The Friday Reading List: Week 6-7 📚

Articles, opinions, podcasts and other literature

Hello,

Edition two.

Two weeks ago, I started a reading list to share my favourite reads across crypto, finance, technology, and beyond. The idea was to cut through the noise of daily price actions and FUD on Crypto Twitter and other forums to help you access literature that informs you about the bigger picture that you might be missing out on.

So, how did the first one go? Well, we survived it — 62% of you even said you found it useful; the other 38%, I see you, and I’m coming for your attention this time.

Oh, and I also share my thoughts on last week’s movie recommendation, Timothée Chalamet-starrer Marty Supreme. I promise no spoilers.

Now, for the past fortnight. Here’s a quick recap of what happened:

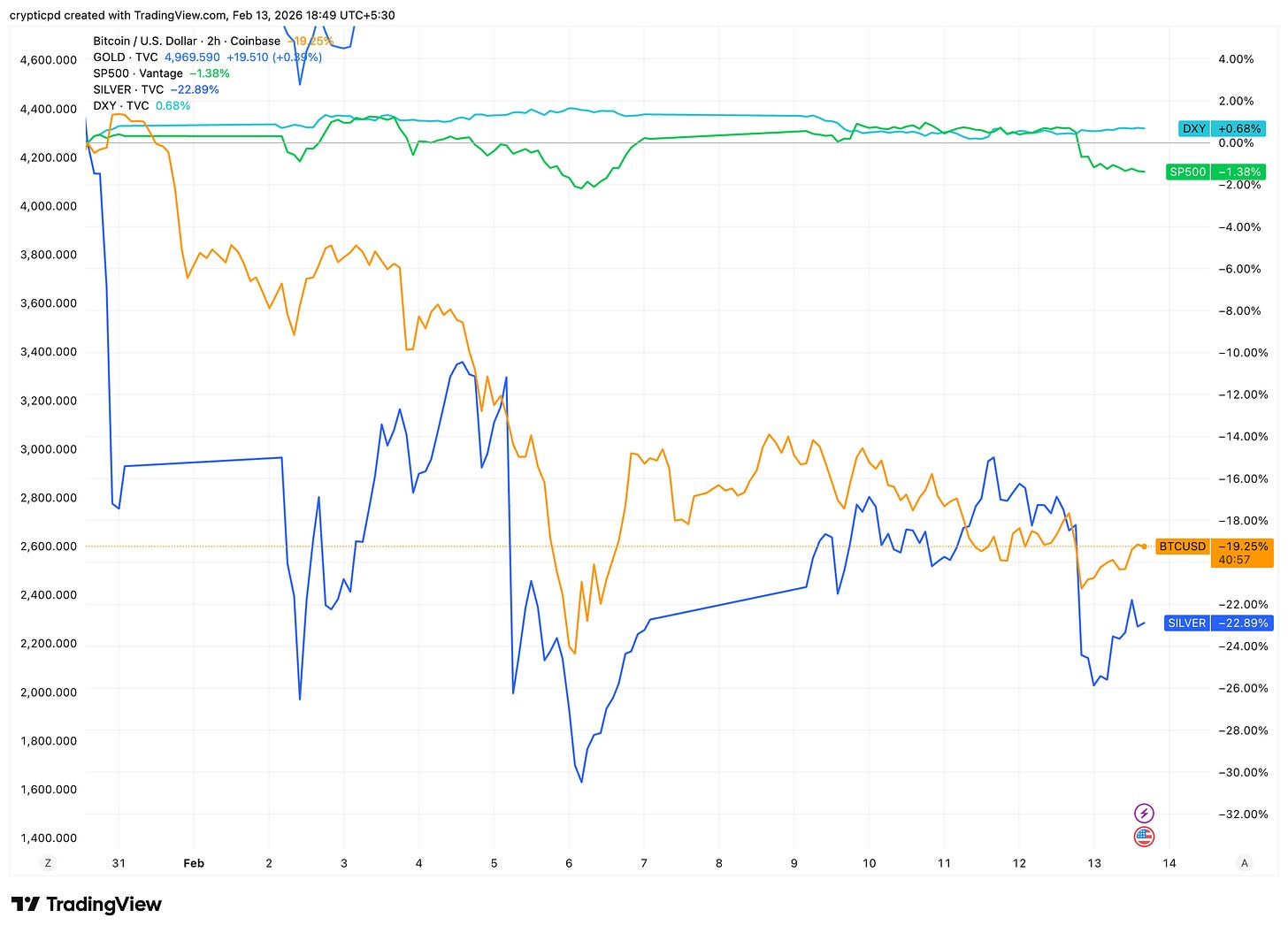

Bitcoin came within touching distance of $60,000 — down about 20% in just the last two weeks.

Silver pared away the preceding fortnight’s gains as it lost over a fifth of its value in this fortnight.

Dollar stayed put, while equities dropped marginally (1-2%).

But if these charts were all you were tracking, then I’d argue you missed some interesting developments in the space of crypto, tech, and beyond that we’ve dived deep into.

Ethereum co-founder Vitalik Buterin dropped some comments on Layer-2s (L2) losing their relevance and stated that “their role in Ethereum no longer makes sense”. He called for a need to course a new path. My colleague, TJ, dived into what the numbers behind L2s’ performance tell us about Vitalik’s comments.

I dug into how capital formation is changing with Virtuals’ new ‘60 Days’ framework. Meanwhile, Hyperliquid reinforced its hold on the top of the charts, and I explored why it is important to look at perp metrics beyond just volume for a much more nuanced understanding.

Galaxy Digital posted its worst quarter in three years and yet shrugged it off, for what lies ahead. And lastly, AI agents started building their own economy, even as we, the humans who developed these bots, remained as silent spectators.

We have got a lot more deep dives and analysis in store for the coming weeks. Before we get there, here’s some literature that will keep you in good company.

Regulation & Policy

CLARITY Goes Missing Again? Act Hits Wall Over Yield Restrictions

Crypto & Tech

Crypto’s Final Use Case — Setting the AIs Free: The argument for why crypto’s killer app might be giving AI agents financial autonomy

Tether Invests in LayerZero Labs: USDT-issuer makes a strategic bet on interoperability infrastructure, backing the team behind USDT0’s cross-chain deployment

Messari’s Deep Research Agent: The research firm launches an agent to track live crypto market data

The 7 Axes of Prediction Markets: A framework for thinking about the dimensions that define prediction market design

The Truth About No-KYC Crypto Cards: A look at what works, what doesn’t, and the regulatory realities

Building Permissionless Neobanks: Pantera on why the next wave of banking infrastructure will be built without gatekeepers

Local Access vs. Edge Intelligence: A deep dive into the fractals of compute and what they mean for infrastructure

Virtuals Protocol Update: Its latest on the protocol powering the next generation of AI agent tokenisation

Cryptopunk’s DeFi/Crypto Thread: A thought-provoking thread on where DeFi stands and where it’s headed

Crypto’s New Narratives: Matt Hougan on the emerging storylines shaping the next cycle

AI Needs Blockchains — Especially Now: a16z crypto makes the case for why AI and blockchains are more complementary than ever

The Long Game for Crypto: Chris Dixon’s take on what matters in crypto when you zoom out during market meltdown

Haseeb Qureshi: Dragonfly’s Haseeb with a thread on the state of the market

DWF Ventures: DWF Ventures on where they’re deploying capital and why

Shaunda Evens: A thread on crypto market structure

Finance and Economy

Money Stuff: Musk Mars Merger, Maybe: On Musk’s plan to merge SpaceX and xAI

AI & Innovation

OpenAI’s ChatGPT Ads — A Faustian Bargain: An opinion piece on what ads in ChatGPT mean for the future of AI trust

AI Bubble: Even Success Can Put Financial Systems at Risk: A case on AI doesn’t need to fail to be dangerous; even the optimistic scenario carries systemic financial risk

The AI Whateverpocalypse Trade: A look at how markets are pricing in every possible AI outcome, from boom to bust, all at once

Death of Software? Nah.: a16z pushes back on the “AI kills software” narrative with a counter

What is Claude? Anthropic Doesn’t Know Either: A profile on Anthropic’s flagship model and the philosophical questions at the heart of building it

World Models for Robotics: A research into how world models are being applied to make robots understand and navigate real environments

Anthropic AI fund-raise: Claude AI maker, Anthropic, raises $30 billion at $380 billion post-money valuation

Culture & Beyond

In Solarpunk Cities of the Future, Tech Follows Nature’s Lead: I couldn’t resist including this one. I’ve become a big fan of Aeon’s essays lately. Their essays cut across science, tech, culture, health, and so much more. This piece imagines cities where technology works with nature rather than against it. Multi-domain writing at its finest

What I am watching/reading this weekend

I am looking forward to finishing The Satanic Verses by Salman Rushdie — I’ve been inching through it for a few weeks now, and I think this is finally the weekend I get to the last page.

Last edition’s movie recommendation, Marty Supreme, is a decent watch, but falls short of supreme. The cinematography was the biggest positive. But the plot had holes that even Timothée Chalamet’s impeccable acting couldn’t fill.

This fortnight, I am looking forward to watching Crime 101, a detective-thief thriller. Although I have low expectations from this one, the power-packed tall order of the cast lineup - Halle Berry, Chris Hemsworth, Barry Keoghan, Mark Ruffalo - has got me locked in.

Write back to us with any recommendations through the next fortnight that you think we should include in the upcoming edition.👇🏾

That’s all for this fortnight. Catch you in the next edition.

Until then, happy reading!

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.