Hello, and happy New Year!

We are just returning from an extended holiday. We planned a short year-end break, and then extended it by a couple of days before we got back to our desks.

But now we are back, recharged and ready to resume informing you about the top web-3 developments. Just as we have been doing all these years, we will continue to deliver weekly deep dives, quantitative analyses, and reviews of crypto literature that we find interesting and worth sharing this year.

ICYMI, here’s our version of 2025 Wrapped, where we tried to capture our top crypto moments from last year.

Instead of rushing back to the most significant news developments or commentary around prices and candles, I prefer a smoother entry into the year. So, I will walk you through some themes that stood out to me in 2025 and showed potential to go big in 2026.

The themes are not exhaustive; they simply represent the topics that took up the most mental space for me within crypto and Web3 over the past year.

Here we go…

Prediction markets are here to stay.

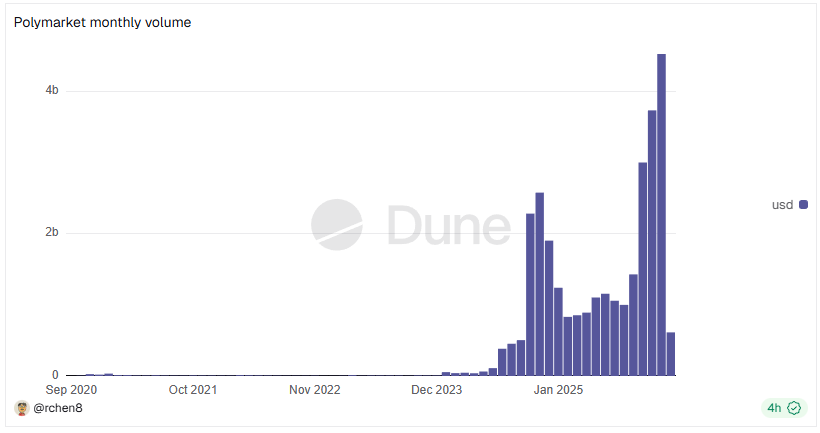

I remember reading about the odds swinging between Kamala Harris and Donald Trump every single day of the last 45 days leading up to the 2024 US presidential elections. Polymarket and Kalshi were everywhere in the news. The monthly volume of bets on Polymarket shot up to $2.3 billion and $2.6 billion in October and November 2024, respectively, with each higher than the cumulative volume recorded till that point.

The volumes peaked on election day and then slipped to an average of about $1 billion per month until September 2025. Few would have foreseen how the prediction markets would fare in the next three months. Between October and December 2025, the top two prediction markets by volume — Polymarket and Kalshi — recorded their new all-time highs, surpassing the volumes seen in the same months last year.

While many began writing obituaries of prediction markets early last year, they reinforced their positions by offering what appealed to the interests of the larger human race: gambling based on one’s speculative skills (many euphemistically call it “monetising speculation”). They boiled down trades to: ‘Do you think this will happen?’ The bettors could pick a yes or a no.

What drove this? One major category: sports, supported by politics, economy and crypto-related events.

While the number of new accounts created and the daily active users on prediction markets dropped between December 2024 and September 2025, regular sporting events kept daily open interest consistently around $100 million during the period.

There is never a shortage of sporting events worldwide. This, along with occasional economic, political, and fiscal announcements, could keep new markets flowing into prediction platforms. Pair this reality with natural time horizons, 24/7 tradeability, firm opinions, and ultra-fast settlements, and prediction markets become pervasive.

This explains why brokerages, wallets and consumer platforms experimented with integrating prediction features. They understand that speculation, once reduced to a single click, is an efficient way to farm engagement and monetise it.

We saw the top-listed crypto companies, Robinhood (HOOD) and Coinbase (COIN), integrate prediction markets in some form last year.

In March 2025, HOOD launched a prediction markets hub directly within its app, allowing customers to trade on the outcomes of real-life events, including college-level sports. Barely a week before the year ended, COIN announced its foray into prediction markets as part of a bouquet of other launches geared toward its ‘The Everything Exchange’ vision.

In 2026, sports will likely remain the strong base category driving steady volume in prediction markets, while occasional macro and economic events will provide episodic spikes. How crypto consumer platforms package prediction markets within their existing ecosystems could be decisive in terms of attracting most users.

Privacy-enabled stablecoins can make blockchains great again.

For a long time, privacy was crypto’s moral argument. The biggest crypto advocates wanted it and defended it in the name of resisting surveillance.

Most blockchains, meanwhile, have an inherent privacy bug. The chains offered radical transparency and maximum composability, making every crypto sceptic feel even more wary about privacy.

This was precisely why the enterprise world didn’t adopt stablecoins for daily business transactions despite the lightning-fast settlements and sub-dollar cost benefits they offered.

I wrote about this last month:

“Every stablecoin transfer becomes a ledger entry that is permanently recorded on the public chain. It allows anyone to watch the dollars move in real time, with finality in seconds and fees approaching zero.”

Public ledgers are great at settlement, but are also highly revealing.

“Stablecoins are faster and cheaper than the systems they’re competing with, yet the people who run payrolls and pay suppliers are sceptical of jumping onto the blockchain route.

That began to change in 2025.

Instead of pitching privacy as anonymity, new builders offered chains that provided selective disclosure. They focused on hiding the right things while still retaining the benefits of public settlement.

They allow businesses to execute their transactions privately, settle them on the public ledger and reveal only as much information as is required for an audit or otherwise.

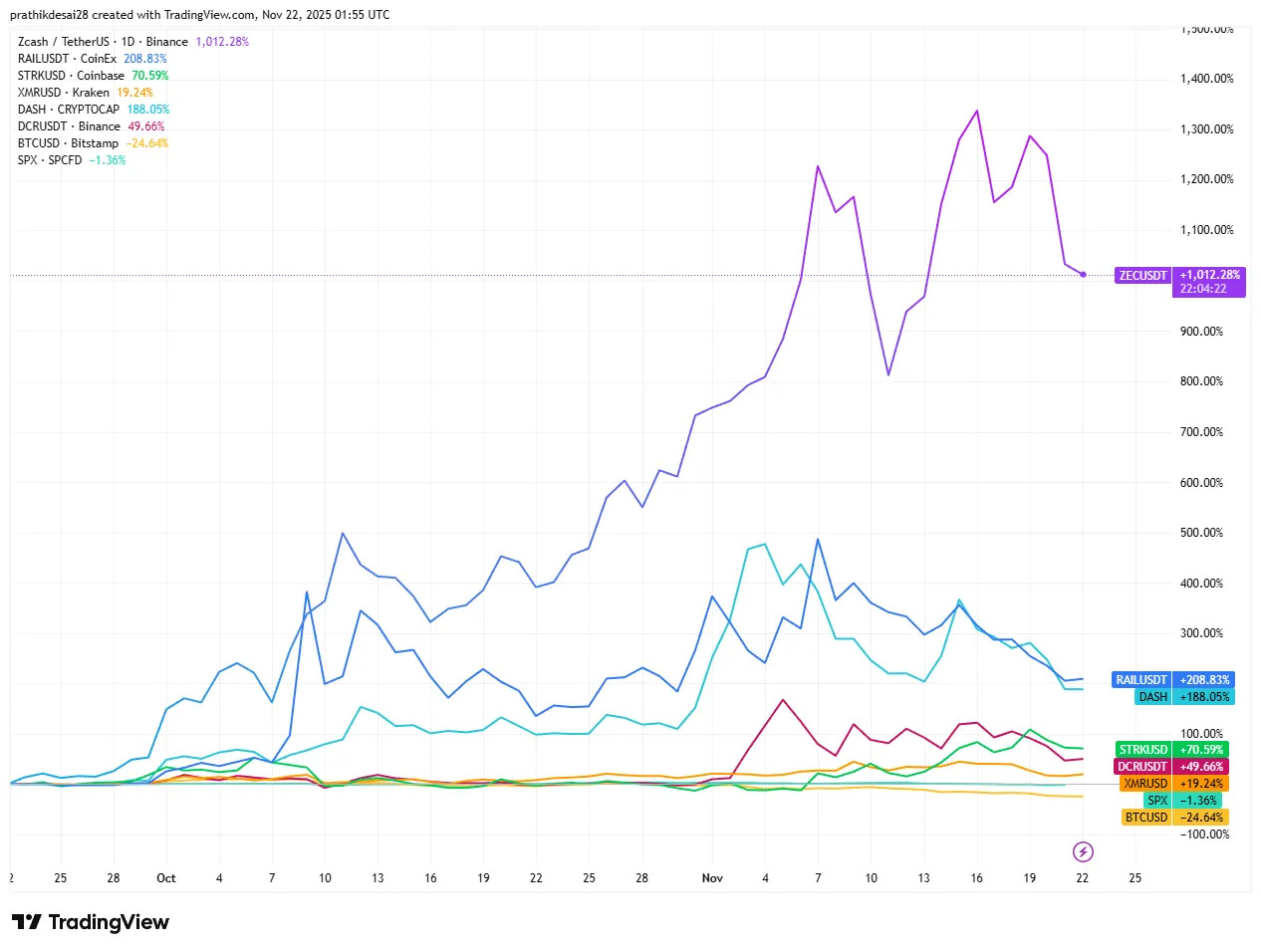

Zero-knowledge (ZK) proofs, private state, encrypted mempools and permissioned visibility witnessed increased adoption and saw their native tokens rise even when the broader crypto market was undergoing a meltdown.

Read: The Privacy Correction

Privacy in crypto can help blockchains level up from closed-circle experiments to widely adopted infrastructure.

If you add privacy to blockchain-enabled payments, stablecoins and enterprise adoption, you’d bet on a broader payment transformation to follow. None of the legacy payment systems worked without confidentiality. No business will build core financial workflows on infrastructure that opens up confidential data to competitors by default.

In 2026, privacy will likely outgrow its rebellious connotation that the early crypto advocates had limited it to, and for good, probably. Only if it does will we see blockchains increasingly being adopted as systems that could replace the slow, high-cost legacy systems corporations are still stuck with.

Crypto is done unbundling.

For most of the last decade, unbundling was crypto’s core promise.

Banks were broken into primitives, which were then broken into protocols. The mental model the builders followed was to dismantle monolithic financial institutions into modular, composable building blocks and let users assemble their own financial stack.

By 2025, it became evident that unbundling served developers and early adopters but proved exhaustive for others. Most users don’t want to wire together a dozen protocols to perform the five basic financial tasks they wish to repeat.

Users want fewer frictions when they hold money, move it, invest it and speculate with it. This realisation marked the re-bundling of the unbundled crypto world.

In 2025, we witnessed attempts from top crypto companies to collapse fragmented crypto experiences into a single, coherent application. We saw this more clearly among companies that already sat at the intersection of distribution, compliance and capital.

Over the years, Coinbase had accumulated custody, spot trading, derivatives (via the Deribit acquisition), staking, wallets, payments and developer tools. The company announced its “everything exchange” vision by offering a one-stop app for all its users, irrespective of what they wanted to access: a wallet, a market, a protocol, etc.

Read: The Great Re-Bundling

And then, there was Robinhood. What began as a zero-commission equities broker now spans stocks, options, crypto, gold, retirement accounts, cash management and prediction markets. Robinhood’s users are everyday retail users who want to manage their entire financial lives with minimal friction. Bundling becomes an economic choice in such instances.

Once protocols mature, distribution often becomes the moat. Network effects begin to accrue where attention is aggregated, making it easier for the company to monetise user behaviour across various products under one roof.

This year, crypto will continue to produce a lot of noise and nonsense, and plenty of ideas that will look transformative for three weeks. But some of the ideas we saw last year, perhaps some of the boring ones that flew under the radar, will change how businesses and individuals use blockchain and other crypto products in 2026.

This year, we will be watching out for those and telling their stories.

Until then, stay curious,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.