Hello,

Over a year ago, becoming a Digital Asset Treasury (DAT) looked like a no-brainer for scores of corporates looking for a bump in their share price.

Some Microsoft shareholders convened and requested that the Board evaluate the benefits of holding some Bitcoin on its balance sheet. They even mentioned Strategy (formerly known as MicroStrategy), the largest publicly listed Bitcoin DAT.

There was a financial flywheel for everyone to follow.

Buy a pile of BTC/ETH/SOL. Watch the stock trade above the pile’s value. Issue more shares at that premium. Buy more coins with that money. Repeat. The financial flywheel behind a publicly-listed ticker seemed nearly flawless to tempt investors. They were paying more than two dollars to gain indirect exposure to Bitcoin worth only a dollar. Those were crazy times.

But time tests the best of strategies and flywheels.

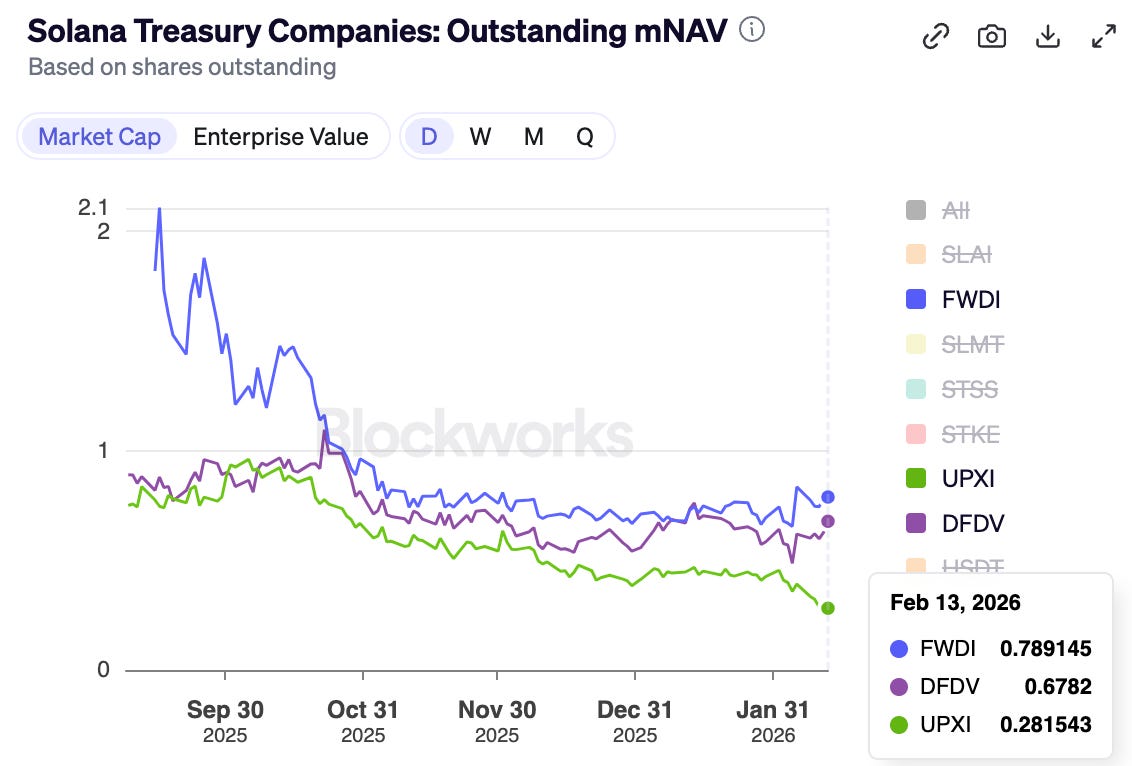

Today, most of these wrappers have a market-cap-to-net-asset-value (mNAV) ratio below 1, as the crypto market has lost more than 45% of its market capitalisation over the last four months. This indicates that the market values these DAT companies at less than the value of their crypto treasuries. This changes how the financial flywheel operates.

Because a DAT is more than a wrapper around an asset. In most cases, it is a company with overhead, financing, legal and operational costs. In a mNAV-premium era, DATs funded their crypto purchases and their costs by selling more stock or raising more debt. In a mNAV-discounted era, this flywheel falls apart.

In today’s analysis, I will show you what prolonged discounts on mNAVs mean for DATs and whether they can survive crypto bear markets.

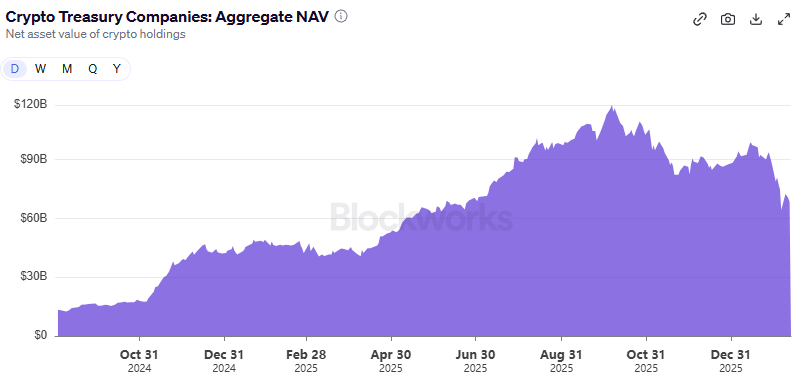

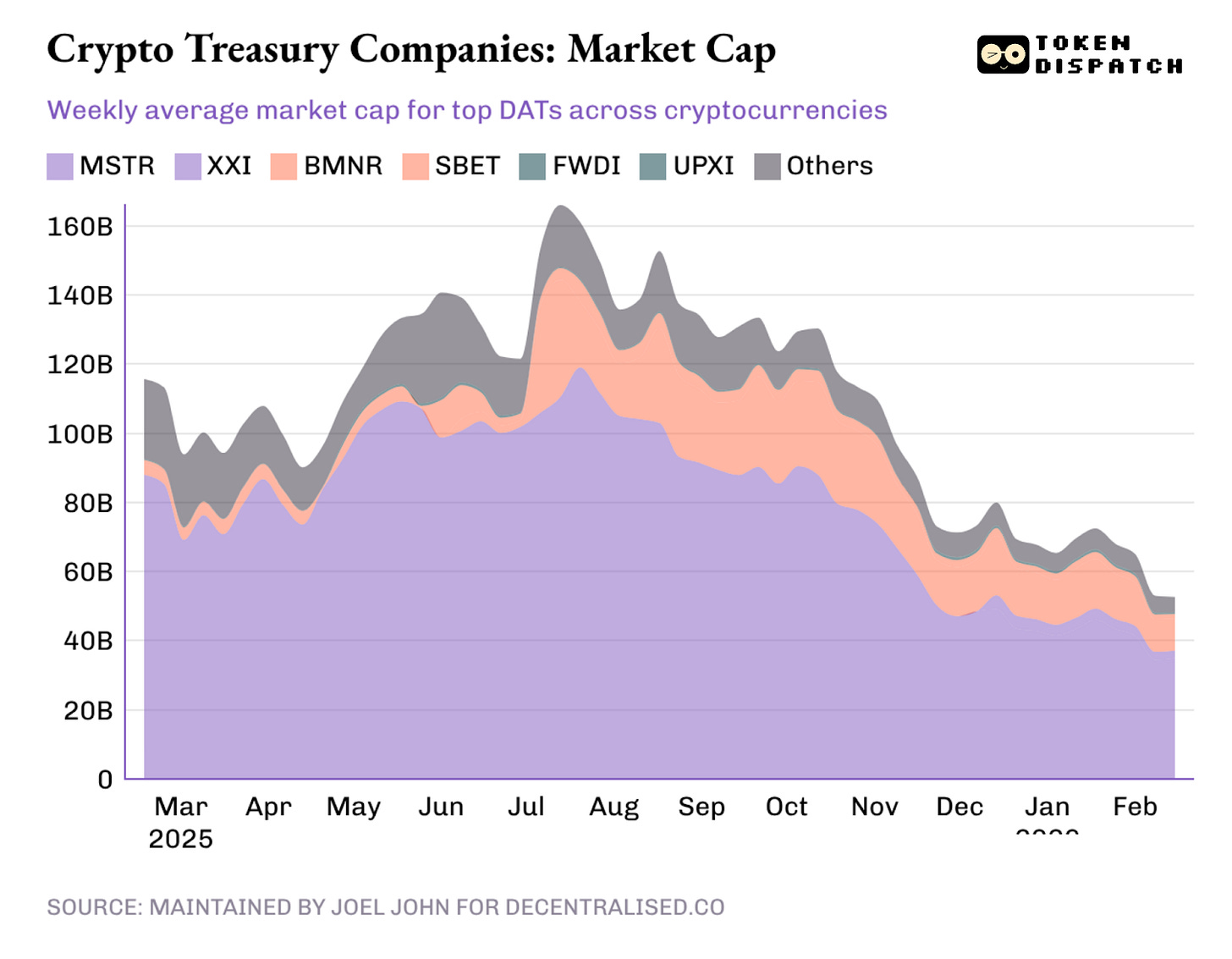

Between 2024 and 2025, over 30 companies rushed to transform into DATs. They built treasuries around blue-chip cryptocurrencies, such as BTC, ETH, and SOL, along with a long tail of memecoins.

At its peak on October 7, DATs held cryptocurrencies worth $118 billion, with the market cap of these companies exceeding $160 billion. Today, DATs hold cryptocurrencies worth $68 billion, with a discounted market cap of just over $50 billion.

All their fortunes were tied to one thing: their ability to wrap an asset and manufacture a story that makes the wrapper trade above the asset value. That difference became the premium.

The premium became the product. If the stock traded at 1.5x the mNAV, the DAT could sell $1 of stock and buy $1.5 of crypto exposure, and characterise the transaction as “accretive”. Investors paid the premium, believing that the DAT could continue selling stock at a premium and use the proceeds to accumulate more coins, thereby increasing the crypto per share over time.

The problem is that premiums don’t stay forever. The moment the market stops paying extra for the wrapper, the “sell stock to buy more coins” flywheel stumbles.

When the stock no longer trades at 1.5x the value of its assets, each new share issued buys less crypto. The premium ceases to be a tailwind and becomes a discount. This is exactly what my colleague, Saurabh, highlighted in his piece for Decentralised.Co.

Read: Asset-Wrapped Equities

With the underlying crypto market struggling, stock premiums have now turned into discounts.

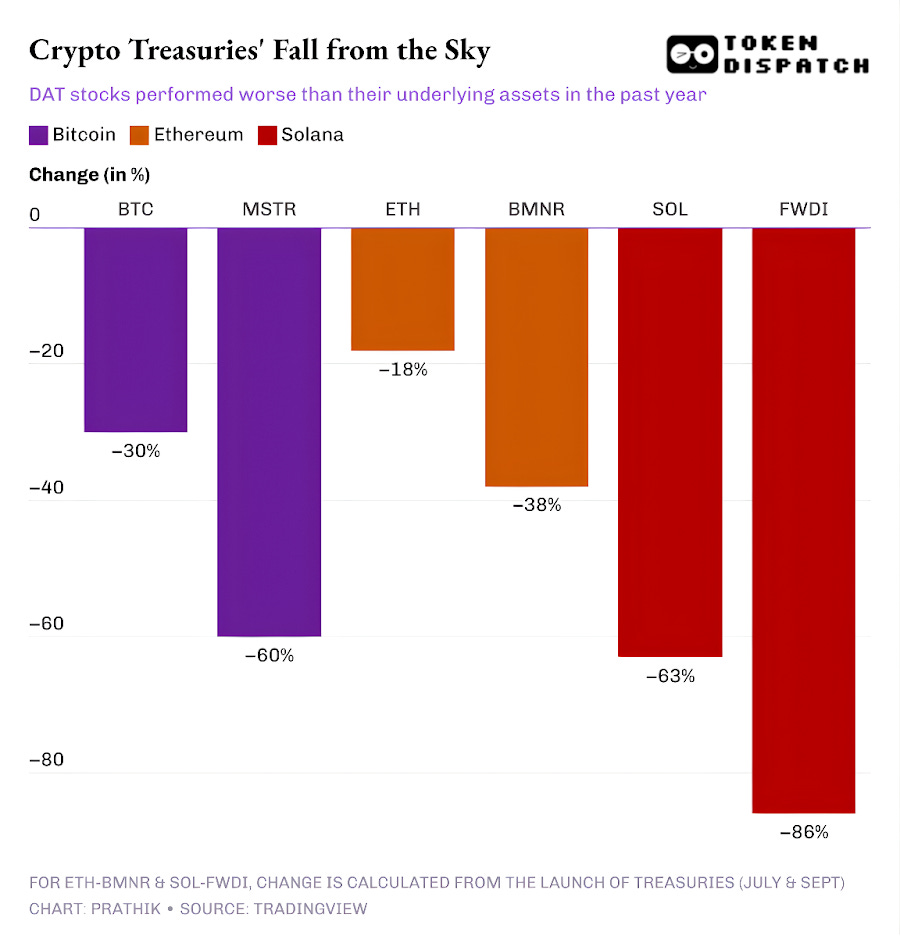

The stock prices of leading DATs in BTC, ETH, and SOL have fallen more than the cryptocurrencies themselves over the past year.

Once the markup premium of the stock over the underlying asset vanishes, investors will naturally ask why they can’t just buy the cryptocurrency cheaper somewhere else, say on decentralised or centralised exchanges or exchange-traded funds (ETFs).

Bloomberg’s Matt Levine asks an important question: If DATs won’t trade even at NAV, let alone a premium, then why shouldn’t the investors force the company to liquidate its crypto treasury or buy back the shares?

Many DATs, including the leader of the pack - Strategy, try to convince the investors that they will hold their crypto through the bear cycle and wait for the premium-era to be back. But I see a more critical problem here. If DATs can’t raise additional funds for an unforeseeable and prolonged period, where will they source funds to operate the shop? These DATs have bills and salaries to pay.

Strategy is an outlier for two reasons.

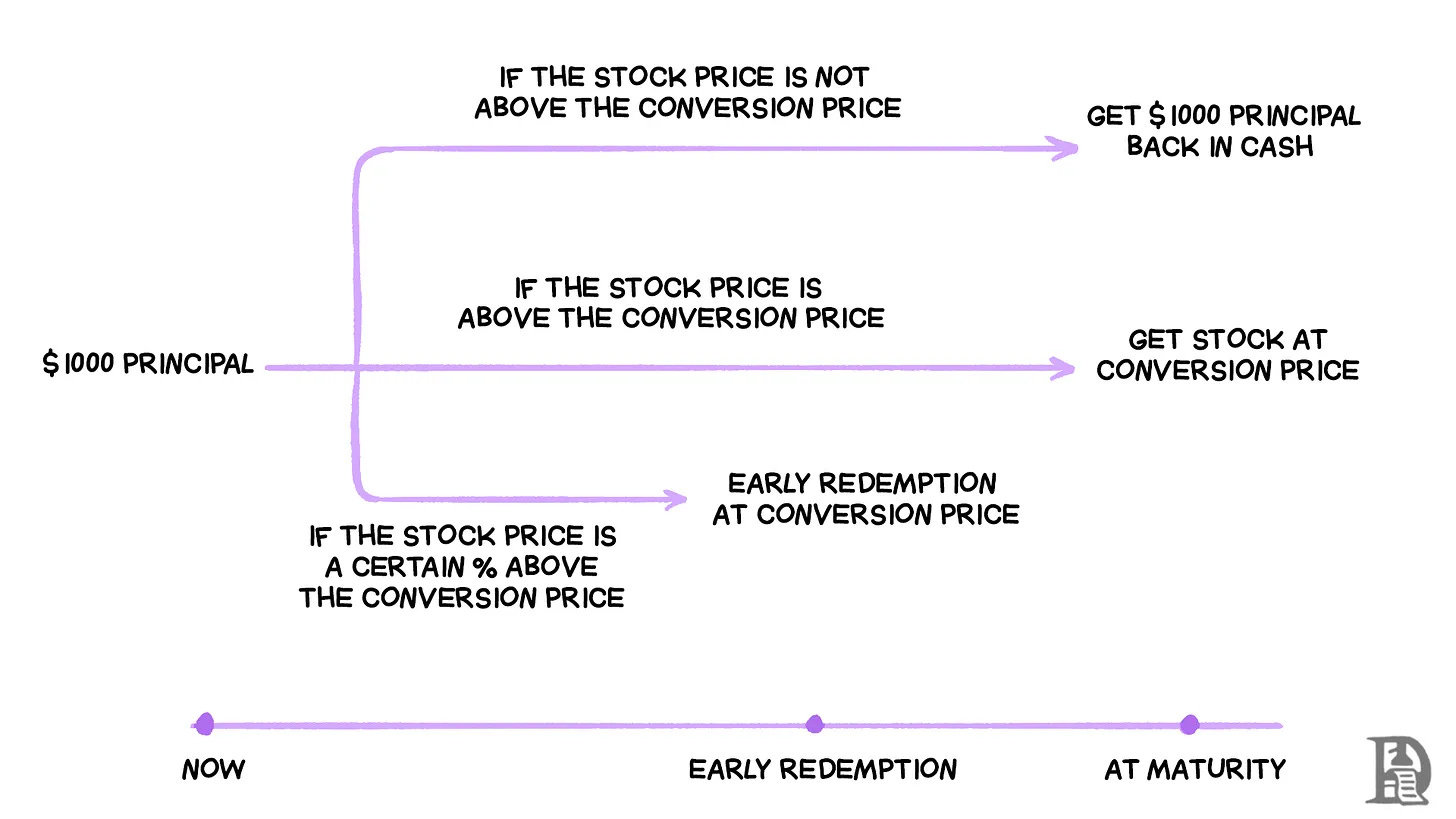

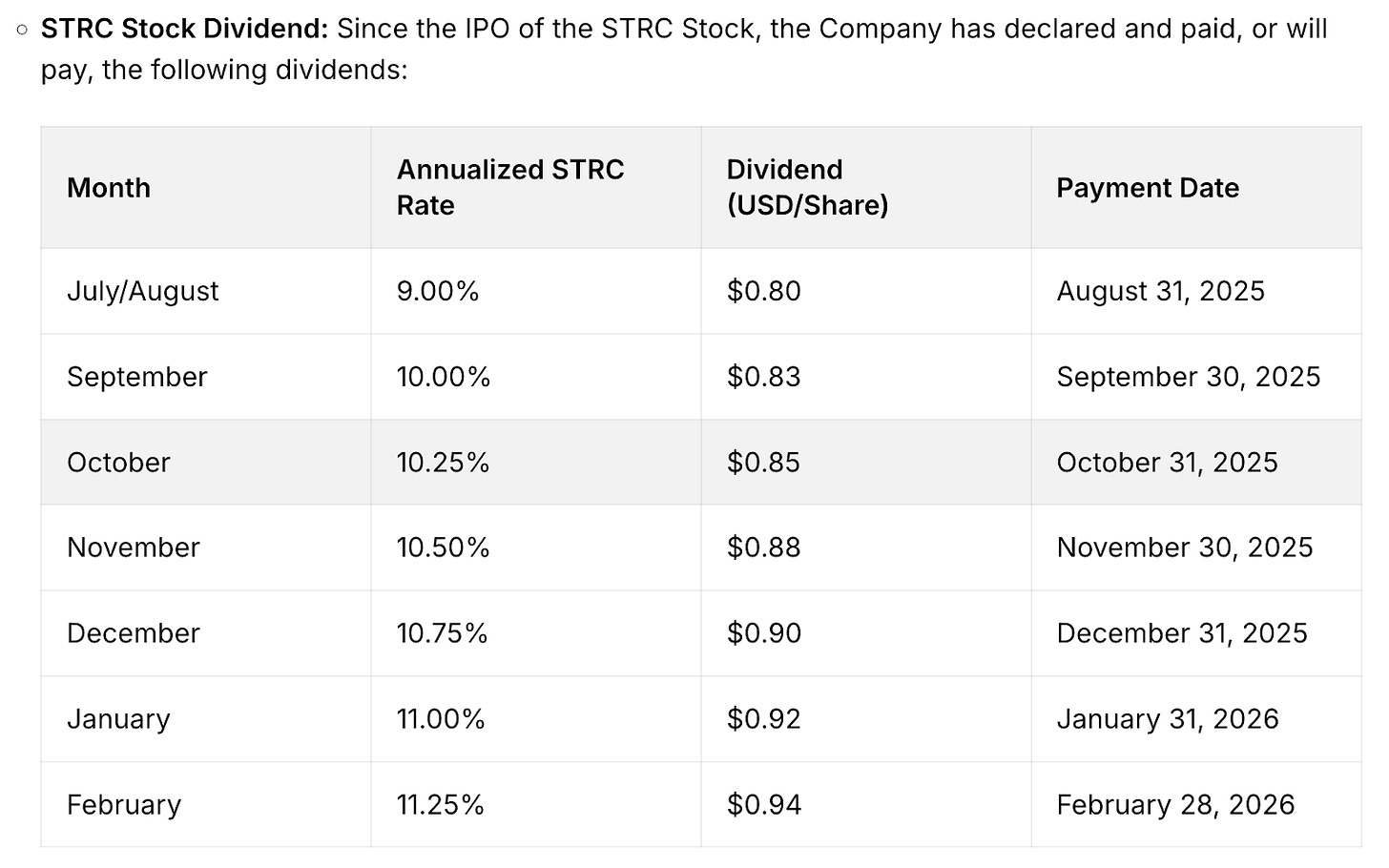

It reported holding $2.25 billion in reserves to cover its dividend and interest obligations for approximately 2.5 years. This is important because Strategy is no longer relying solely on zero-coupon convertible bonds to raise funds. It also has preferred instruments with significant dividend payouts.

It also has an operating business that, however small, still records recurring revenue. In Q4 2025, Strategy reported $123 million in total revenue and $81 million in gross profit. Although Strategy’s bottom line could swing significantly based on the mark-to-market value of crypto prices in each quarter, its business intelligence arm is the only source of tangible cash flow.

But this still doesn’t make Strategy’s play invincible. The market can still punish the equity, as it has over the past year, and impair Strategy’s ability to continue raising funds at lower costs.

While Strategy may weather the crypto bear cycle, newer DATs that lack sufficient reserves or an operating business to cover their unavoidable expenses will feel the squeeze.

This distinction is even clearer with ETH DATs.

BitMine Immersion, the largest ETH-based DAT, has a marginal operating business to support its ETH-treasury. In the quarter that ended on November 30, 2025, BMNR reported total revenue of $2.293 million, comprising consulting, leasing, and staking revenue.

The balance sheet shows the company holding digital assets valued at $10.56 billion and cash equivalents of $887.7 million. BMNR’s operations contributed to a net negative cash flow of $228 million. All of its cash requirements were met through the issuance of new shares.

Raising funds was relatively easier for BMNR last year, as its stock traded at an mNAV premium for most of the year. Over the past six months, the mNAV has declined from 1.5 to about 1.

So, what happens when the equity doesn’t trade at a premium anymore? Issuing more shares at a discount could reduce the per-share price of ETH and make it less attractive to investors than buying ETH directly from the market.

It explains why BitMine said last month that it would invest $200 million for a stake in Beast Industries, a private company owned by YouTuber Jimmy “MrBeast” Donaldson. The company said it would “explore ways to collaborate on decentralised finance initiatives”.

ETH and SOL DATs may also argue that staking income, which BTC DATs can’t boast, could help them remain afloat during market meltdowns. But that still doesn’t solve the problem of meeting the cash flow obligations of a company.

Even with staking rewards, which accrue in crypto - either ETH or SOL, DATs will not be able to pay salaries, audit fees, listing costs and interest, as long as they are not converted to fiat. The company must either have enough fiat revenue or sell or rehypothecate its treasury to meet its cash needs.

This is evident in Forward Industries, the biggest SOL-holding DAT.

FWDI recorded a net loss of $586 million in Q4 2025 despite earning $17.381 million in staking and related revenue.

The management explicitly stated that its “existing cash balance and working capital will be sufficient to meet our liquidity needs through at least February 2027”.

FWDI also discloses an aggressive capital-raising strategy that involves at-the-market share issuance, buybacks, and a tokenisation experiment. However, all these may be unsuccessful attempts to manage the wrapper price if the mNAV premium doesn’t exist for an extended period.

The Road Ahead

Last year’s DAT boom centred around the speed of asset accumulation and raising funds by issuing stock at a premium. As long as the wrapper traded at a premium, DATs could keep turning expensive equity into more coins per share and call it “beta”. Investors pretended that the only risk was the asset price.

But premiums don’t stay forever. Crypto cycles could turn them into discounts. I wrote about this when we first observed premiums declining within weeks of the 10/10 liquidation event last year.

Read: Where’s DAT Beta? 🎁

However, this bear cycle will prompt DATs to evaluate whether their wrappers should continue to exist once they no longer trade at a premium.

One way to address this dilemma is for the company to enhance its efficiency to complement its DAT strategy with a cash-flow-positive business or surplus reserves. That’s because when the DAT story stops selling during bear markets, a routine corporate story decides its survival.

If you read Strategy & Marathon: Faith and Power, you’ll recollect why Strategy still manages to stay afloat across multiple crypto cycles. However, the newer cohort, including BitMine, Forward Industries, SharpLink, and Upexi, cannot rely on the same muscle.

Read: SharpLink and Upexi: DATs with Tradeoffs

Their current experiment with staking yield and a thin operating business could collapse under market pressure unless they consider alternative options to cover real-world obligations.

We observed this with ETHZilla, an Ethereum treasury company, when it sold approximately $115 million of its ETH holdings and purchased two jet engines last month. The DAT then leased the engines to a major airline and engaged Aero Engine Solutions to manage them on a monthly fee basis.

Going forward, I will evaluate not only the digital-asset accumulation strategy but also the conditions under which it can survive. In the ongoing DAT cycle, only those who can manage their dilution, liabilities, fixed obligations, and trading liquidity will be able to outlast market downturns.

That’s it for this week’s quantitative analysis. I will be back with the next one.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.