Today’s edition is brought to you by Polymarket.

Bet on the future by trading shares in outcomes, elections, sports, markets, you name it.

Polymarket turns collective wisdom into real-time probabilities.

Now merged with X, predictions integrated with live social insights from Grok & X posts.

Think you know what’s coming next? Prove it.

Hello

We are taking a break from the recaps for today and doing something different (maybe even clichéd, at this point).

Around this time every year, our social media feeds fill up with “Wrapped” slides — top artists people listened to, most-played tracks, cuisines tried, movies watched and reviewed, workouts registered, and total steps clocked. Then why not a crypto version of this, I thought.

So, here it is. Except when I sat down to list the top crypto moments of the year, our “top tracks” were liquidation clusters, Treasury-backed stablecoin businesses, gas-limit upgrades and AI agents executing trades for you when you are fast asleep at 3 am.

If you stared at charts of only cryptocurrencies, you’d swear nothing favourable happened throughout the year. Crypto’s total market cap slipped from roughly $3.25 trillion to $2.98 trillion. BTC and ETH limp into New Year’s Eve while nursing double-digit YTD drawdowns.

But there’s so much that’s happened beyond price action. So much so that saying “the needle has moved” would be an understatement. A lot of that action happened in boring fundamentals that have likely changed the trajectory of the crypto industry for good.

Think of the first crypto-related regulation being signed into law, crypto exchange-traded funds (ETFs) and digital asset treasuries (DATs) that reshaped institutional participation, and prediction markets getting integrated within traditional finance. These just scratched the surface of what the industry can offer.

So, here’s a playlist of moments that moved the space beyond red and green candles. Consider it a tour through infrastructure evolution, regulatory reset notes and cultural weirdness, some of which will follow us into 2026, whether we like it or not.

Crypto Wrapped, Token Dispatch edition.

Ready. Get Set. Play?

1. Presidential memecoins rug retail

Election season turned memecoins into political weapons. Tokens named after candidates exploded, collapsed, relaunched, and repeated, often within hours. The gimmick was attention. Politics became the distribution layer, and narratives were woven around these memecoins.

Overnight, retail traders who bought into these narratives became exit liquidity for those who launched the coins.

What has resulted is an absolute collapse of retail trust in memecoins, something that’s still not recovered. The memcoin market cap has slipped from $96 billion to $36 billion year-to-date (YTD).

https://coinmarketcap.com/view/memes/

Read: Game, Set and Death for Memecoins?

We wrote about how the episode unfolded here, and about the mastermind who orchestrated it all.

2. Crypto’s biggest hack Ft. Bybit

A major Bybit-linked exploit earlier in the year reminded markets that centralised custody risk has remained persistent since 2022. The heist wiped out $1.4 billion in funds, rattled user confidence and shook risk committees across institutions.

The hack also put the spotlight back on different types of crypto custody and their risk profiles, prompting users to reevaluate their risk profiles.

Read: Crypto’s Biggest Heist Rocks Bybit 🦹🏻♂️

3. Regulatory shift towards crypto under Trump 2.0

After years of unfavourable enforcement actions against crypto, the US Securities and Exchange Commission changed its stance toward crypto following Donald Trump’s re-election as President of the United States. This year saw the SEC settling, pausing, or quietly deprioritising some high-profile crypto cases against Coinbase, OpenSea, Consensys, and Ripple.

Read: Case Closed: SEC’s Crypto Cleanup🧹

The year also witnessed presidential pardons for Changpeng Zhao (founder of Binance), Ross Ulbricht (founder of Silk Road), and Samuel Reed, Benjamin Delo, and Gregory Dwyer (co-founders of BitMEX).

What also followed were inevitable controversies linking these closures and pardons to the massive crypto funds that have flowed into political lobbying over the past year.

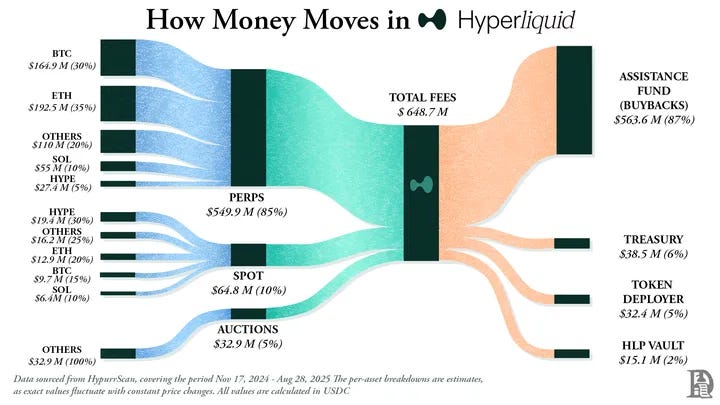

4. Rise of Hyperliquid

Hyperliquid shattered the assumption that perp DEXs had peaked. With fast execution, aggressive fee design, and a social trading meta, it climbed to the top of on-chain perps by volume and revenue, all this without leaning on token incentives.

It signalled that execution quality and a strong revenue model in crypto can rival emissions as a liquidity driver. Hyperliquid demonstrated this through its buyback model, which reserved about 90% of the fees it earned.

Read: Burn, Baby, Burn 🔥

If cross-margin and institutional access improve in 2026, centralised perp dominance may finally face sustained competition.

5. Stablecoins go corporate

Stripe and PayPal pushed deeper into crypto settlement, framing stablecoins as working capital tools rather than mere digital dollars to hold value. Merchants began warming up to stablecoins, seeing value in faster, cheaper settlements.

We saw these rails scaling through the year as more merchants and businesses jumped on the stablecoin-settlement bandwagon.

Read: Stablecoins Go Corporate? 🏢

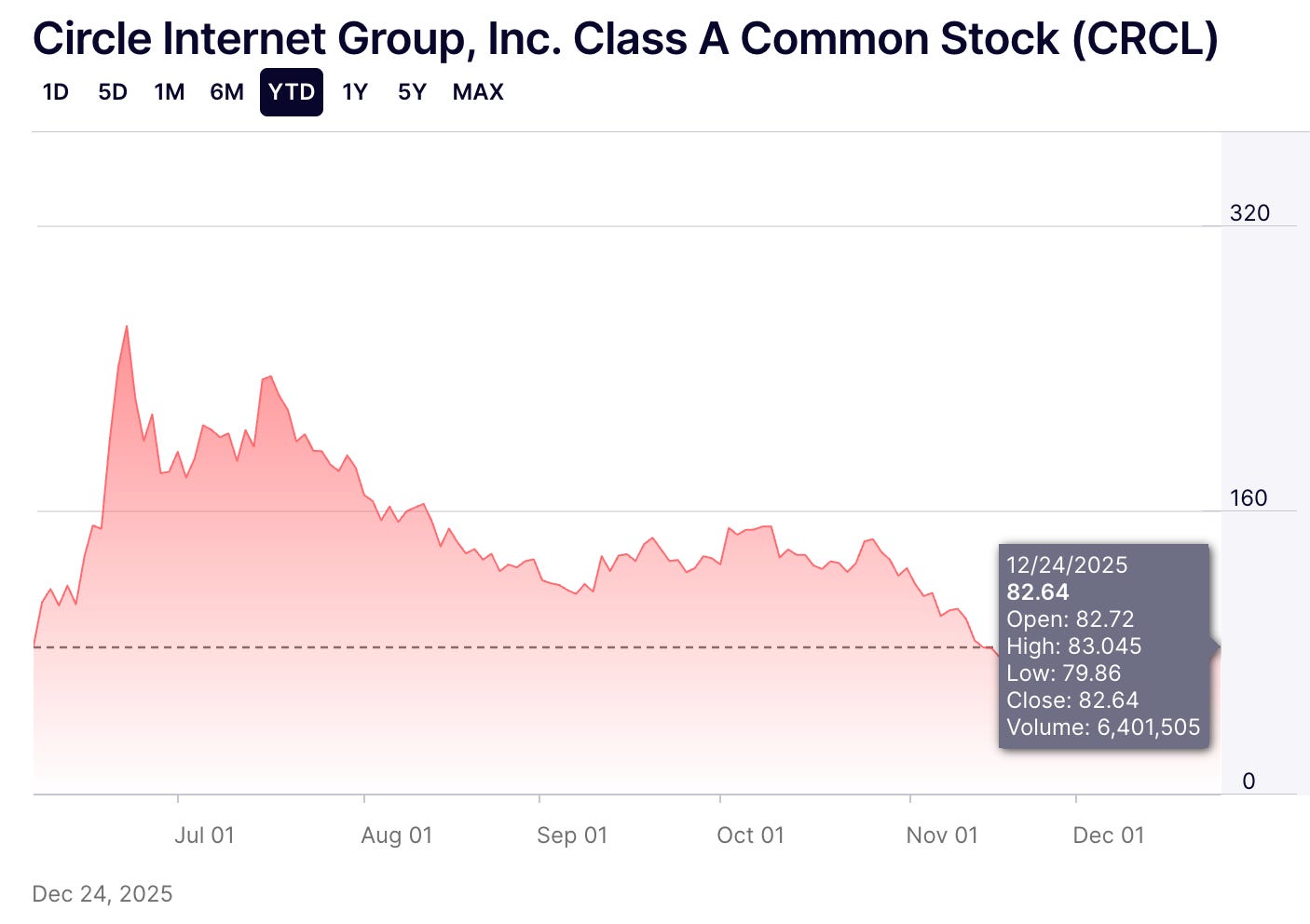

6. Circle’s rise, fall (and rise?) at Wall Street

The USDC issuer, Circle, had a stellar public debut on June 5, opening at $69/share after listing at $31. The stock shot up further to record an all-time high of $299/share, almost 10x its listing price, in just three weeks.

The euphoria drove IPO chatter up in the market. Circle’s reserve income model looked compelling, at least until it didn’t. And then, the inevitable happened. The correction phase that started in July never ended until mid-November. The price of its shares fell from $299 to an intraday low of $64.

https://www.nasdaq.com/market-activity/stocks/crcl

But Circle will still walk into 2026 with optimism.

That’s because of its most recent venture into enterprise-grade payments infrastructure. Circle’s Arc and the Circle Payments Network (CPN) will enable the USDC issuer to earn from payments, treasury management, and settlement rails rather than relying solely on rate-driven income. If regulation stabilises in 2026, the pivot may pay off.

Read: Circle’s Token Bet 🪙

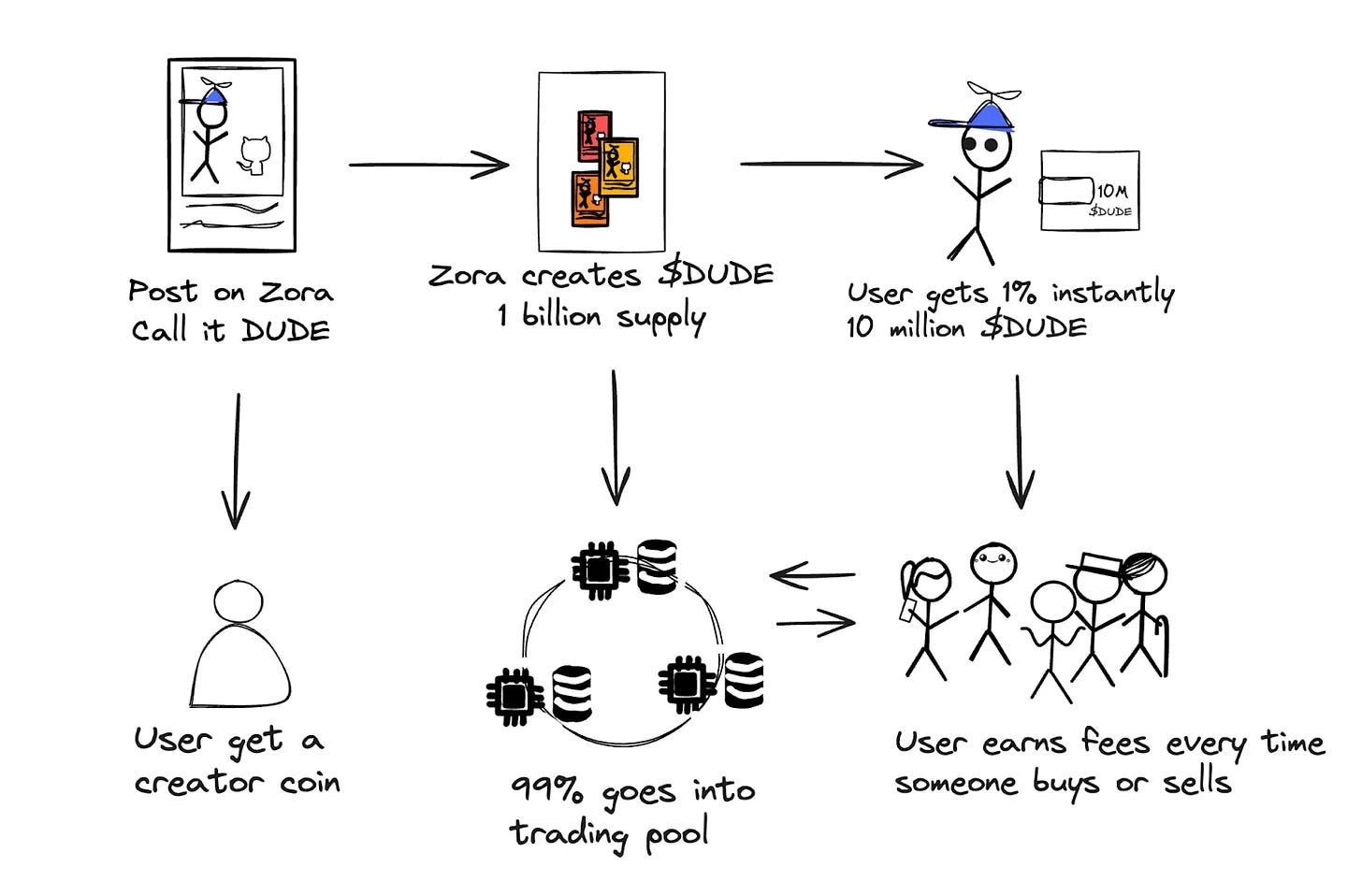

7. Creator economy infra accelerates on Base, Zora

This year saw the rise of the on-chain creator economy. Base became a distribution engine as Zora’s protocol established a social network integrated with Coinbase’s Layer-2 to enable the tokenisation of social media content.

Zora, a five-year-old forgotten protocol, shot back into the spotlight by offering social media features to Coinbase when it needed them the most.

Read: The Content Creator Trap 🪤

The big question for 2026 will be whether these ecosystems can sustain engagement as speculation fades.

8. Stablecoin supply jumps; Trump signs GENIUS Act

After three years of stagnation between $165 billion and $210 billion, stablecoin supply surged past $300 billion this year. This came on the heels of Washington advancing the GENIUS Act, the first-ever crypto-related legislation.

The law has given crypto builders a sense of certainty and a regulatory framework within which they can continue to build.

Read: Stablecoins: The Billion-User Path to Crypto? 🪙

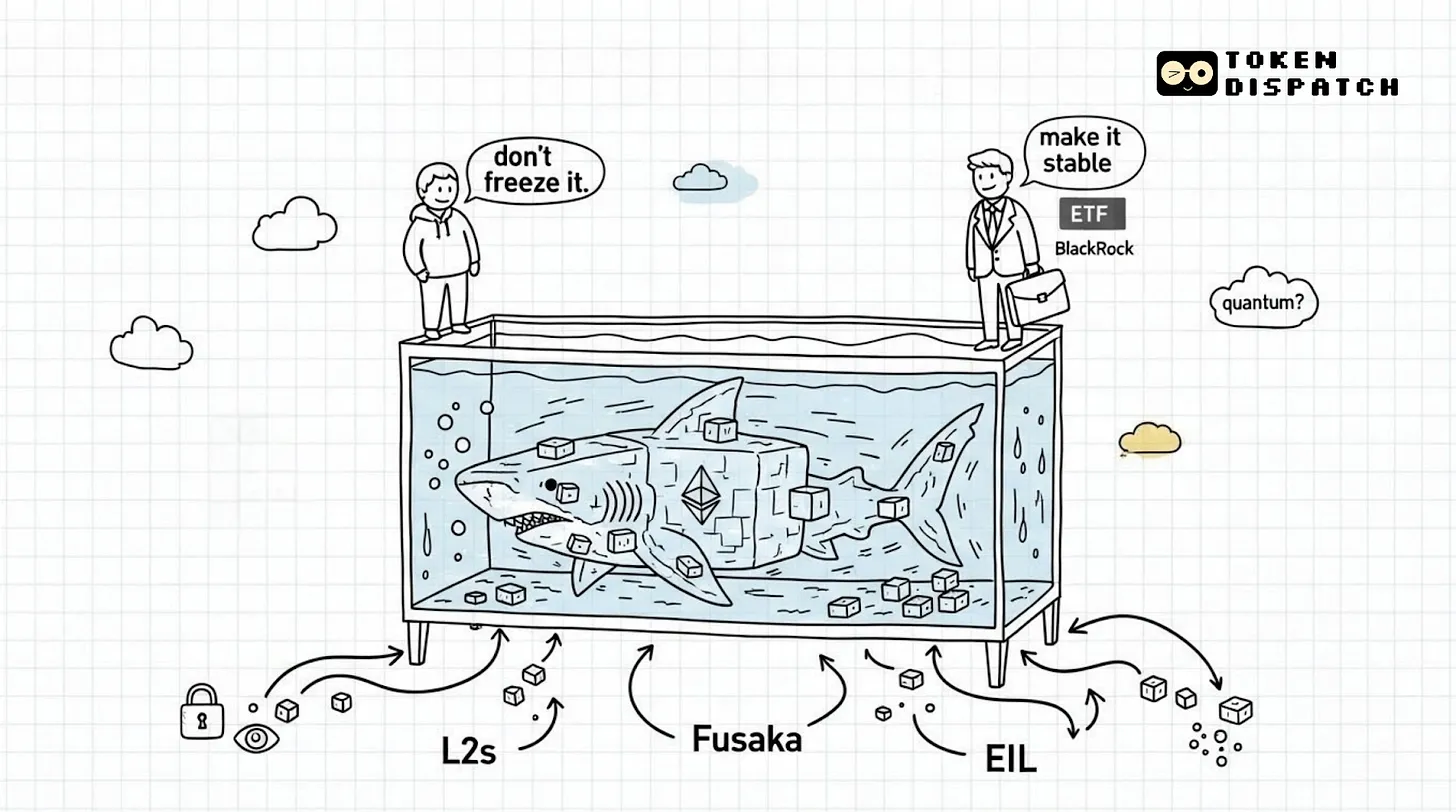

9. Ethereum Courts Institutions

Although ETH ETFs launched to muted expectations in July 2024, Q2 and Q3 2025 saw a change of fortunes. Institutions began accepting non-staking exposure in exchange for clean execution and familiar wrappers.

Then came the Ethereum-based Digital Asset Treasury (DAT) companies, which offered something that even the ETH ETFs couldn’t: staking yield for the holders.

Together, they made Ethereum too attractive an asset to have on one’s balance sheet.

If throughput gains from Pectra and Fusaka, Ethereum’s two upgrades in 2025, translate into lower costs in 2026, ETH ETFs could underpin more sophisticated yield and collateral products down the line.

Read: 2025: Ethereum Won, ETH Didn’t

10. Rise and Fall of DATs

Digital Asset Treasuries exploded as public companies chased BTC exposure via balance sheets. Then mNAV premiums cracked, revealing leverage, maturity mismatch, and liquidity fragility.

Read: Where’s DAT Beta? 🎁

The rebound occurred through staking-based DATs tied to ETH and SOL, exposures that came with cash-flow anchors rather than pure beta, as seen with BTC. In 2026, treasury-style crypto exposure may increasingly resemble yield products and not merely BTC proxies.

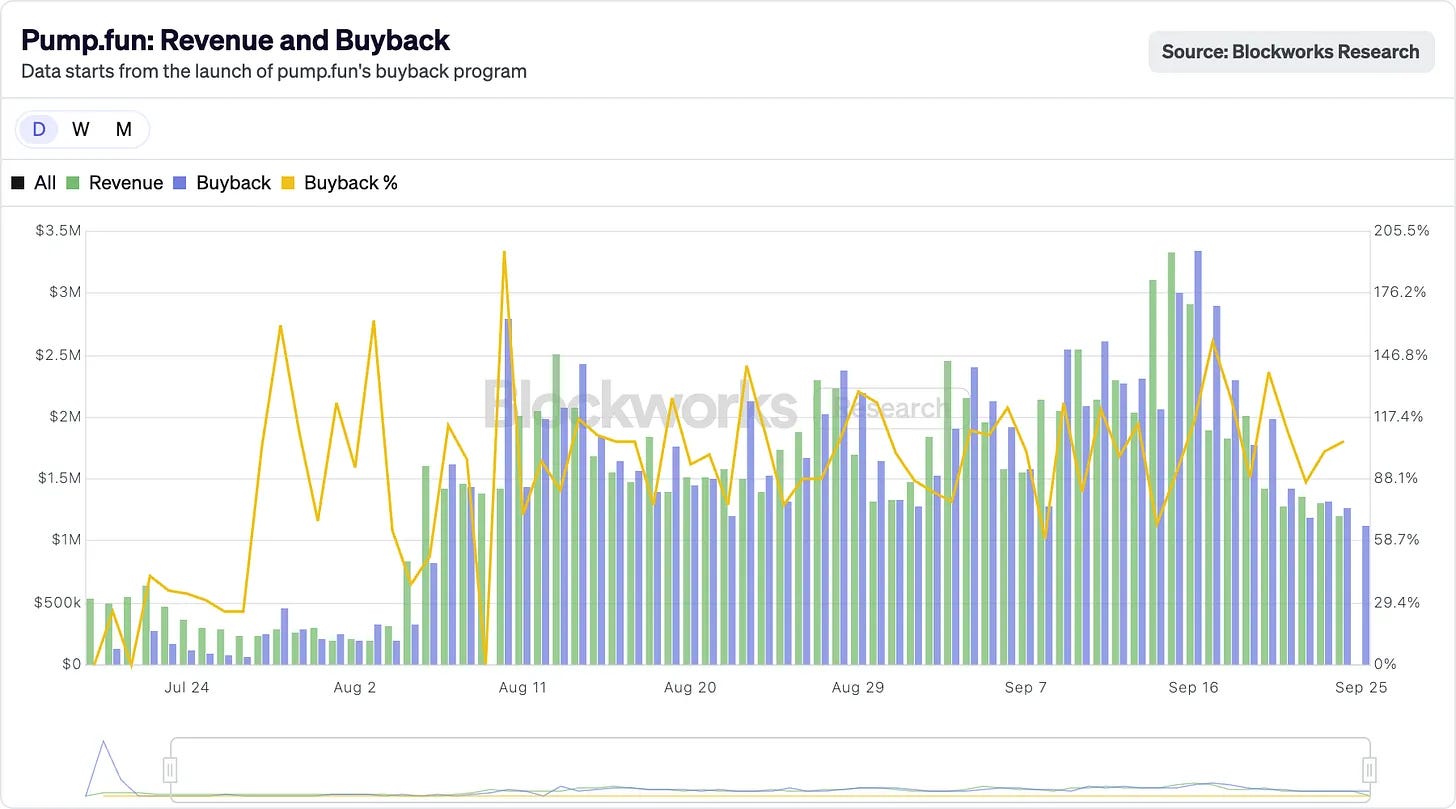

11. pump.fun’s revenue pump

Although memecoins lost roughly 60% of their market cap, pump.fun remained one of the largest revenue-generating crypto companies throughout the year. Yes, the memecoins that graduated went down.

Memes didn’t last as long, yet pump.fun used its revenue to buyback its PUMP tokens and keep its investor community happy.

Read: Burn, Baby, Burn 🔥

12. Crypto’s worst liquidation

One tariff headline against China from US President Donald Trump on a Friday triggered a brutal liquidation wave on October 10. Basis spreads blew out, open interest vanished, and automated deleveraging cascaded across venues.

The event exposed crypto’s sensitivity to macro shocks. It even sparked conversations about crypto’s 24/7 market hours and the lack of circuit breakers.

Read: Brakes for the Borderless🚦

13. Trad-Fi giants enter stablecoin ecosystem

In 2025, legacy payments infrastructure finally collided with stablecoin rails. Stripe and PayPal went beyond experimenting and struck meaningful partnerships, acquired talent, and embedded stablecoins into core settlement and merchant workflows.

Issuers gained instant merchant reach while these giants gained programmable settlement and faster cross-border flows.

Read: The Payments Party

14. Tether reinforces dominance; diversifies reserves

Tether printed enormous profits from Treasury yields while expanding reserves into gold and BTC. Its grip on global crypto settlement has further tightened in emerging markets despite the faster growth pace of Circle and other smaller stablecoin issuers.

Tether’s most significant milestone for 2026 will be to ensure growth in the US-regulated markets.

Read: Gold, Bills, Thrills 🏅

15. Fusaka + Pectra upgrades lift Ethereum

Although ETH’s price action lacked momentum this year, its two upgrades helped Ethereum, the chain, finally ship with higher gas limits and improved rollup settlement.

If utilisation rises in 2026, ETH’s value proposition may shift from monetary narrative to bandwidth allocation—an adjustment markets haven’t priced clearly yet.

Read: How to Freeze a Shark?

16. DEX share climbs vs CEX incumbents

DEX market share rose quietly, driven by perps demand, post-hack caution, and improved UX. Although incentives could encourage participation, their impact remains fragile in the long term. Liquidity still chases faster latency and better performance

Read: DEXed Out, Not Down 💱

2026 will reveal whether decentralised trading is eating into CEXs’ market share or merely benefiting from cyclical mistrust.

17. AI agents infiltrate finance

AI agents moved from novelty to infrastructure. They parsed filings, generated trade intents, executed arbitrage, and automated compliance checks. The new crop of bots changed how they responded to traders’ intraday liquidity patterns.

The ubiquity of AI agents this year has also underscored the need for a report card to evaluate their performanceand help users choose the right one.

Read: The PageRank Problem for Agents 🥇

18. VC concentrates on fewer, larger cheques

This year, crypto saw deal counts falling even as the cheque sizes grew. Investors backed infra, settlement, and AI-crypto convergence, abandoning experimentation at the edges.

The upside of this trend was that stronger projects got a better runway. The downside was that creative risk-taking narrowed. Whether 2026 revives early-stage appetite depends on liquidity and whether infra narratives finally translate into returns.

Read: Fewer Bets, Bigger Cheques 👜

19. Tokenised RWAs break into equities

Tokenisation crossed a psychological line as equities moved on-chain. HIP-3 and xStocks offered programmable settlement without broker bottlenecks.

Adoption was cautious, but attention came from the real value that the users saw. In 2026, deeper liquidity and clearer custody could unlock cross-margin experiments that blur asset-class boundaries entirely.

Read: Everything Is a Ticker 📊

20. Prediction markets hit mainstream traction

Despite the lull that followed the 2024 US Presidential Elections, prediction markets recovered and attracted attention from traders speculating on everyday activities, including economic announcements and sports.

Top prediction markets raising over hundreds of millions of dollars with valuations exceeding tens of billions of dollars showed us the appetite markets had for these platforms.

Read: The Sports Engine 🎰

21. Bitcoin miners hit hard

After post-halving economics squeezed miners hard in 2024, many had pivoted to AI compute hosting and holding BTC in treasuries, hoping to realise capital appreciation.

However, the market meltdown BTC witnessed in the latter part of the year drove many miners into operating losses, with the cost to mine BTC far outstripping the revenue from selling it. AI hosting helped some, but it wasn’t universally profitable or instantly scalable.

Some players are betting on ancillary business segments to complement their AI and/or mining bets.

Read: The Miners’ Mirage 🪩

22. Need for Privacy ft ZCash

Even as the crypto markets faced macroeconomic stress, one sector within the crypto landscape stood out as the industry’s outperformer: privacy protocols.

These protocols were building infrastructure that added more utility to blockchains by addressing the transparency problem, which revealed too much information that users of the network would like to keep private.

Read: The Privacy Correction 🔐

23. Coinbase’s push for “everything app”

Just as the world moved to close the year, Coinbase rolled out a host of features and announcements, including the integration of prediction markets, derivatives, payments, smart wallets, and tokenised treasury access in rapid succession.

This year, Coinbase has set a precedent by demonstrating the clarity of its aim to become a full-stack financial platform, not just an exchange.

Read: Coinbase’s Walled Garden🪴

24. Big Tech experiments with blockchain

We saw tech giants, including Alphabet, explore blockchains to coordinate identity, settlement, and autonomy between AI agents.

If agentic economies materialise in 2026, for the first time, crypto’s next adoption wave could see machines become more dominant actors than users on-chain.

Read: The DIY Blockchain Trend 👀

25. Robinhood’s redemption arc

The once equity-focused trading platform, Robinhood, shed its “gamified trading app” image to become a diversified financial engine with a growing crypto business.

After the GameStop hangover and icy volumes, it rebuilt into a profitable platform driven by interest income, expanded products, higher ARPU, and crypto adoption. The platform has turned retail chaos into bank-like revenue and is now laying the foundation for broader financial services.

Read: The Great Robinhood Redemption 🎰

Looking back

2025 didn’t reward holders or hype; if anything, it punished laziness. The lack of movement on price charts understates the structural rewiring that has occurred through new settlement rails, upgraded execution layers, credible regulatory frameworks, bot-native liquidity, and quiet institutional bridges.

Markets did not accurately capture the impact of these moves. There’s still no guarantee 2026 will unlock that bottled-up momentum. Some of these threads may be dead ends. But there is a possibility that many of these moments could converge to drive massive liquidity in the coming year.

That’s it for this year’s crypto wrapped edition.

Wish you a happy New Year,

Prathik

Token Dispatch is a daily crypto newsletter handpicked and crafted with love by human bots. If you want to reach out to 200,000+ subscriber community of the Token Dispatch, you can explore the partnership opportunities with us 🙌

📩 Fill out this form to submit your details and book a meeting with us directly.

Disclaimer: This newsletter contains analysis and opinions of the author. Content is for informational purposes only, not financial advice. Trading crypto involves substantial risk - your capital is at risk. Do your own research.