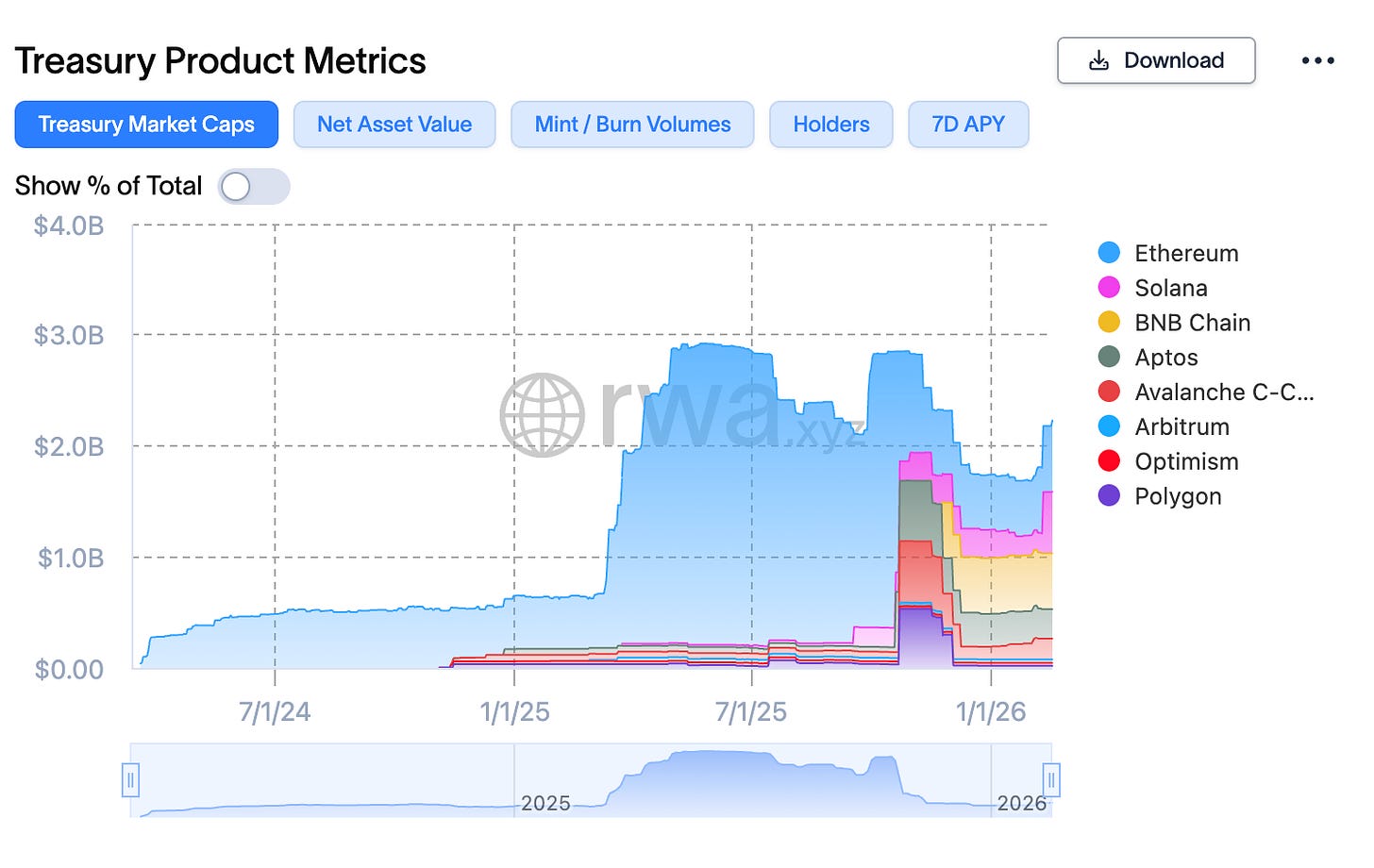

Tokenised real-world assets on public blockchains have approached $20 billion. Tokenised U.S. Treasuries alone crossed $10 billion in January this year, growing tenfold in under two years and tokenised gold has surpassed $6 billion.

These are meaningful milestones for crypto but tokenisation has captured a fraction of a fraction of the world’s assets. The global gold market exceeds $30 trillion. The U.S. Treasury market is $27 trillion. Global real estate sits north of $300 trillion. It remains, by any honest accounting, early.

What shifted recently is not the size of the market but the identity of the participants.

On February 11 this year, BlackRock made its tokenised U.S. Treasury fund, BUIDL, tradable on Uniswap, one of the largest decentralised exchanges in crypto. The world’s largest asset manager, overseeing $10 trillion, chose public DeFi infrastructure to settle tokenised government bonds. And then it bought governance tokens in the protocol.

The deal had been a year and a half in the making, brokered partly by Uniswap’s former COO who had previously started BlackRock’s digital asset division. The meetings alternated between BlackRock’s offices in Hudson Yards and Uniswap’s headquarters in SoHo. It is hard to imagine two more different rooms.

U.S. Treasuries are the base collateral of the global financial system. They underpin the $5 trillion repo market, the overnight plumbing that keeps banks liquid. Leverage is created against them. Structured products are anchored to them. Stablecoins are backed by them. When that collateral moves on-chain, the instruments built on top of it follow. Lending protocols gain access to higher-quality collateral. Derivatives infrastructure connects. Stablecoins are anchored to verifiable on-chain reserves rather than off-chain attestations.

BlackRock’s BUIDL is already becoming a building block for other on-chain products. Ethena’s USDtb and Ondo’s OUSG use it as a core reserve asset. It has been accepted as collateral on centralised exchanges. It has expanded to multiple blockchains. What began as a single tokenised fund is quietly becoming infrastructure on which other products build.

This follows the same pattern. Hyperliquid didn’t invent commodity trading; it removed the friction. Stablecoins didn’t invent the dollar; they made it move where banks wouldn’t.

Tokenisation doesn’t invent ownership. It makes ownership programmable, portable and globally accessible in a way that the existing intermediary stack was never designed to support.

JPMorgan already runs tokenised payments through its Onyx platform. Goldman Sachs operates digital-asset infrastructure for institutional clients. The Canton Network, backed by BNY Mellon and Deutsche Börse, is building permissioned DeFi infrastructure. And now, BlackRock sits on Uniswap, holding governance tokens in a protocol built by pseudonymous developers.

This mirrors what happened with stablecoins. First came scepticism, then cautious experimentation, and then quiet recognition that the infrastructure simply works better for certain use cases. Tokenisation is still in the second phase. The assets on-chain remain a sliver of the assets they represent. But the direction of travel is no longer in question, only the pace.

The technologies that have changed human life in the most defining ways share a single characteristic: they all become invisible. Until something breaks, nobody acknowledges their value.

Nobody thought about shipping containers when they ordered a new electronic device online, until the COVID-19 pandemic brought supply chain issues to the mainstream. People don’t care about the submarine fibre-optic cables that transmit 99% of international data. These technologies have become embedded in daily life to such an extent that their presence is often ignored, while their absence becomes unimaginable.

A perpetual DEX gives back to ordinary people the right to have financial opinion and act on it; something that accredited investor rules took away. Prediction markets allow people to put money behind their mouths. Tokenisation gives global investors access to assets their geographies had locked away. All these primitives address the same complaint that the existing system was built for those who were already inside it, while restricting the outsiders from accessing it.

From barely $45 billion in circulation, stablecoin supply has shot up over six times to $307 billion in the last five years. Although crypto has existed for more than one and a half decades, the focus on developing institutional-grade privacy in the past few years has made more institutions evaluate alternatives to traditional infrastructure for achieving cost efficiency.

What crypto built, through failures, frauds, casino years and reiterations, is an alternative system that didn’t ask for permission while allowing humanity to address the same old need of expressing an opinion.

Today, crypto is often viewed negatively and criticised as a superstructure for its prolonged sideways price movements. What is often ignored is the boring base that crypto has provided to satisfy some of humanity’s oldest impulses, be it speculating or transferring a value. And it is here that crypto’s venues have evolved to become indispensable, quietly becoming part of the fabric of everyday life.

That’s it for today. We will be back with another analysis.

Until then, stay curious!

Prathik & Thejaswini

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.